Markets love confirmation. Sure, it’s one thing to see stock prices climb higher, but it’s another to see a broad swath of companies participating in the move.

That’s what’s this week’s featured indicator is all about. It measures the percentage of global stocks hitting fresh 30-day highs. I like to think of it like a roll call for a bull market: the more names participating, the stronger the rally should be.

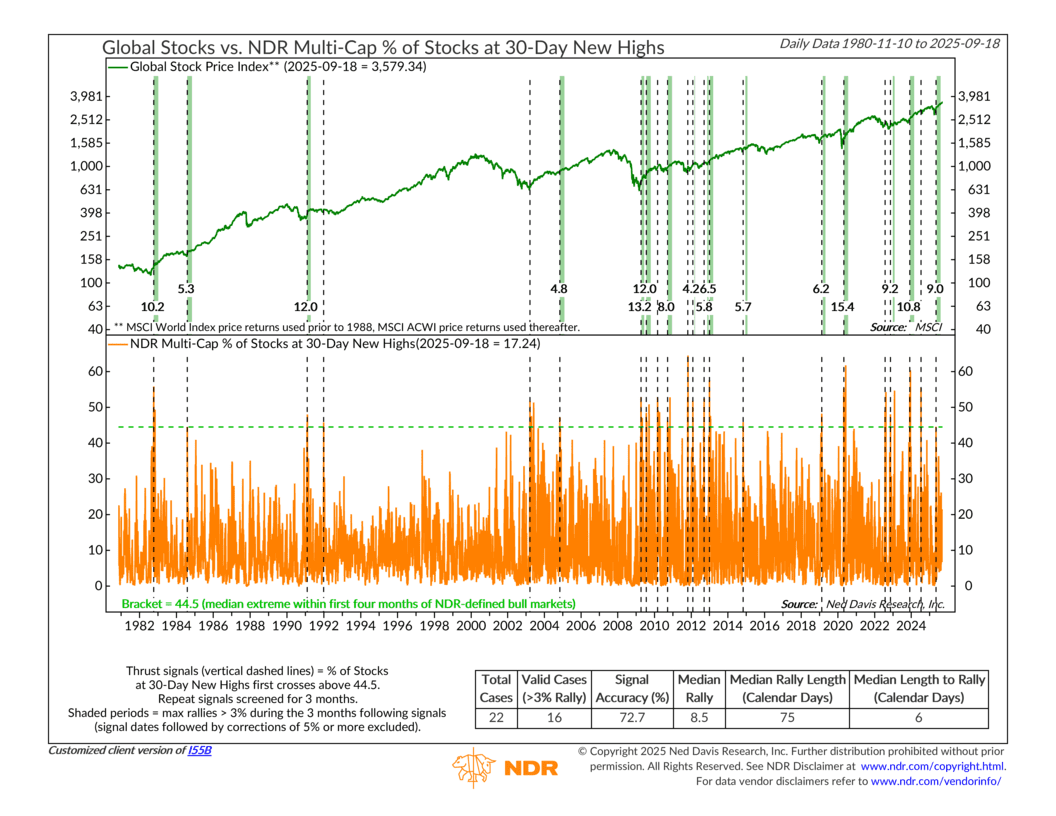

The top half of the chart shows global stock prices going back to 1980. The bottom half shows the Ned Davis Research Multi-Cap Equity Series and the percentage of stocks within the index making new short-term highs. The key level to watch is when that percentage surges above 44.5%. That threshold has historically triggered what’s called a “thrust signal”—a burst of market strength where enough individual stocks are breaking out to give investors confidence that momentum can keep carrying the market higher.

Looking back, these thrust signals have been powerful. Out of 22 valid cases since 1980, 16 were followed by rallies of at least 3% within the next three months. That’s an accuracy rate of nearly 73%. On average, the market gained 8.5% in the months following a signal, with rallies lasting about 75 days. In other words, when this indicator gives the go-ahead, history suggests it pays to pay attention.

So where are we now? As of mid-September, only about 17% of stocks globally are at 30-day highs—well below that 44.5% trigger line. We did see a thrust signal back in May, but it expired last month after global stocks rallied nearly 9%. Since then, no new signal has emerged. That doesn’t mean the rally can’t continue, but history tells us that another thrust would go a long way toward extending the current run.

The takeaway? Momentum is still alive, but the breadth isn’t there anymore. If we do get that surge in participation—if enough stocks across the globe start breaking out together—it would offer a powerful sign that this bull market still has room to run. Until then, it’s a reminder that strong markets are healthiest when more players are on the field, not just a select few carrying the load.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The MSCI ACWI captures large and mid cap representation across 23 Developed Markets and 24 Emerging Markets countries. With 2,935 constituents, the index covers approximately 85% of the global investable equity opportunity set.