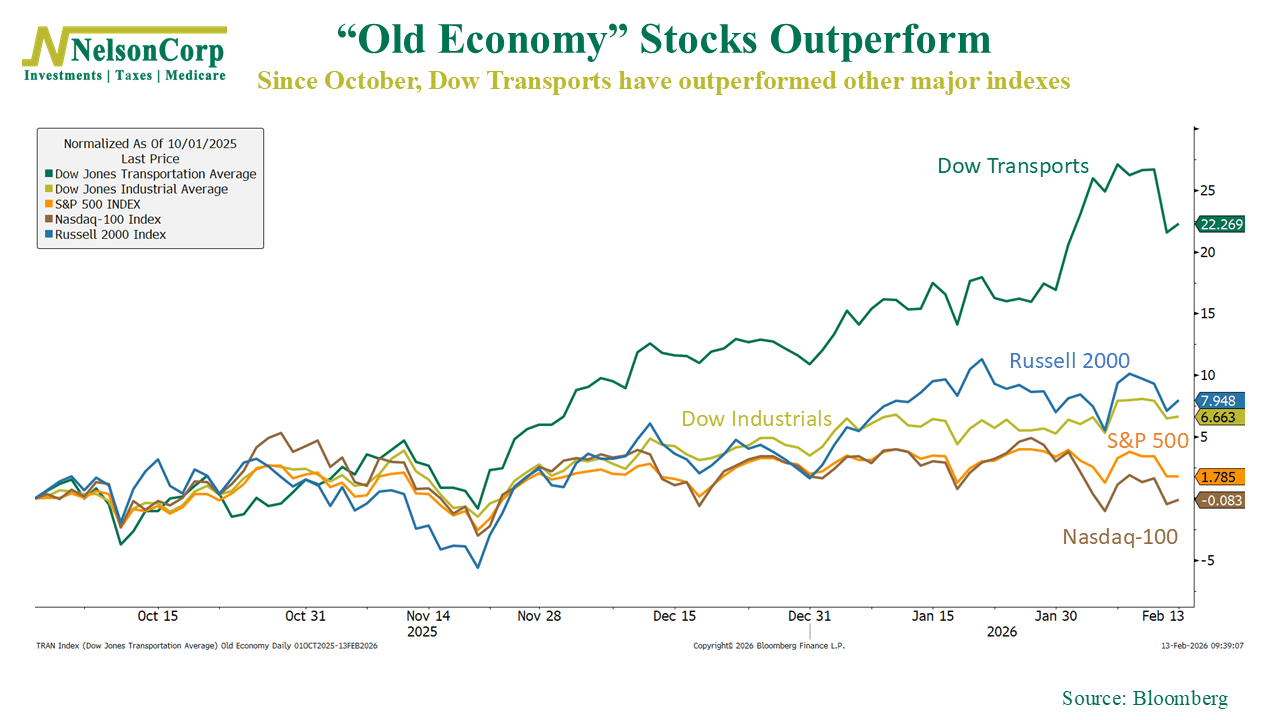

Over the past few months, we’ve seen an interesting shift happening in markets. As this week’s chart shows, the so-called “old economy” stocks have taken the lead.

Since early October, the Dow Jones Transportation Average has surged more than 20%, decisively outperforming the S&P 500, the Nasdaq-100, the Dow Industrials, and the Russell 2000. By comparison, the broader S&P 500 has posted only modest gains, and the Nasdaq-100 has had difficulty building sustained momentum.

Transportation stocks, which include rails, truckers, and airlines, are closely tied to the movement of goods and people. In traditional Dow Theory, strength in transports is viewed as confirmation of underlying economic momentum. When these companies lead, it suggests demand is firm and activity is broadening beyond a narrow group of mega-cap technology stocks.

For investors, this could be a signal that the market is gradually rotating toward more traditional sectors of the market, rather than remaining overly concentrated in the large technology stocks that have dominated performance in recent years.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks.

The Nasdaq 100 Index is a basket of the 100 largest, most actively traded U.S. companies listed on the Nasdaq stock exchange. The index includes companies from various industries except for the financial industry, like commercial and investment banks.

The Dow Jones Transportation Average is a 20-stock, price-weighted index that represents the stock performance of large, well-known U.S. companies within the transportation industry.

The Russell 2000 Index is a small-cap U.S. stock market index that is made up of the smallest 2,000 stocks in the Russell 3000 Index.