by NelsonCorp Wealth Management | Sep 14, 2023 | Indicator Insights

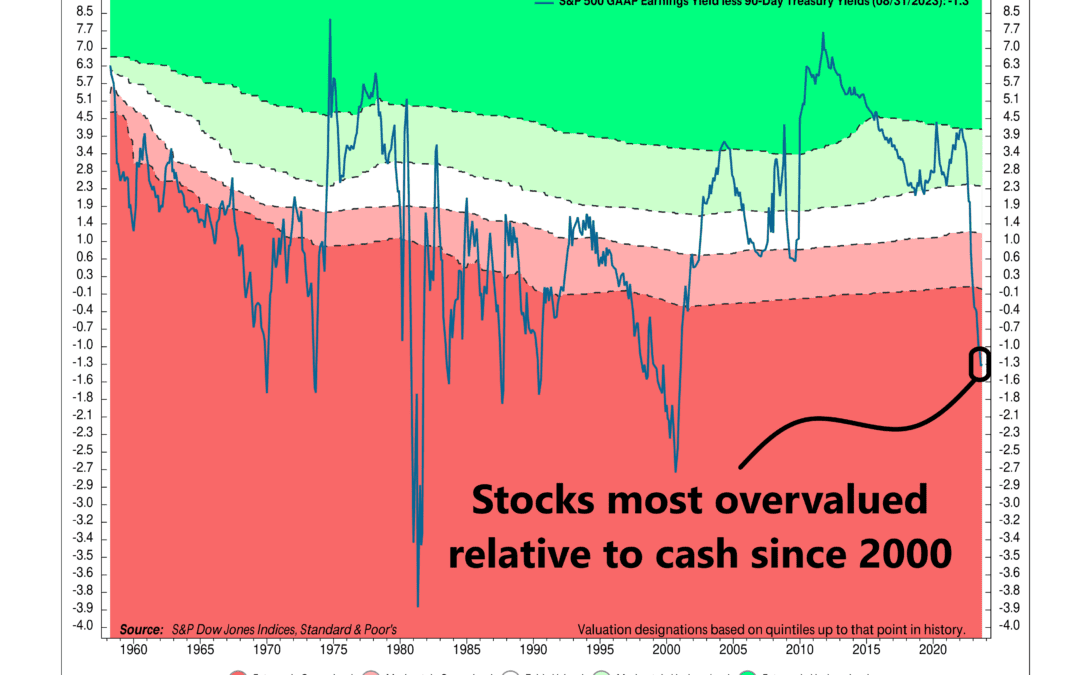

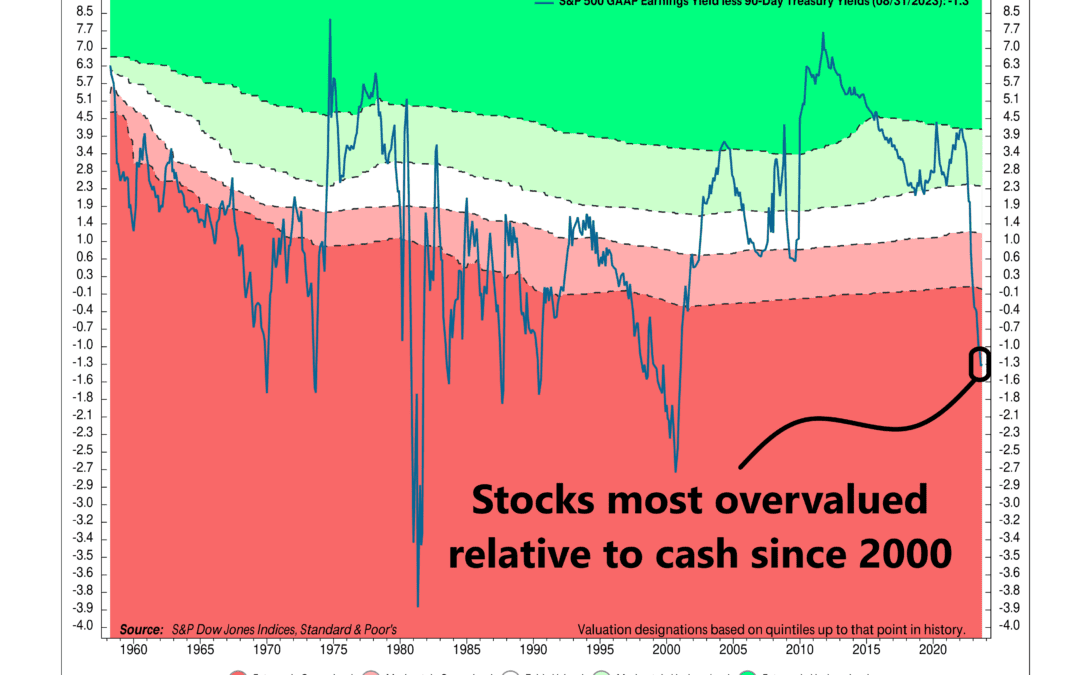

They say valuation—like beauty—is in the eye of the beholder. But we can still objectively value the stock market by comparing it to another asset, and that’s the goal of this week’s featured indicator. Specifically, the indicator compares stocks to a safe...

by NelsonCorp Wealth Management | Sep 7, 2023 | Indicator Insights

The equity risk premium is something that has been talked a lot about recently in the financial world, mainly because it dropped to its lowest level in 14 years last month. This is concerning because it has the potential to pose a significant challenge to the...

by NelsonCorp Wealth Management | Aug 31, 2023 | Indicator Insights

This week’s indicator features the Credit & Liquidity Risk OAS Index (orange line, bottom clip), which is an index that packages credit spread risk into one neat little metric. It rises when credit spreads widen and falls when credit spreads narrow. But...

by NelsonCorp Wealth Management | Aug 24, 2023 | Indicator Insights

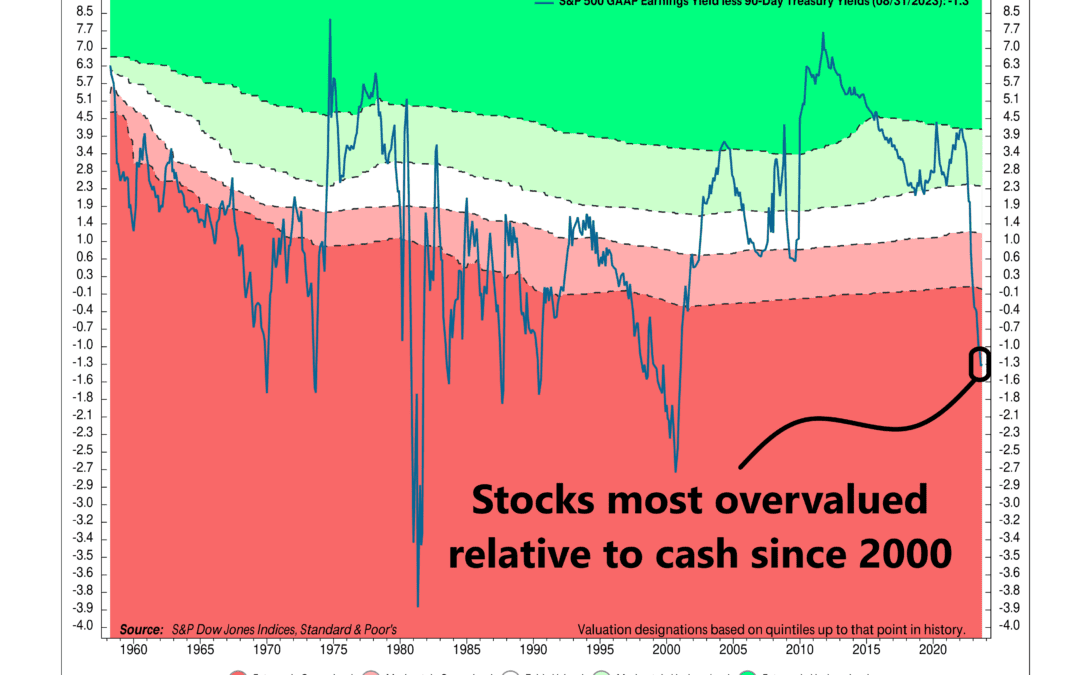

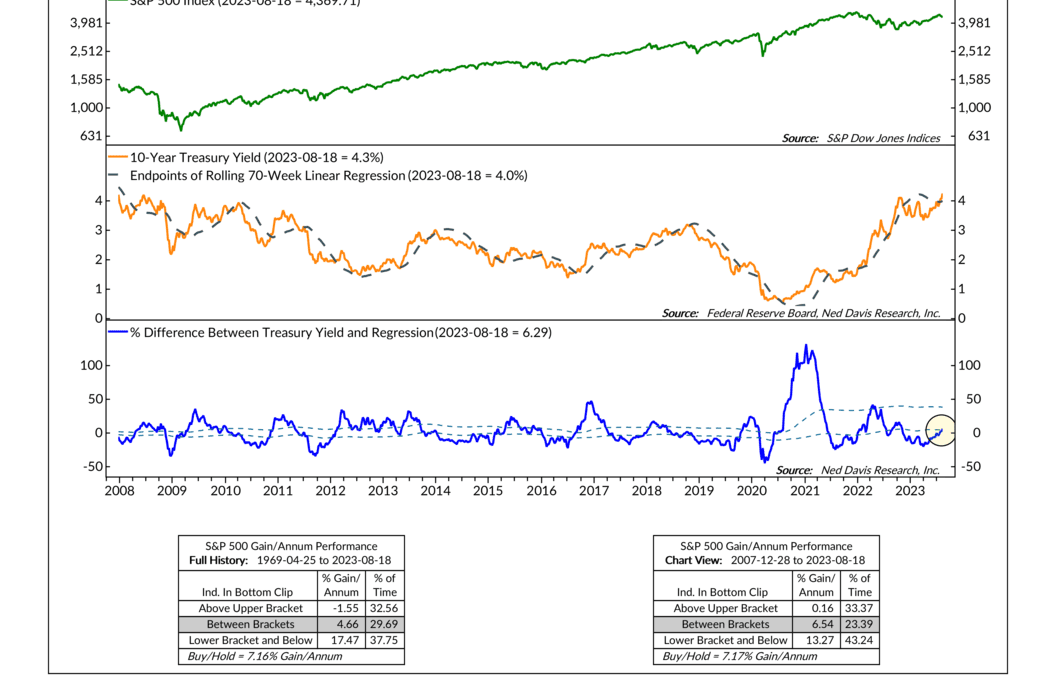

This week’s indicator focuses on interest rates—and why rapid changes in interest rates can negatively affect the stock market. When we talk about interest rates in the financial world, we often reference the 10-year Treasury rate, the rate at which the federal...

by NelsonCorp Wealth Management | Aug 17, 2023 | Indicator Insights

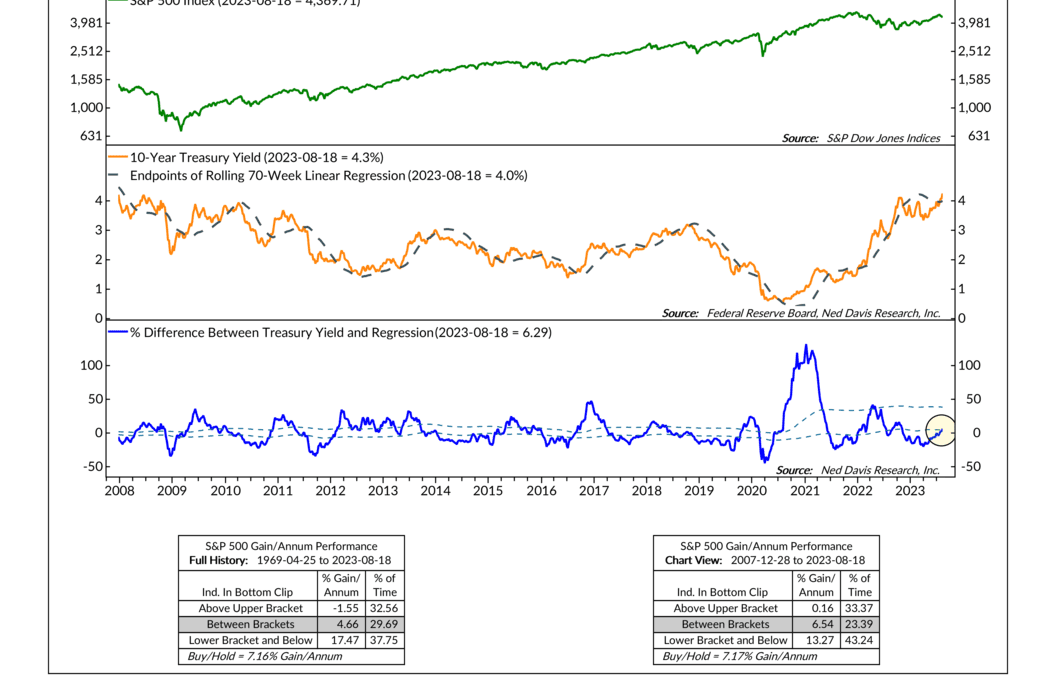

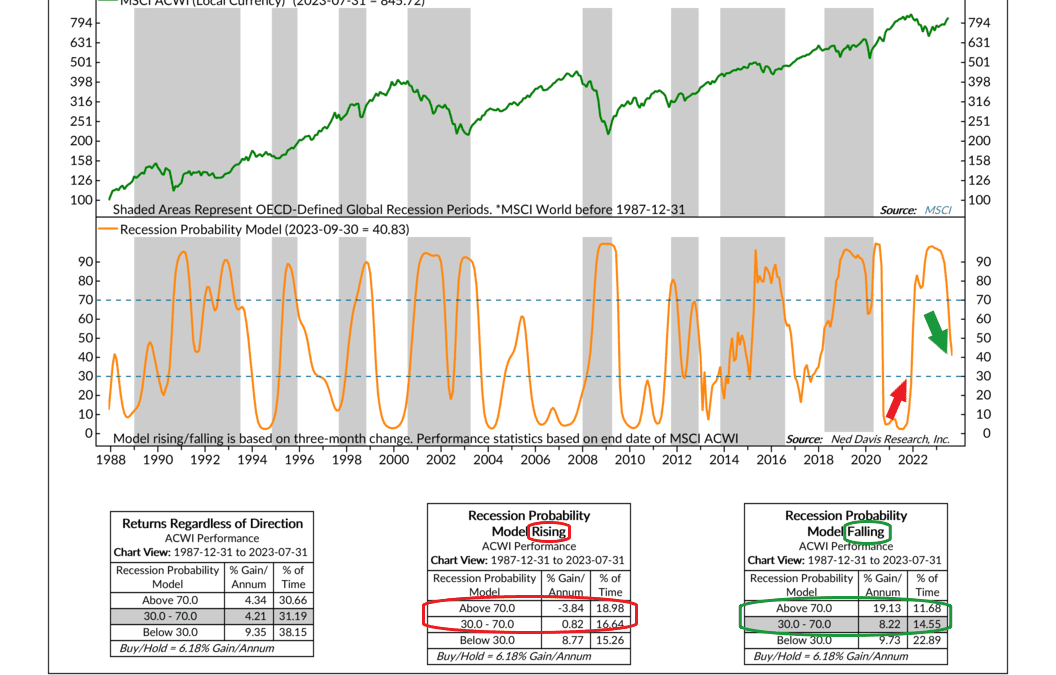

This week’s indicator is called the Global Recession Probability Model. It uses a statistical technique called “logistic regression” to identify when global economic growth might slow down, with the probability ranging from 0% to 100%. We talked about this...

by NelsonCorp Wealth Management | Aug 10, 2023 | Indicator Insights

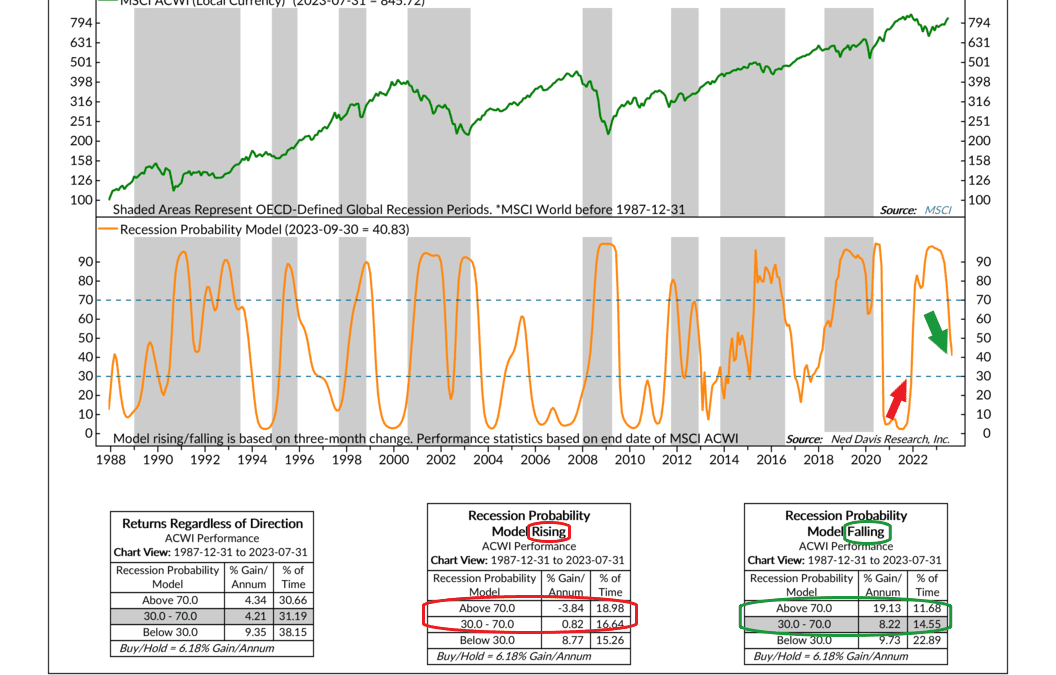

Last April, we talked about the real earnings yield indicator and how a continued fall in inflation could eventually bring the indicator into positive (bullish) territory. This week I want to give an update on how things are going. But first, here’s a quick...