The good news on Wall Street this week came from a place that has been stuck in the mud for a while: manufacturing. The latest Institute for Supply Management Manufacturing index jumped to 52.6, up from 47.9 previously.

This was significant for a couple of reasons. For one, readings above 50 indicate expansion. This is welcome news following nearly a year of contraction. This was also the highest level since 2022. And most of the increase was due to new orders and production, which showed a nearly 10-point increase overall.

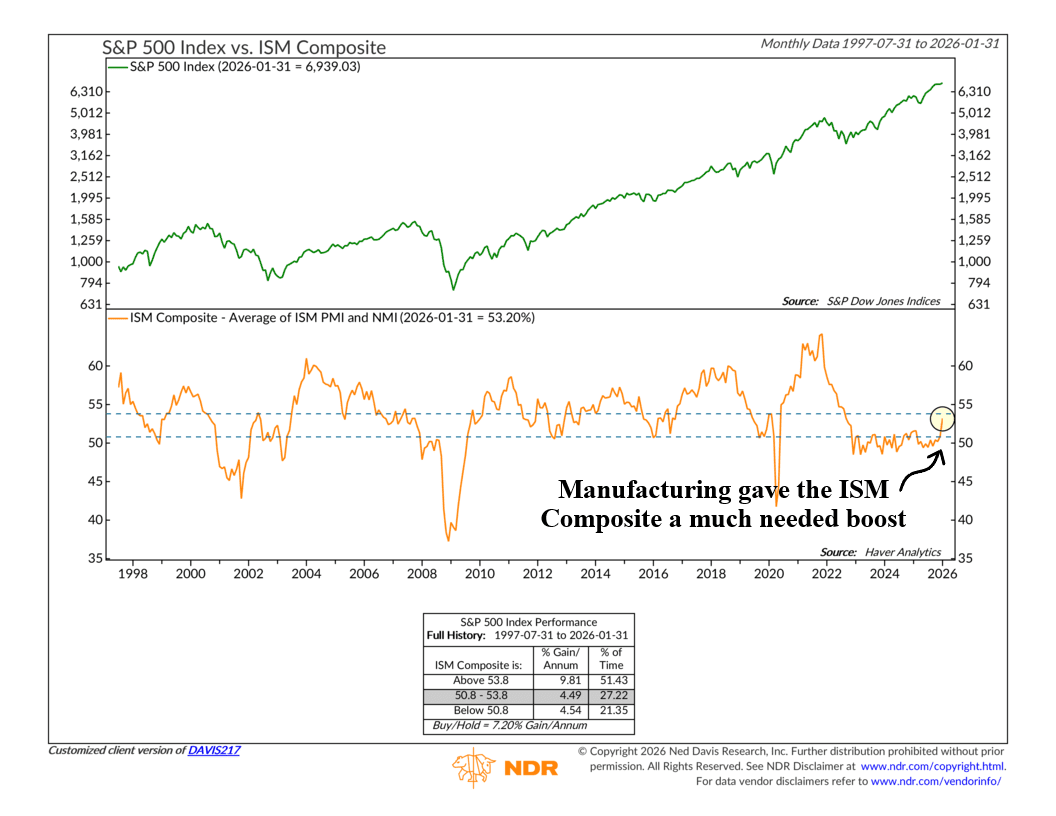

Why is this important? Because the manufacturing index is one of two inputs in our featured indicator (shown above), the ISM Composite. The ISM Composite simply combines the ISM Manufacturing index and the Non-Manufacturing (Services) index into one reading to help call the stock market.

Historically, moves in the ISM indexes have corresponded to moves in the S&P 500 Index. When the average of the ISM indexes is above the top bracket, the S&P 500 has grown at a higher rate. Below that, the S&P 500 has grown at a slower, more moderate pace.

As you can see, this composite has been stuck either below the lower bracket or just slightly above it for about three years now. It just hasn’t been able to garner enough momentum to get out of that rut. But, after last week’s massive spike in the manufacturing index, it appears the composite might finally be gaining some momentum. It’s only 0.6 percentage point away from hitting that upper, bullish zone for the S&P 500.

In fact, the overall stock market is already taking notice of this change. So far this year, we’ve seen what appears to be a rotation out of the high-growth tech sector (software stocks, specifically) and into companies that tend to benefit from improving economic growth prospects, like this indicator suggests. This includes areas of the market like cyclical, value-oriented sectors and smaller-cap companies.

The bottom line? An expanding manufacturing sector reinforces what we talked about last week, that the economy is still growing. In that kind of backdrop, market leadership can change. It’s often when leadership begins to rotate and some of the market’s more “forgotten” sectors finally get their turn in the spotlight.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.