Sometimes we get an economic report that really jumps off the page. That was the case with this week’s productivity data.

According to the BLS, labor productivity surged at a 4.9% annualized pace in the third quarter, the fastest increase in two years. Headlines quickly followed, with some pointing to artificial intelligence as the catalyst and others urging caution. But which is it? A genuine AI-driven leap forward, or just a noisy data point?

The answer, as usual, lives somewhere in between.

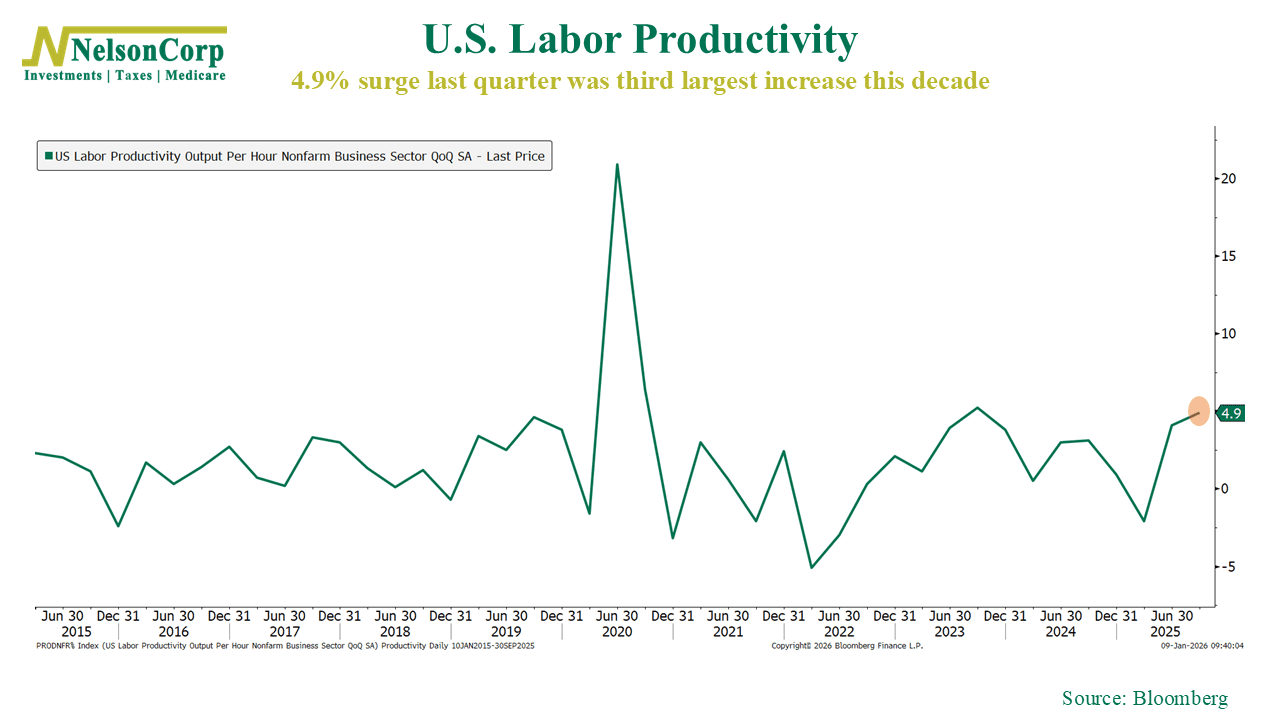

The chart above shows quarterly labor productivity growth, which measures how much output the economy produces for each hour worked. When this number rises, it generally means businesses are becoming more efficient. They are producing more without needing proportionally more labor. That can support higher profits and stronger economic growth over time.

The 4.9% jump looks impressive. But quarterly productivity numbers can be volatile. They often move sharply from one quarter to the next. Small changes in output or hours worked can have a big impact.

That’s what happened this quarter. Economic output increased quickly. Hours worked rose only modestly. The combination pushed productivity higher.

When we zoom out, we see that year-over-year productivity growth is running closer to 1.9%. That’s still really good, and an improvement from recent years, but it’s far from a productivity boom.

So what about AI?

Right now, most economists would say AI is certainly a contributor but not really the primary driver yet. Businesses are investing in technology, automation, and process improvements, and AI is part of that mix. But the data do not yet show a clear, sustained AI-driven productivity surge. What we’re seeing looks more like a gradual improvement driven by investment, tight labor markets, and companies finding ways to do more with limited workers.

The bottom line? One of the most important economic indicators—productivity—is improving. Whether that comes from AI or other forces matters less than what it supports: healthier growth, stronger profits, and a more resilient economy.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.