At first glance, the stock market seems pretty straightforward. If plenty of stocks are hitting new highs, that’s bullish. If plenty are hitting new lows, that’s bearish. But what happens when a lot of stocks are making new highs and new lows at the same time? That’s what this week’s indicator tackles.

It’s called the High-Low Logic Index. Think of it like the transmission in a car. It tells us whether the market is “in gear” or “out of gear” based on how many stocks are setting new 52-week highs or lows.

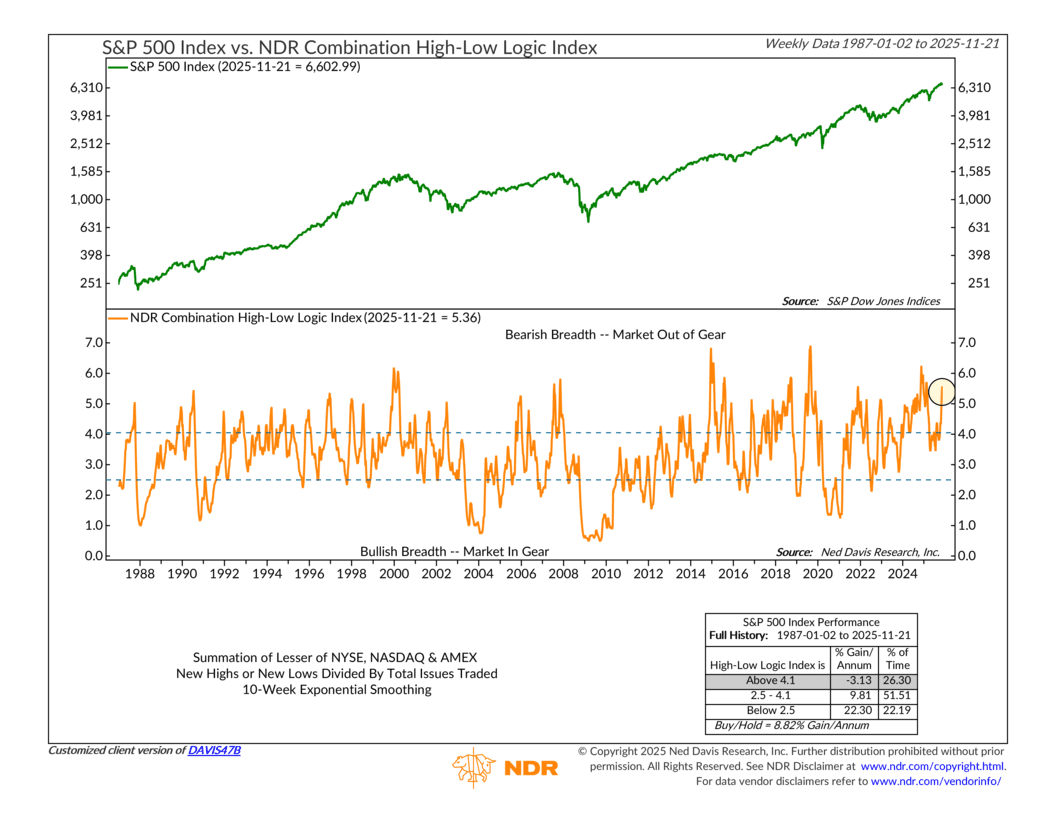

Here’s the basic idea. Each week, the indicator looks at all the stocks on the NYSE, NASDAQ, and AMEX and counts the number hitting new 52-week highs and the number hitting new 52-week lows. It then takes the smaller of those two numbers and divides it by the total number of issues traded. That result is smoothed with a 10-week exponential average to filter out noise.

So why does this matter? Because low readings usually show a market that’s moving with conviction. Either there are very few new lows—signaling strong upside momentum—or very few new highs—signaling a washout, where sellers have exhausted themselves. Historically, both environments have tended to be bullish going forward. On the chart, that’s the “in-gear” zone, and the performance numbers back this up.

That’s the normal case. But the unusual case is when the indicator spikes higher. That means a lot of stocks are making new highs and a lot are making new lows at the same time. That’s a market that’s “out of gear”—lots of internal disagreement, lots of churn, historically a pattern you often see around market tops. According to the performance box, those periods have produced negative annualized returns on average.

And right now, with the High-Low Logic Index sitting above 5, the market is clearly in that out-of-gear territory. It’s telling us that beneath the surface, the gears aren’t meshing the way they normally do in a healthy, trending market.

The bottom line? This indicator is an important part of the Participation component in our broader market model. It’s all about depth. How many stocks are truly supporting the market’s trend? When this High-Low Logic Index shows a market that is out of gear, it’s a sign of an unstable foundation. When combined with other indicators—what we call the weight of the evidence—it can be a powerful tool in an investor’s toolbox.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.