Well, it didn’t come as a surprise, but the Fed went ahead and cut rates this week—their first move since last December. What was more interesting, though, were the new economic projections.

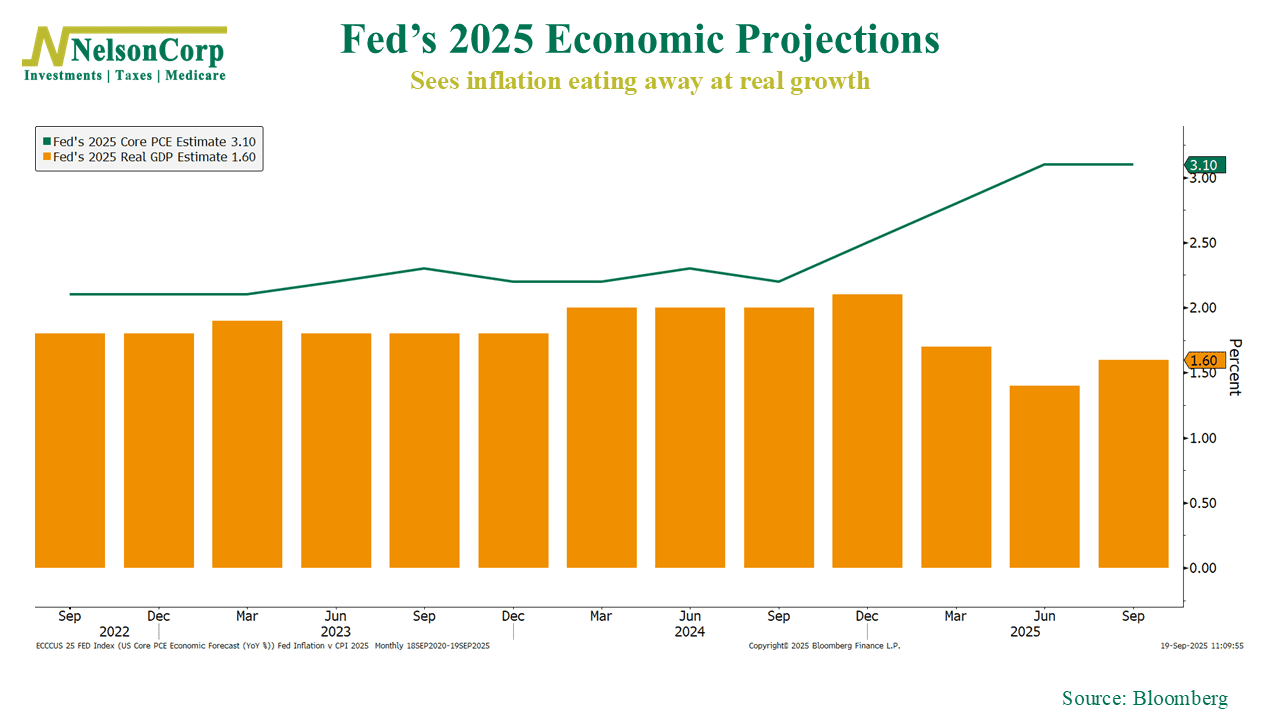

This week’s chart shows the Fed’s outlook for 2025. The bars track their estimate for real GDP, which they see slipping to just 1.6%. And the line shows core PCE inflation, which they expect to climb to 3.1%.

This result is revealing. Basically, the Fed is projecting that higher inflation will eat into already soft growth—a kind of stagflation-lite.

That sets up an interesting dynamic. They’re easing policy to try and shore up the economy, especially with signs of weakness showing up in the labor market. But at the same time, they’re effectively saying inflation will stay above target. So is the Fed looking past inflation now?

One way to read it is that the Fed is being forward-looking. If the labor market really is slowing, inflation may already be lagging behind. Whether that view holds up remains to be seen, but the message is clear: the Fed is willing to cut rates even while inflation stays sticky.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.