Some of the most popular types of indicators we look at are sentiment-based. How are investors are feeling. Are they too excited? Too scared? This is helpful because when emotions reach extremes, when they go too far, the market tends to move the other way.

But here’s the thing: feelings don’t happen in a vacuum. The environment can influence how optimistic or pessimistic investors are. Financial conditions, for example, affect how investors perceive risk. When money is easy to borrow and financial conditions are loose, it takes a lot more optimism to push the market into overly extreme territory. And on the flip side, when financial conditions are tighter, it takes a lesser amount of optimism to get to the extreme.

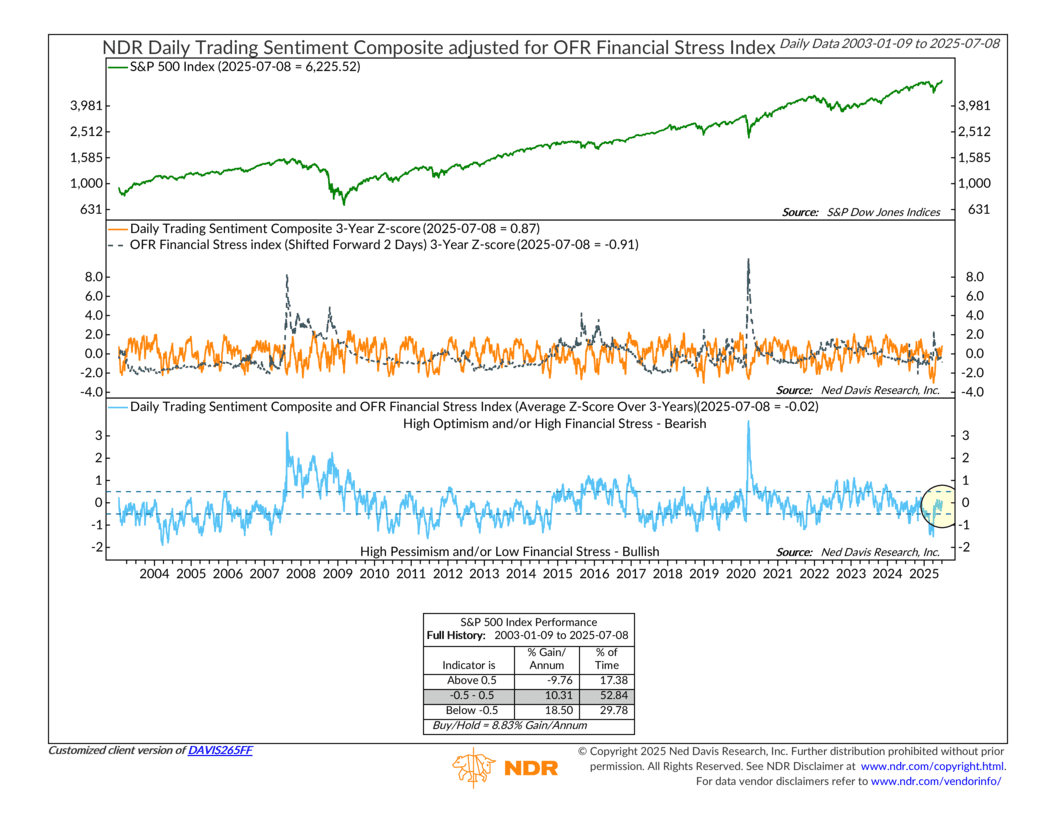

This week’s indicator shows a way to adjust for that. Instead of looking at investor sentiment by itself, it combines it with a measure of how stressful the financial system is. The result is a cleaner, more balanced view of what investor emotions might actually mean for the market.

The sentiment data comes from the Daily Trading Sentiment Composite. It’s a blend of short-term trading indicators that measure investor positioning, behavior, and outlook. On its own, the index has a solid track record of flagging market extremes.

But here’s where the adjustment comes in. To account for the overall environment, the sentiment index is paired with the OFR Financial Stress Index—a broad measure of how tight or loose financial conditions are. The idea is simple: we combine the two and this helps filter out the noise and tells us whether sentiment is truly stretched for the environment we’re in.

You can see how this has played out in the past for this indicator. When financial stress was high, like during the 2008 crisis or early 2020, the same level of investor optimism carried more downside risk. But when financial conditions were easy—like they’ve mostly been over the past year—it takes more enthusiasm to raise red flags.

Where are we right now? Well, the raw sentiment numbers suggest investors are pretty optimistic. But once we adjust for the fact that financial conditions are still fairly easy, the signal comes back much more neutral. Even though sentiment looks a bit hot on the surface, easy financial conditions are acting as a buffer. That helps explain why the market hasn’t stumbled despite high optimism.

The bottom line? After adjusting for financial conditions, the extreme optimism we’ve seen lately appears less extreme. But this will be something to watch closely, because if financial conditions start to tighten, the same level of sentiment could suddenly become more of a problem.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.