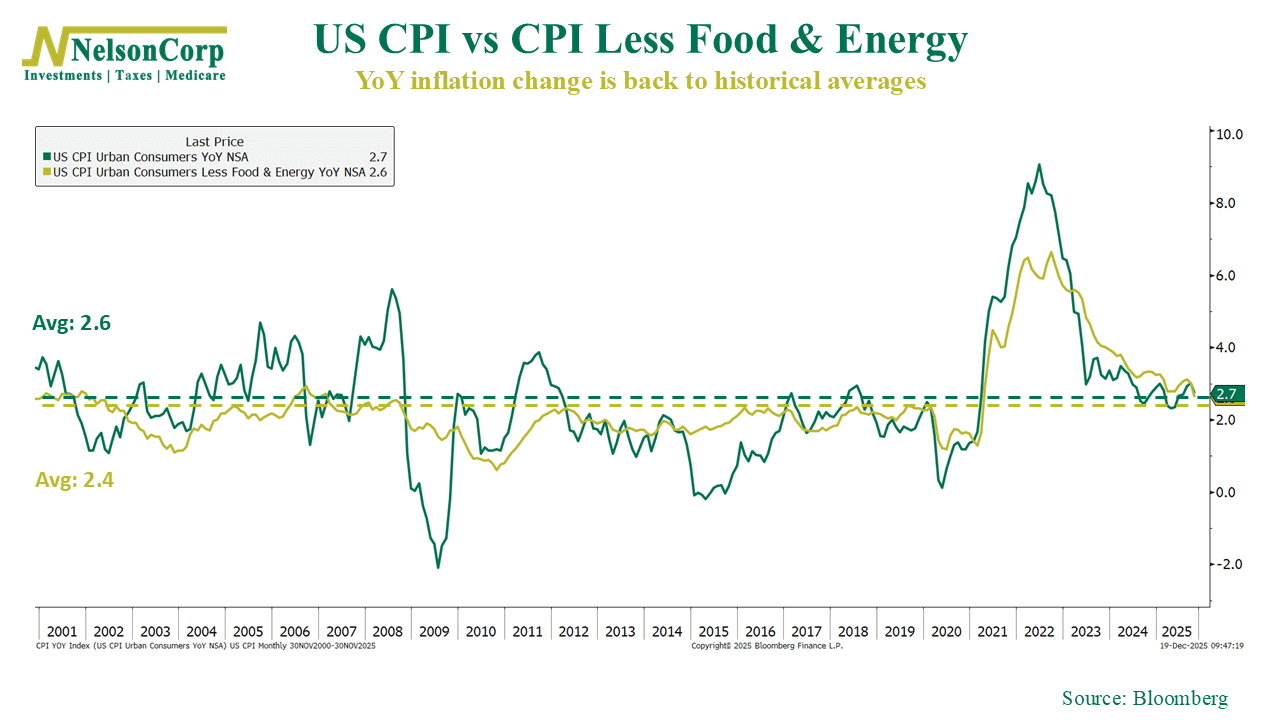

The big news in the finance world this week was the release of the November inflation numbers. On the surface, it was a good report. The headline Consumer Price Index (CPI) posted a 2.7% y/y gain, down from 3% in September. And if we back out food and energy costs, which economists call core inflation, the rate dropped to 2.6% last month, the lowest rate since March 2021.

But it was an interesting report, to say the least. Because of the government shutdown last month, the Bureau of Labor Statistics couldn’t collect prices throughout October and started sampling later than usual in November. This led to some economists questioning the data. Just how reliable are these numbers?

It’s hard to say at this point. But at the very least, the data we have suggests that inflation pressure remains mostly contained. Oh, and this has helped boost stock prices in recent sessions, as it paves the way for the Fed to cut rates further next year, if so inclined.

But again, it was certainly a strange report, one you might want to—at least—take with a grain of salt.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.