In recent weeks, the stock market has shown some weakness. This naturally raises the question: will this trend continue?

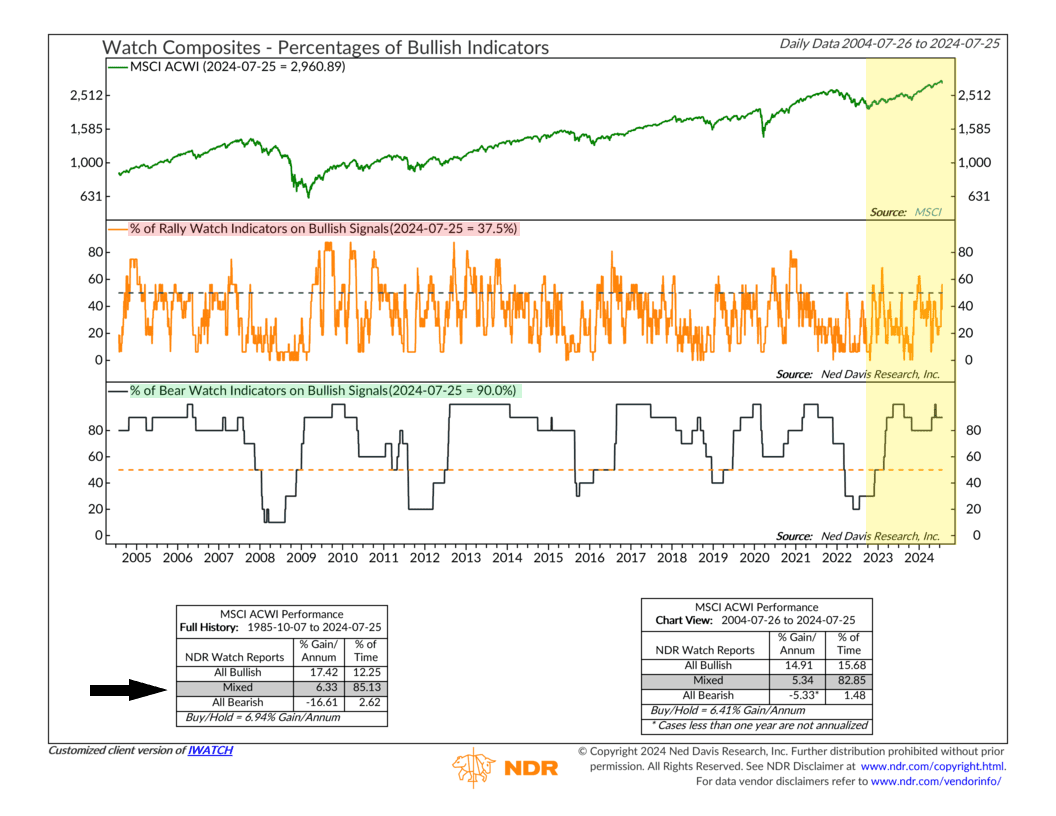

To help answer this, we use a composite indicator that combines two reports: the Rally Watch and the Bear Watch. The Rally Watch report tracks levels that usually lead to a market rally, while the Bear Watch report tracks levels that warn of market declines. Together, these reports help us understand when the market might be heading for a significant drop.

For instance, if both reports fall below 50% bullishness, it often means global stocks, represented by the MSCI All Country World Index, will see negative returns. This situation is rare, but when it occurs, it’s usually a good idea to reduce risk in your portfolio.

Most of the time, however, the two reports give mixed signals. This happens when the Rally Watch indicators drop below 50% while the Bear Watch indicators stay above 50%. In these cases, the market might see a moderate decline, but not a prolonged bear market.

Right now, the good news is that we’re seeing mixed signals. As highlighted in the chart, the Rally Watch report is at 37.5% bullish, which isn’t great, but the Bear Watch report is at 90% bullishness. This suggests that the market’s longer-term uptrend is still intact, and any declines we experience now are likely to be shallow and short-lived.

The bottom line? While there are some signs of weakness, the overall market outlook remains positive for the long term. Stay informed and adjust your investments as needed, but there’s no need to panic.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The MSCI ACWI captures large and mid cap representation across 23 Developed Markets and 24 Emerging Markets countries. With 2,935 constituents, the index covers approximately 85% of the global investable equity opportunity set.