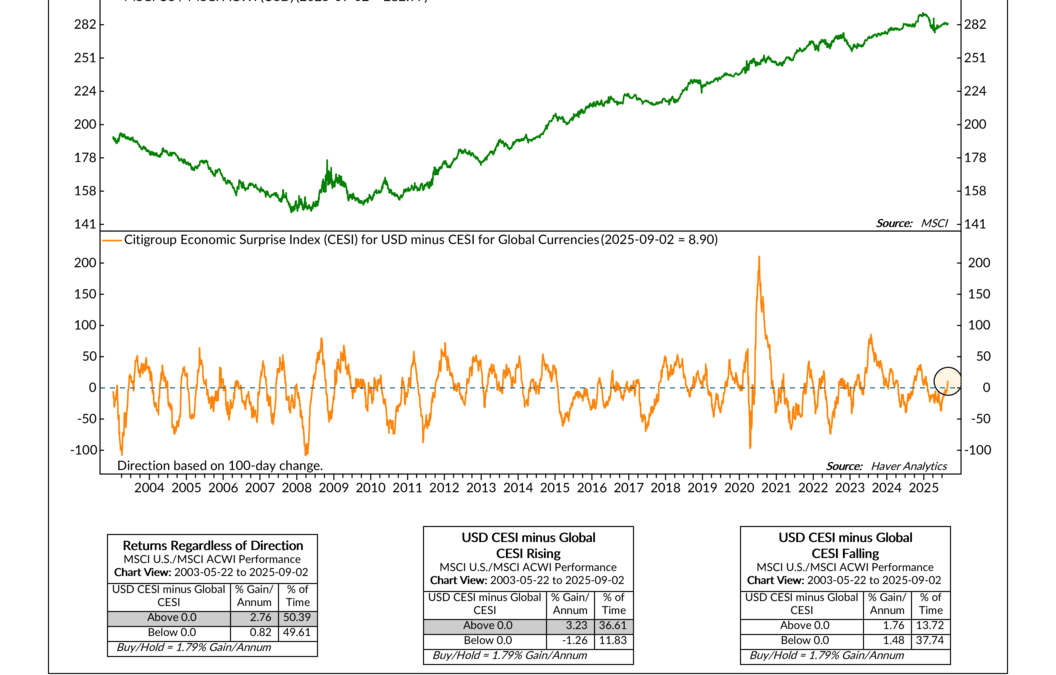

Overextended

Have you ever noticed how a truck can only pull so much before the trailer starts to sway? Sure, you can push it a little, but eventually, the load and the power have to stay in balance. The stock market works in a similar way when you compare it to the amount...

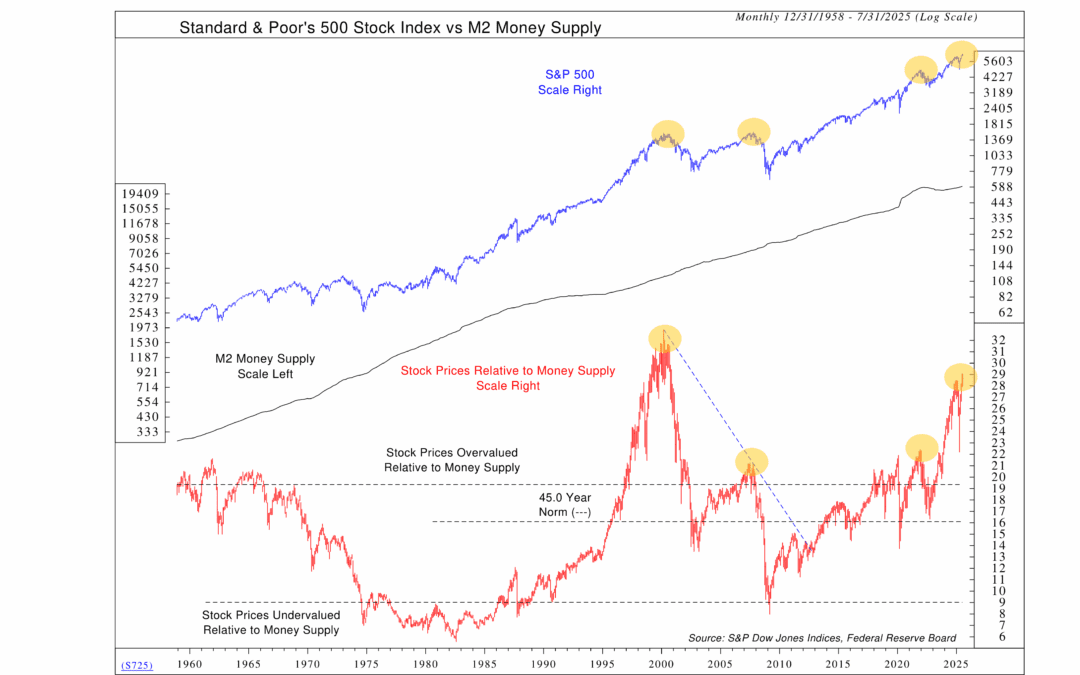

Really a Rally?

There are a lot of challenges in investing. But one that’s particularly tricky is knowing when a market rally is, well, a rally. Maybe it’s the start of a new rally? Or maybe the current one is running out of steam? That’s where this week’s indicator...

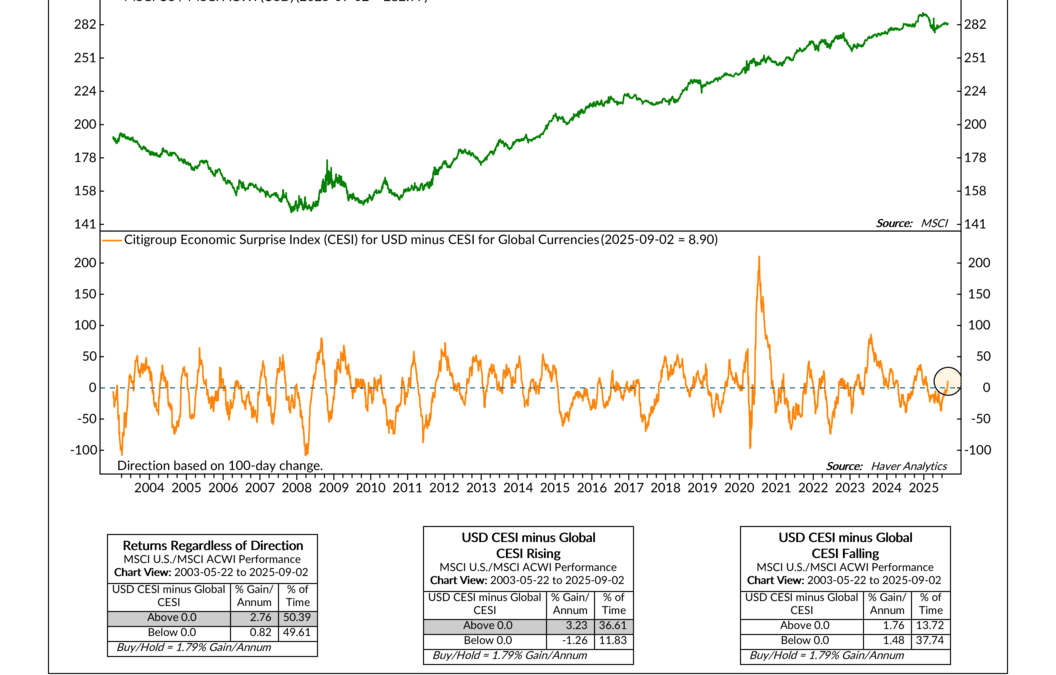

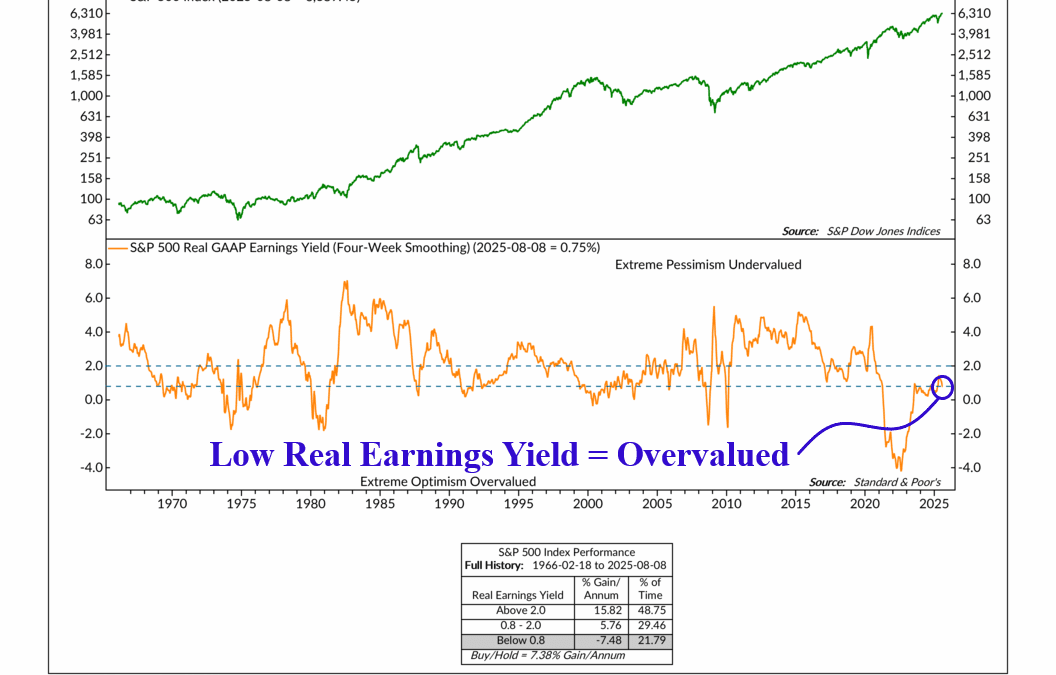

Relative to What?

Most people watch the stock market by looking at prices. Are they going up? Are they going down? But price is only one component. How do we know if that price is actually a good deal? That’s where this week’s featured indicator comes into play. It measures...

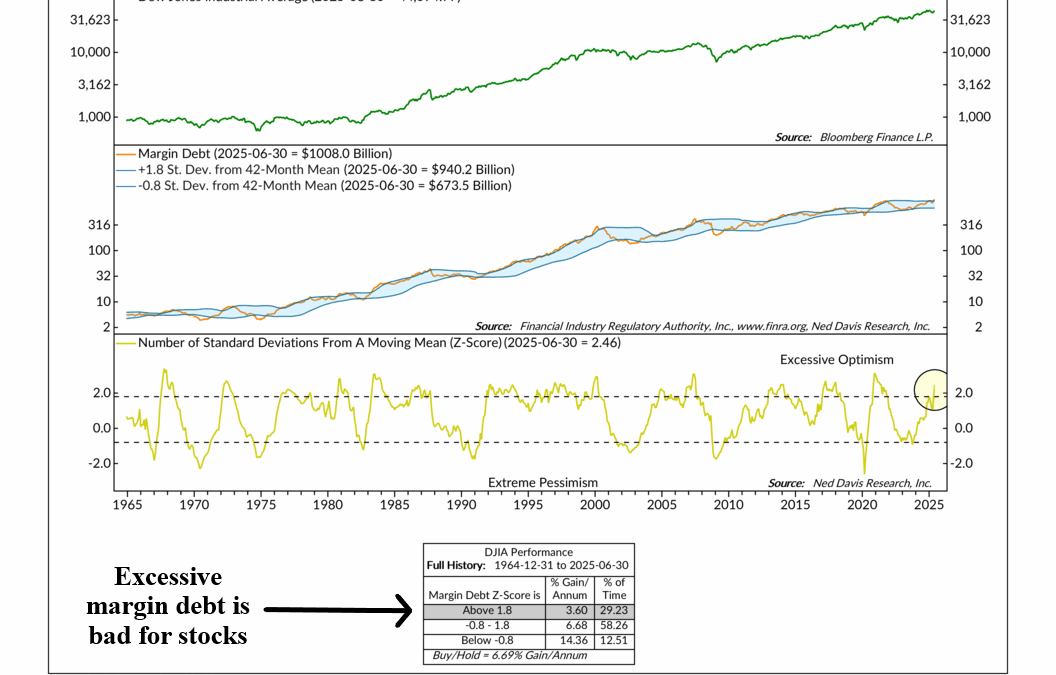

Put It on My Tab

Margin debt. What is it? Technically, it’s the total amount of money owed to brokerage firms by customers who’ve borrowed funds to buy financial securities. But in simple terms, it’s just money investors borrow to buy stocks. Why would someone do this? Because...

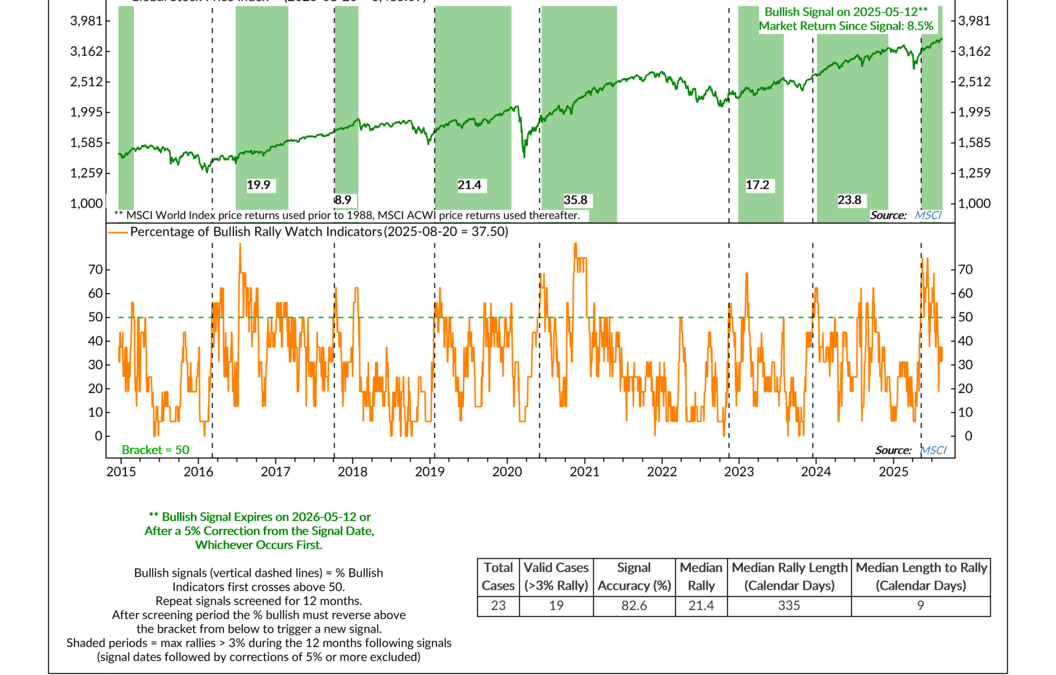

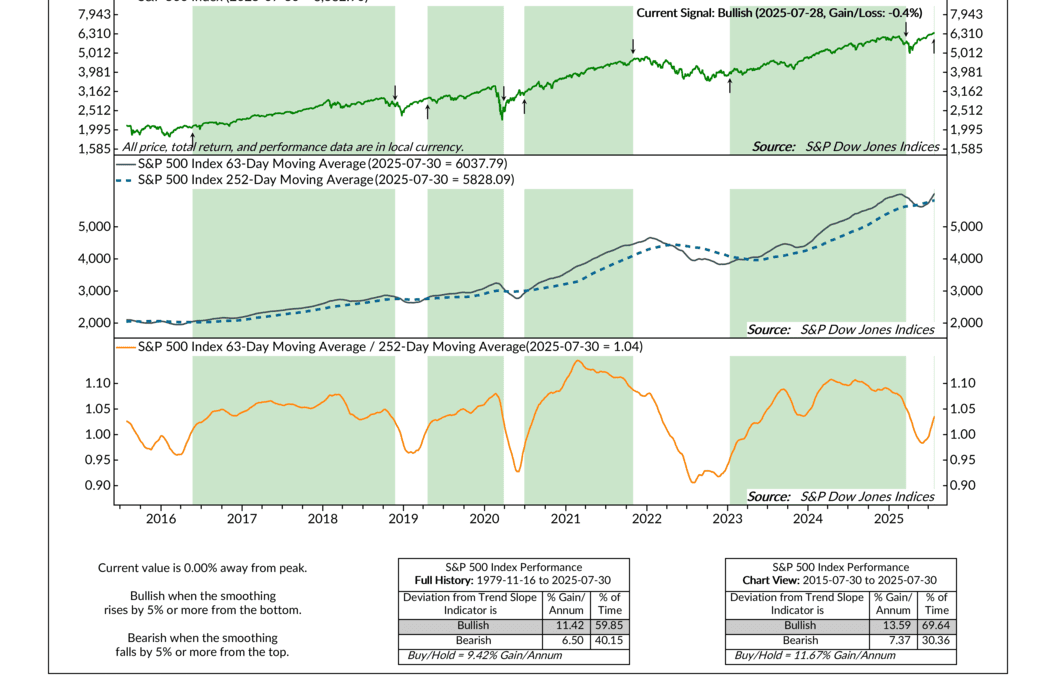

Hitting the Slopes

The market’s trend is back on track, and one of our favorite slope-based signals just turned bullish. Check out what that means—and why it could matter for your next move.