The stock market is starting to look a lot like the top of my wife’s double-shot espresso latte: frothy. Frothy, in the context of the stock market, means prices are being driven more and more by excitement and speculation than by fundamentals.

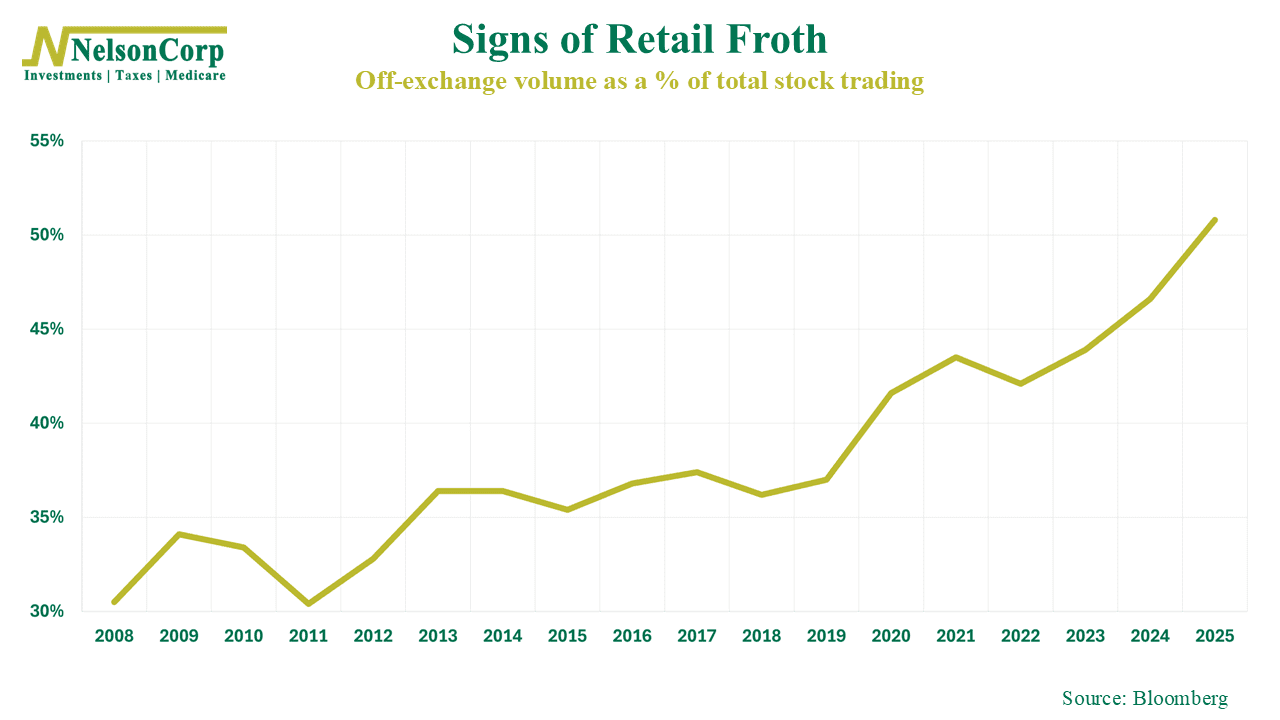

For example, this week’s chart shows the amount of market trading happening off-exchange—that is, outside of the big public exchanges like the NYSE. This is generally a good proxy for retail investor activity, or how everyday people are investing their own money—as opposed to big institutions or professional traders.

As you can see from the chart, it’s absolutely exploded recently, climbing to nearly half of all market activity. That’s up big time from where it was back in 2008, when it was more like 30%.

Now, this doesn’t necessarily mean that stocks have become disconnected from reality, but individual investors have been shown to trade more on emotion and chase stories and trends. A case could be made that when more off-exchange trading is taking place, prices can move more erratically from the fundamentals.

Our take? It’s good to see individual investors bring new energy and participation to the market. But we also need to keep an eye out for excessive speculation and investor enthusiasm, as the crowd tends to be wrong at the extremes. The key is to stick with a plan built on discipline and diversification, not on whatever’s bubbling to the surface this week.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.