The Federal Reserve has a way of setting the tone for markets. Whether it’s tightening the screws with rate hikes or loosening the reins with cuts, its moves send ripples across Wall Street.

So, for this week’s indicator, I want to highlight a metric that taps into this relationship.

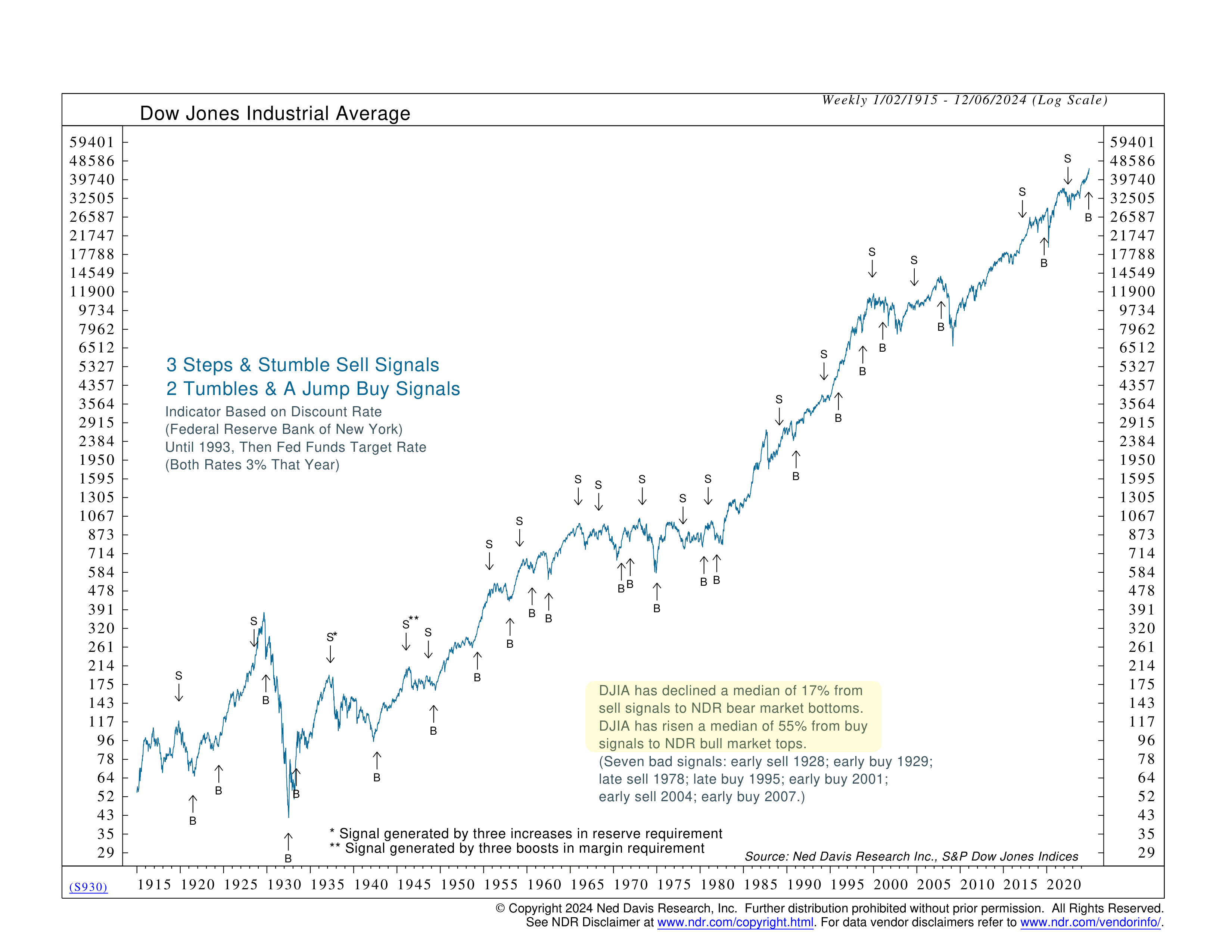

The first half of it is called the “Three Steps and a Stumble” rule. It was developed by the stock market technician Edson Gould in the 1970s. In a nutshell, it states that three rate hikes in a row by the Federal Reserve tend to cause the stock market to stumble.

Seems simple enough. But does it work? Our indicator suggests it does. Since 1915, the Dow Jones Industrial Average has declined by an average of 17% following a period of three consecutive Fed rate hikes.

When you think about it, it makes sense. So much sense, in fact, that investors quickly realized the counterpart to this idea. They dubbed it the “Two Tumbles and a Jump” rule, which posits that two Fed rate cuts in a row tend to cause the market’s performance to “jump.” And indeed, as the chart shows, the Dow has climbed 55%, on average, from these buy signals to bull market peaks.

Which takes us to today. On November 11th, the Fed cut the Fed Funds rate for the second time in a row, generating a buy signal from the indicator. That was the two tumbles. Now do we get a jump? History says we will.

But, of course, no signal is perfect. Early buy signals in 1929, 2002, and 2007, as well as a late buy in 1995, show that timing can sometimes be off. Overall, though, we believe the weight of the evidence supports the idea that rate-cutting cycles often coincide with the beginning of sustained market rallies.

So, here’s the bottom line: fighting the Fed rarely works. When they change direction, it often pays to follow their lead. Our indicator, the “Two Tumbles and a Jump” part of it, is pointing to brighter days ahead, so it’s highly likely that the stock market has some juice left in it.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks.