We got some encouraging economic news this week. In the third quarter, real GDP grew at a 4.3% annualized pace, the fastest growth in two years and well above expectations. That strength is welcome, but it also helps explain something else we’ve been living with lately: higher interest rates.

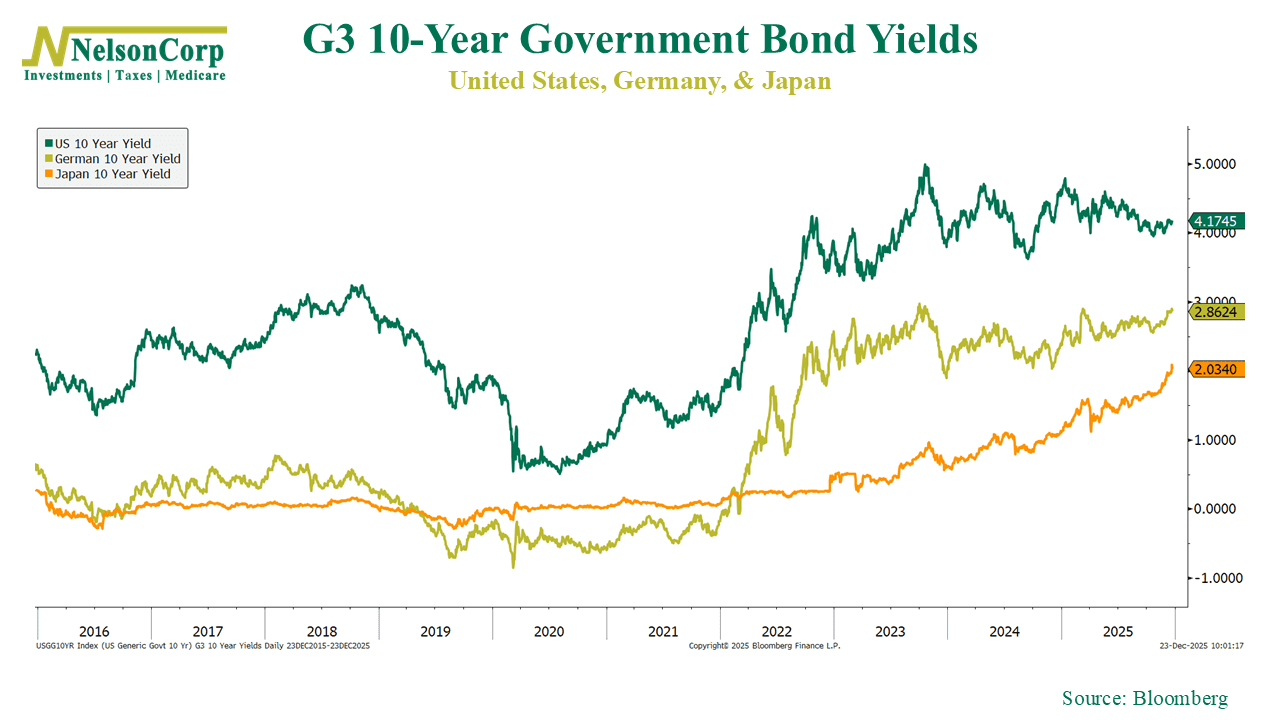

This week’s chart shows 10-year government bond yields for the U.S., Germany, and Japan, the so-called G3. As you can see, despite very different economies and central bank approaches, long-term rates across all three have moved meaningfully higher since 2021 and remain elevated today.

What’s going on here? Well, in the U.S., resilient growth and stubborn inflation pressures continue to push long-term yields higher. Germany faces a similar mix, with fiscal concerns and inflation keeping bond investors cautious. Even Japan, long associated with ultra-low rates, has seen yields rise as global rates reset higher and domestic policy shifts.

The bigger point is that this is a global story. Large government deficits, lingering inflation risks, and stronger-than-expected economic activity are all working in the same direction, putting upward pressure on long-term interest rates.

The bottom line is that long-term rates still look likely to stay higher for longer, and markets are adjusting to that reality.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.