What happens to the stock market after the Federal Reserve first cuts interest rates?

With the September FOMC meeting approaching and the Fed expected to make its first rate cut, this question is on many people’s minds.

Let’s look at this week’s indicator for an answer. It shows what happened to the S&P 500 Index the last 17 times the Fed cut rates.

As you can see, on average, the first rate cut leads to a stock market rally, with the blue line showing a gain of nearly 14% over the next 12 months.

That’s great news, but there’s a wrinkle to this. If we break down the returns (the other two lines), we see that earnings per share for the S&P 500 actually drop by an average of 9.32%, while the price-to-earnings ratio (green line) goes up by 28.16%. This results in an overall positive return.

So, the stock gains come from “multiple expansion.” This means that even though earnings fell, investors were willing to pay more for stocks because interest rates had dropped.

Ok, sure, that’s great news, too.

But there is one issue. We’ve seen a significant amount of multiple expansion already this cycle. This makes us wonder: Are stocks already too expensive?

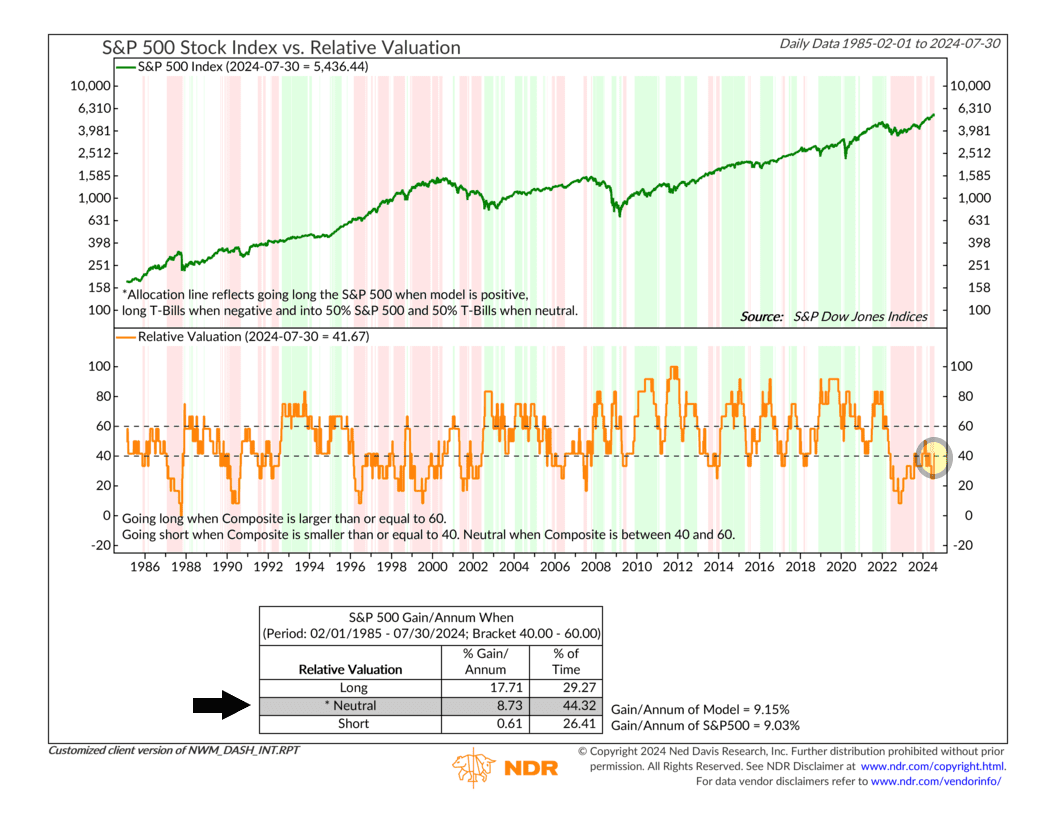

Maybe, but there’s some other good news. Recently, our Relative Valuation Composite, shown below, jumped from negative to neutral.

This indicator combines various relative valuation metrics, such as stock earnings in relation to interest rates. With recent declines in interest rates, the takeaway from this indicator is that overall valuations for stocks are becoming more attractive.

To be sure, valuations are still a concern, and they still look expensive on an absolute basis. But perhaps there is still a little bit of room left for multiple expansion when the Fed cuts rates later this year.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.