With financial markets under a bit of selling pressure recently, it’s natural to wonder what’s driving things. As always, there are plenty of factors at play. But there’s one important piece that may not be on your radar: Japanese monetary policy.

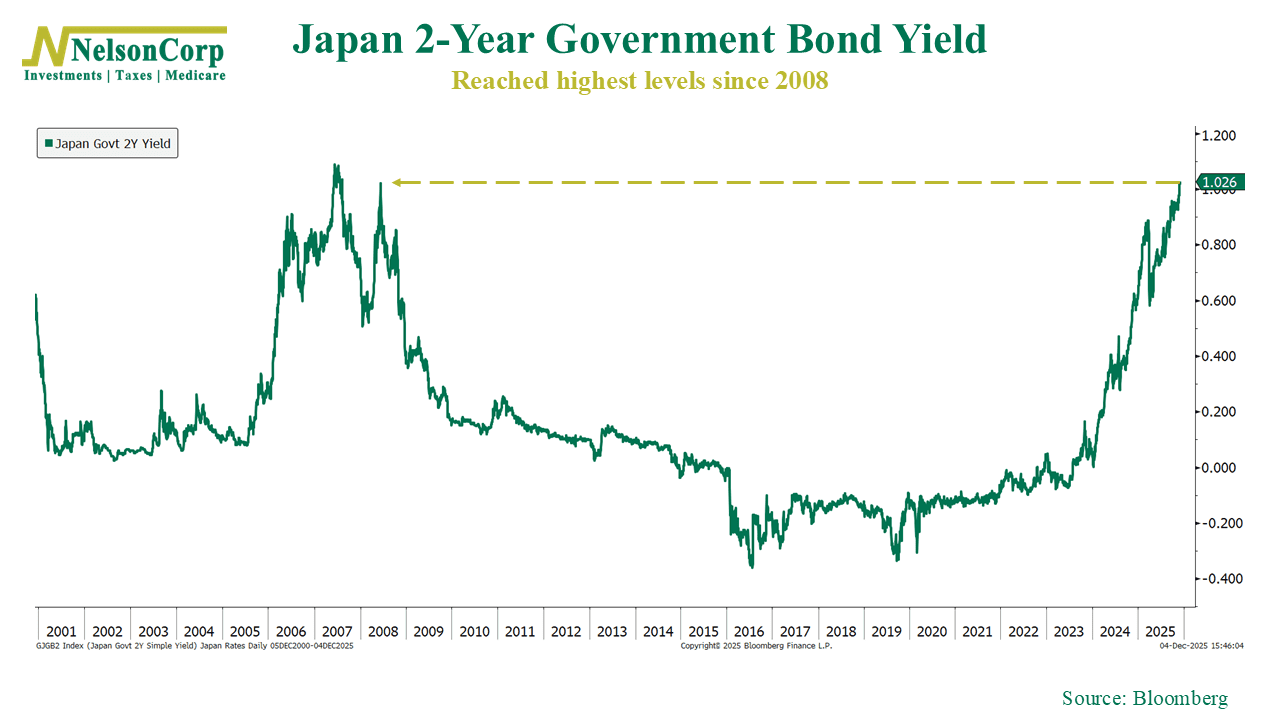

This week’s chart shows that Japan kept its two-year government bond yield near zero for many years after the financial crisis, even dipping into negative territory for much of that period. That stretch of ultra-loose policy made Japan one of the quiet engines supporting global risk-taking.

Why? Because it fueled the so-called carry trade. This is where investors borrowed cheap yen to buy higher-yielding assets elsewhere. And this all worked great—and was profitable—as long as the Bank of Japan kept policy loose and steady.

But recently, things have started to shift. Japan has allowed interest rates to rise again, and recently the Bank of Japan signaled that even higher rates may be in the pipeline. That has pushed the two-year yield to its highest level since 2008, as shown on the chart.

What does this mean for financial markets? Well, it means that one of the biggest behind-the-scenes drivers of global risk appetite has likely gone away—or at least is no more a “sure thing.” In the short term, this could mean volatility in financial markets. In the long run, I guess we’ll have to see what markets—and global risk appetites—look like when the Bank of Japan is no longer underwriting the carry trade.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.