Interest rates are important for the stock market. In a technical sense, they’re what we call the “discount rate.” This is the rate at which the future cash flows generated by the companies in the stock market get discounted back to the present. Because of how the math works, higher interest rates reduce the present value of those cash flows, while lower rates increase them.

This week’s indicator, shown above, measures one of the most important discount rates in the market: the 10-year Treasury Yield. The “10-year” can be thought of as the benchmark for all other interest rates. Where it goes matters—a lot—for pretty much everything in the financial world.

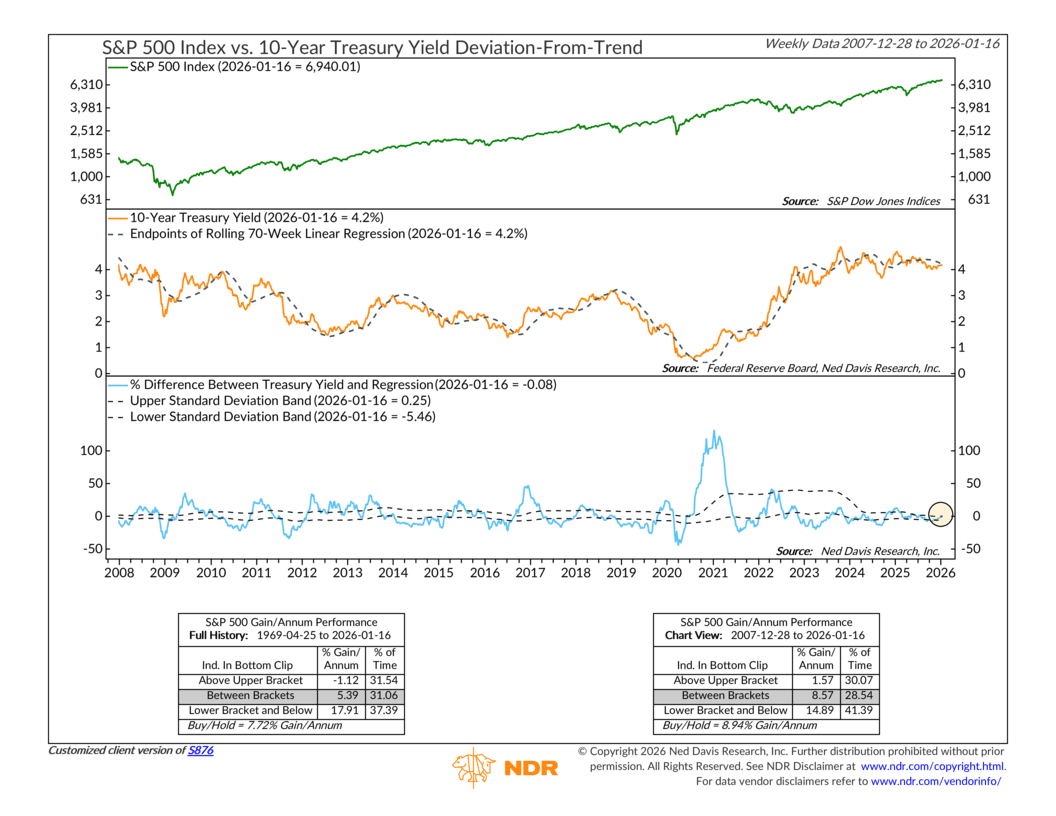

The indicator works like this. In the top panel, shown in green, is the S&P 500 Index. That’s the stock market. The middle panel, shown in orange, tracks the 10-year Treasury yield, which is currently around 4.2%. The dashed line alongside it represents a rolling 70-week linear regression, which you can think of as a statistical estimate of where the 10-year “should” be over time. That level is also about 4.2% today.

So, what does that all mean? Well, the bottom clip shows the percentage difference between those two lines—the 10-year and the regression. As the performance box at the bottom of the chart shows, when this measure is below the lower bracket, stock market performance (the S&P 500) does quite well. But when the measure is above the upper bracket, stock performance is very poor—and sometimes even negative.

Now, all this makes sense when we tie it back to what we talked about at the beginning of this post. When interest rates run higher than they should, the discount rate rises and the value of future cash flows falls. In other words, higher rates put pressure on stock prices.

So, where is the indicator now? Well, for most of last year, the 10-year was trending below its linear regression line—and that proved to be a nice little tailwind for the stock market. However, as I mentioned above, the 10-year is now equal with its linear regression—both are exactly 4.2%. This means any move higher from here will trigger a “sell” signal for the indicator.

Bottom line? I think the takeaway here is that although stocks are not in immediate trouble, an important tailwind may also be fading. The bond market is no longer confirming the equity market’s optimism the way it did earlier in the cycle, so this is something to keep an eye on going forward.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.