Coming into the new year, we wanted to see markets answer one simple question: Are stocks moving together, or is the rally being carried by just a handful of names? That distinction matters more than most investors realize. Broad participation is often the difference between a market that can sustain upside and one that’s vulnerable to stalling.

That’s where this indicator comes in.

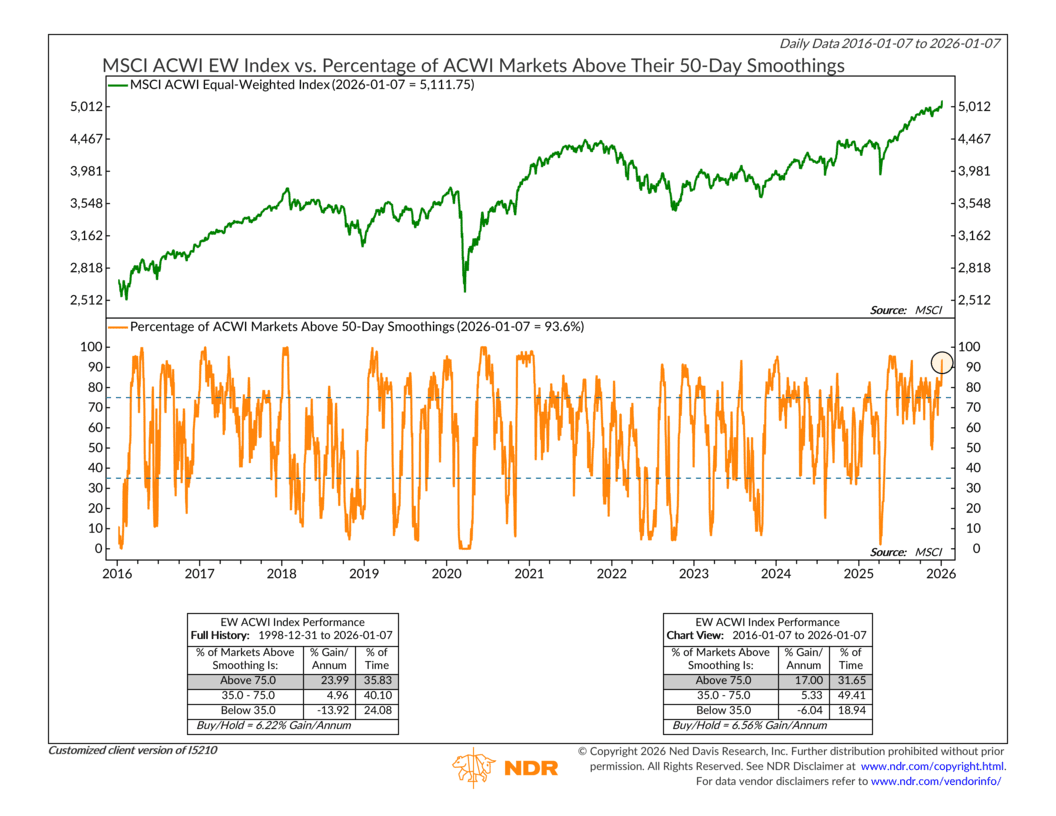

The chart above combines two key pieces of information. The top panel shows the MSCI ACWI Equal-Weighted Index, which gives every global stock market the same amount of “weight.” This index strips out the dominance of mega-caps and lets us see how the “average” market around the world is behaving. The bottom panel shows the percentage of ACWI markets trading above their 50-day moving average. In simple terms, it tells us how many markets are in short-term uptrends at any given time.

When that orange line is high, it means most markets are participating in the advance. When it’s low, leadership is narrow and fragile. The dashed lines on the chart help frame those regimes. Readings above roughly 75 percent tend to reflect strong, broad momentum. Readings below about 35 percent usually signal widespread weakness and defensive conditions.

Historically, this has been a useful way to separate healthy environments from choppier ones. When participation has been strong, forward returns for global equities have generally been solid. When participation has been weak, returns have been far more mixed, with higher volatility and greater downside risk. In other words, markets tend to reward investors when strength is shared.

That’s what makes the current reading notable.

To start the new year, participation has surged. As I’ve highlighted, roughly 94 percent of ACWI markets are now trading above their 50-day moving averages. That’s a sharp and decisive move higher, especially given where it was late last year. This tells us this rally is no longer being carried by a narrow group of markets. Strength has broadened out meaningfully across regions and countries.

From a risk-management perspective, that matters. This jump in participation has been a key driver behind our overall risk model moving back into positive territory. Price action is improving, momentum is rebuilding, and importantly, more markets are pulling in the same direction.

The takeaway, then, is straightforward. Markets don’t need to be perfect to work, but they do need participation. The early-year surge we’re seeing suggests a healthier global backdrop than we had just a few weeks ago. That doesn’t eliminate the possibility of short-term pauses or pullbacks, but it does improve the odds that the trend has a sturdier foundation beneath it as the year gets underway.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The MSCI ACWI Equal Weighted Index is an equity index that measures the performance of large- and mid-cap stocks across developed and emerging markets worldwide, with each constituent assigned an equal weight rather than being weighted by market capitalization.