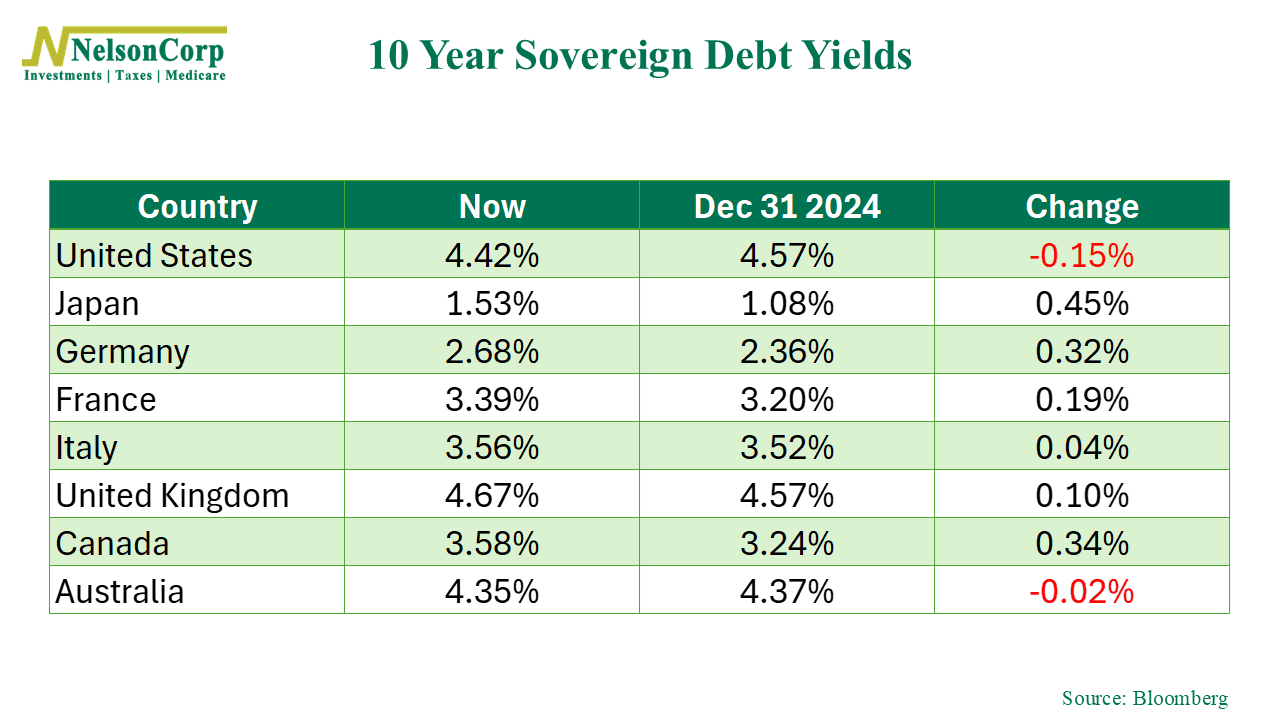

If you had to guess which major country saw its long-term bond yields fall this year, would you have picked the United States? Maybe. Maybe not. But it’s true.

As our featured chart shows, while most developed economies have seen their 10-year sovereign debt yields rise in 2025, U.S. yields have actually moved lower—down about 15 basis points since December 31, 2024.

That challenges the narrative we heard earlier this year: that the U.S. was becoming a riskier place to park long-term capital. It also helps explain why the dollar has weakened—other countries are now offering better yield compared to just a few months ago.

But the bigger story is that yields are mostly rising across the globe. Capital has a realistic cost again. And yet… nothing bad has happened. Contrary to the textbook view, rising yields haven’t dragged down stock valuations. In fact, equity markets in every country listed above are up on the year.

The bottom line? Investors are looking through the move in yields and focusing more on earnings growth expectations. That’s likely a bullish medium-term signal.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.