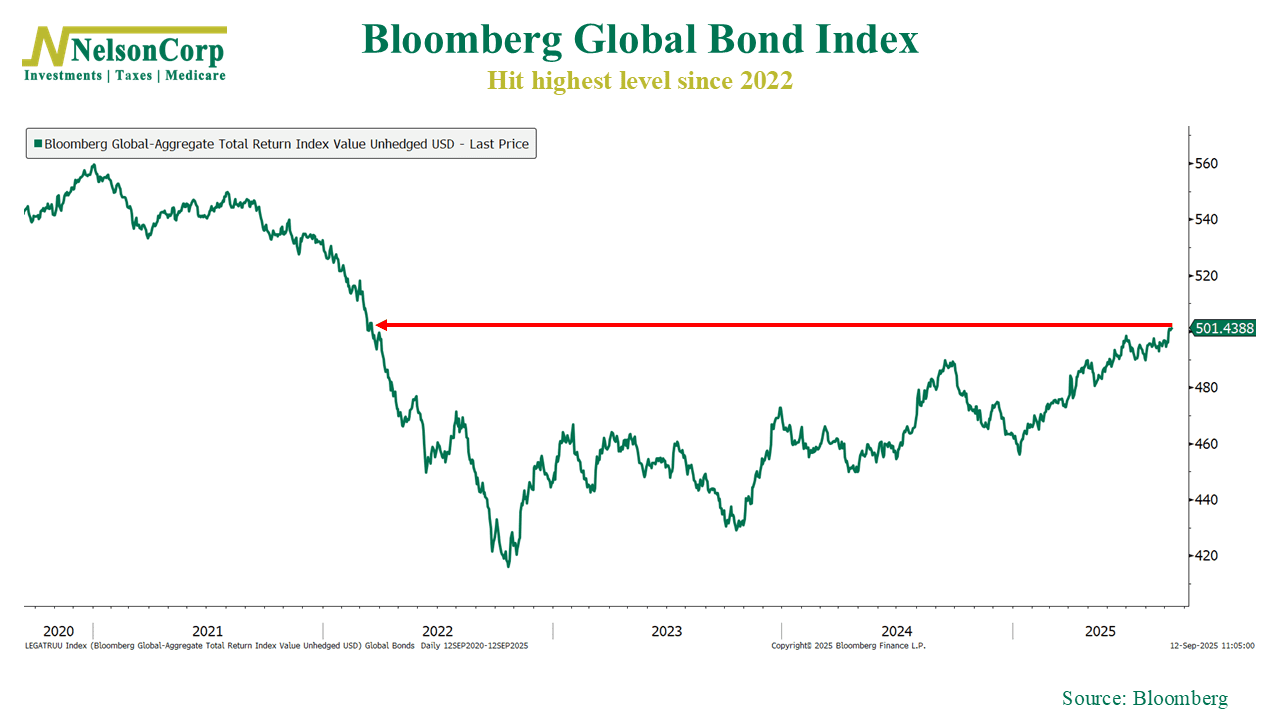

Are bonds back? They’re certainly looking feisty again. As this week’s chart above shows, the Bloomberg GlobalAgg Index, which tracks returns on sovereign and corporate debt across developed and emerging markets, has surged more than 20% from its 2022 low—and is now sitting at its highest level since March 2022.

In other words, bonds are in a bull market.

Now, if you remember back a few years ago, that wasn’t the case. Bonds got absolutely hammered by inflation and higher interest rates. But now, they seem to be making a comeback. Central banks around the world are slashing rates, and lower rates mean higher bond prices.

The bottom line? Bonds are enjoying a strong comeback as falling rates lift prices, and while future returns could be more modest, the renewed stability makes them a welcome anchor in portfolios once again.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The Bloomberg Global-Aggregate Total Return Index is a broad-based benchmark that measures the performance of global investment grade, fixed-rate debt markets. The index includes government, corporate, and securitized bonds from developed and emerging markets, all issued in major currencies.