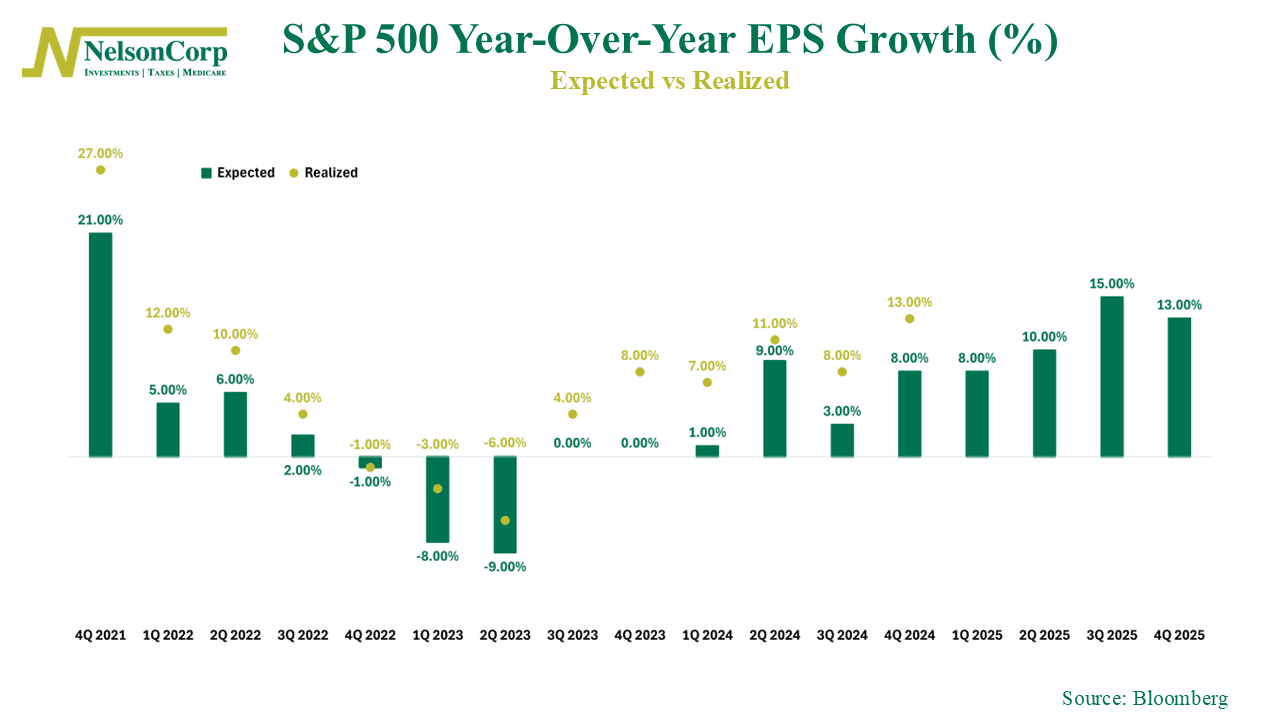

This week’s chart is all about earnings—expectations versus reality, to be exact. Each green bar represents the market’s forecast for S&P 500 year-over-year EPS (Earnings Per Share) growth, while each gold dot shows what actually happened.

As you can see, actual earnings have been on a bit of a rollercoaster over the past few years, with some quarters showing positive growth and others negative. But look closely and you’ll see that earnings pretty much always come in stronger than expected. The most striking example is the latest quarter—Q4 2024—where companies delivered 13% EPS growth, well above the 8% consensus estimate. That’s one of the stronger earnings beats the past three years.

This came despite lingering concerns that U.S. stocks are overvalued and too concentrated. Looking ahead, the market expects earnings strength to continue, and that seems reasonable given solid economic growth, resilient consumer spending, and steady business investment. Of course, risks are still lurking—tariffs and economic slowdowns could pose challenges—but so far, corporate America is proving far more resilient than many expected.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.