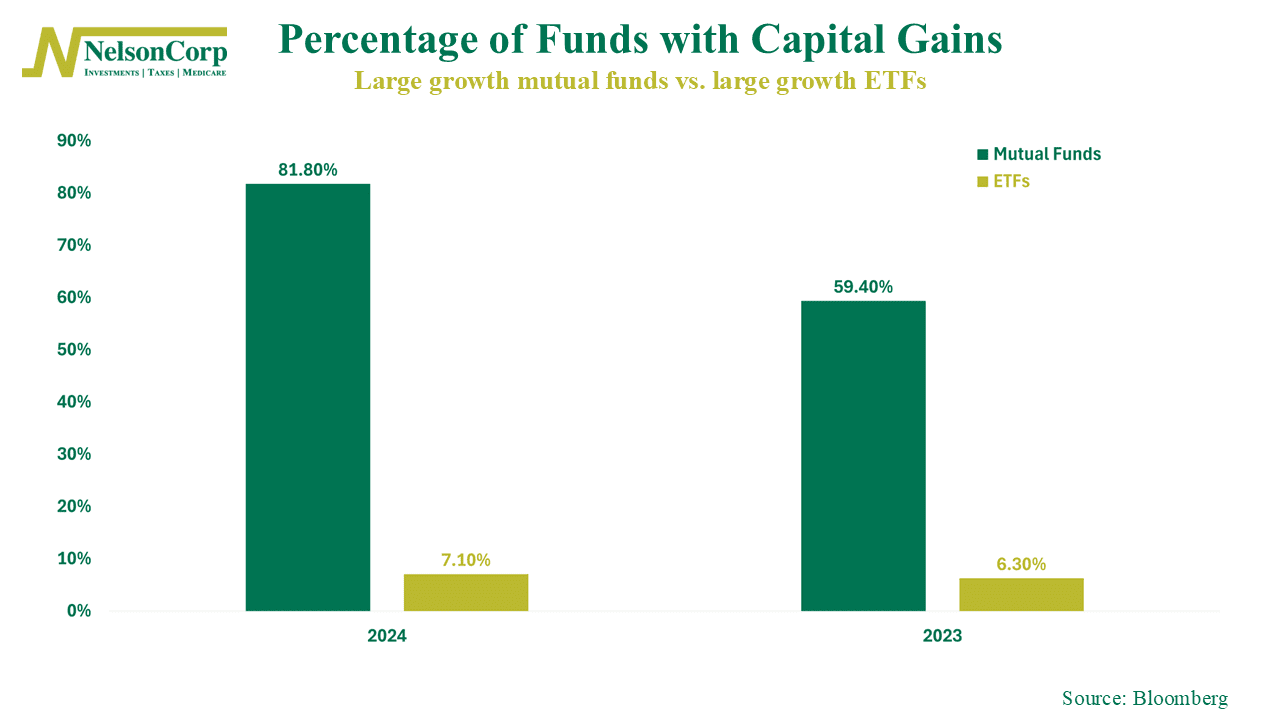

When you invest in a fund, you probably expect to pay taxes on the money you make. But sometimes, you get stuck with a tax bill even if you didn’t sell anything. That’s what this week’s chart is all about. In 2024, more than 80% of large growth mutual funds handed out capital gains to investors. Meanwhile, only 7% of similar ETFs did the same. That’s a big difference—and even bigger than it was in 2023.

The reason has to do with how the funds work behind the scenes. Mutual funds often have to sell stuff when people pull their money out, and that can trigger gains that get passed along to everyone else still in the fund. ETFs don’t usually have that problem. They have a more tax-friendly setup that helps keep gains out of your mailbox.

If you’ve ever been surprised by a fund-related tax hit, this might explain why. Two funds can look nearly identical on the surface—but one could be quietly building up a tax bill while the other keeps things cleaner. It’s a good reminder to pay attention not just to what you own, but how it’s built.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.