Investors often find themselves confused and overwhelmed amid the vast sea of financial information. That’s why we rely on a few fundamental investing principles to navigate our decision-making process.

One such principle has to do with the importance of staying on the right side of a trending market. Imagine a skilled surfer gracefully riding the crest of a wave. Due to the laws of physics, the surfer can actually move faster than the wave itself. As I’ll show in our featured indicator this week, something similar can occur in the stock market.

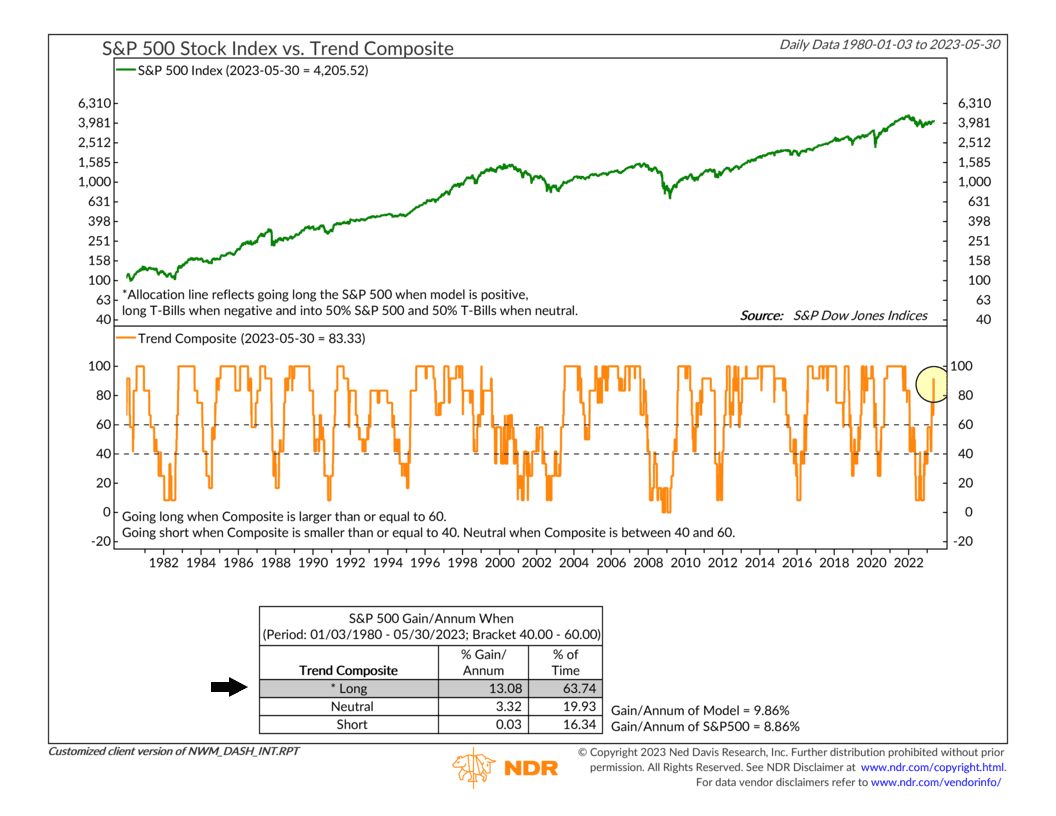

The chart above is our Trend Composite indicator. It’s a composite of six different indicators that individually measure the “trend” of the stock market. I won’t bore you with the details of each indicator, but they all look at the past performance of the stock market in one way or another to determine the market’s trend—either bullish (up), bearish (down), or neutral (sideways). The resulting composite reading, represented by the orange line, offers insights into the market’s prevailing trend.

The performance box on the bottom of the chart shows how the S&P 500 Index (green line) has historically performed during different composite readings. When Long (above 60), the S&P 500 has returned roughly 13% per year, which is well above its long-run average return of about 8.85%. When Neutral or Short, however, the S&P 500 has struggled to make much in the way of gains.

In other words, adhering to the model’s rules, the Trend Composite can potentially generate an average annualized gain of 9.84%, surpassing the S&P 500’s long-term buy-and-hold return. It’s akin to a surfer outpacing a wave.

Currently, the Trend Composite’s reading is about 80%, which is well above the 60% threshold needed to signify a bullish environment for stocks. This is a good sign that the underlying long-term trend likely remains bullish despite a seemingly sideways trending market.

So, the bottom line is that by embracing the insights provided by our Trend Composite, we can potentially harness the power of market trends to enhance investment outcomes. And like a skilled surfer riding a wave, we can use trending markets to better manage stock market risk.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.