The United States is leading the pack in terms of global economic growth. It might surprise some, but the U.S. economy has remained resilient, growing faster than other countries—and the stock market has kept pace.

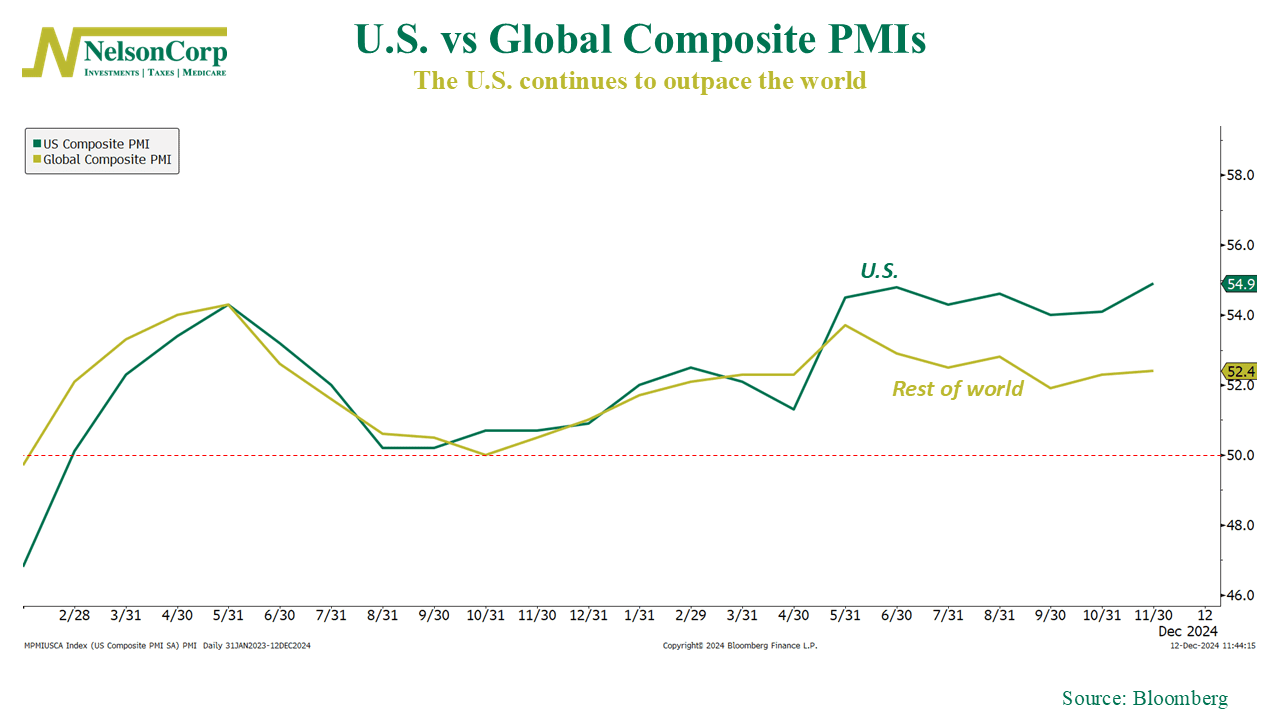

To illustrate, our chart this week compares the U.S. Purchasing Managers’ Index (PMI) to that of other developed countries. PMIs might sound complicated, but they simply measure manufacturing and services activity in an economy.

As the chart shows, the U.S. and other regions are growing (with PMIs above 50), but the U.S. has recently pulled ahead. The U.S. PMI has climbed close to 55, while the global average lingers around 52.

Looking ahead, we expect the U.S. to keep its edge through 2025. Slowing inflation, lower interest rates as the Federal Reserve adjusts policy, strong consumer and business finances, and advancements in artificial intelligence all support this growth. U.S. stocks will likely outperform if these trends continue, reinforcing our confidence in large-cap investments.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.