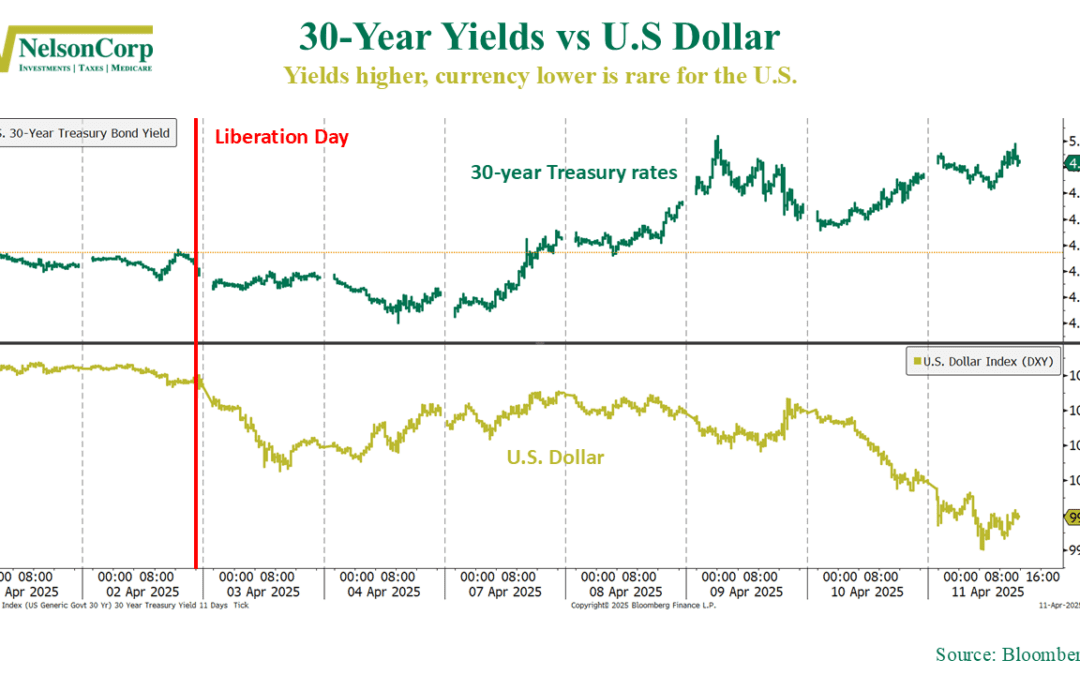

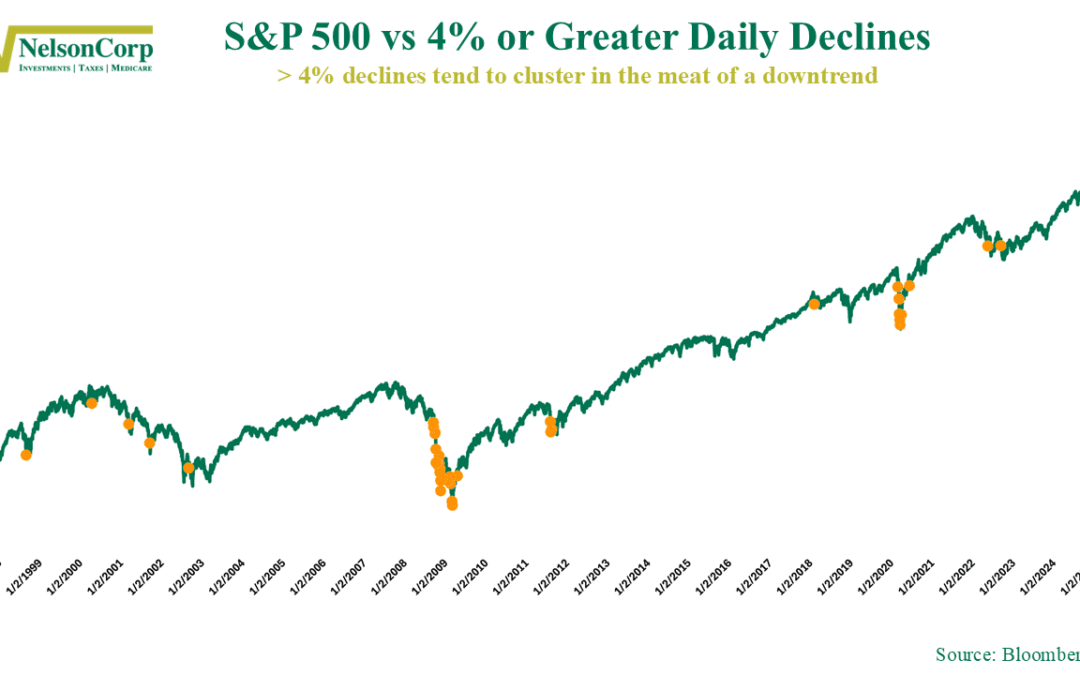

Stock Plunge

We’re doing something a little different this week. The chart we’re looking at isn’t one of our go-to indicators—it’s more of a historical curiosity. But with the market falling over 9% last week, it’s worth digging into how things have played out after similar...

Financial Focus – April 9th, 2025

This week’s Financial Focus highlights the fast-approaching tax deadline and why now is the perfect time to start planning ahead, not just looking back. Nate Kreinbrink also breaks down the key decisions around Social Security—one of the most important assets in retirement—and how timing can impact your long-term financial picture.

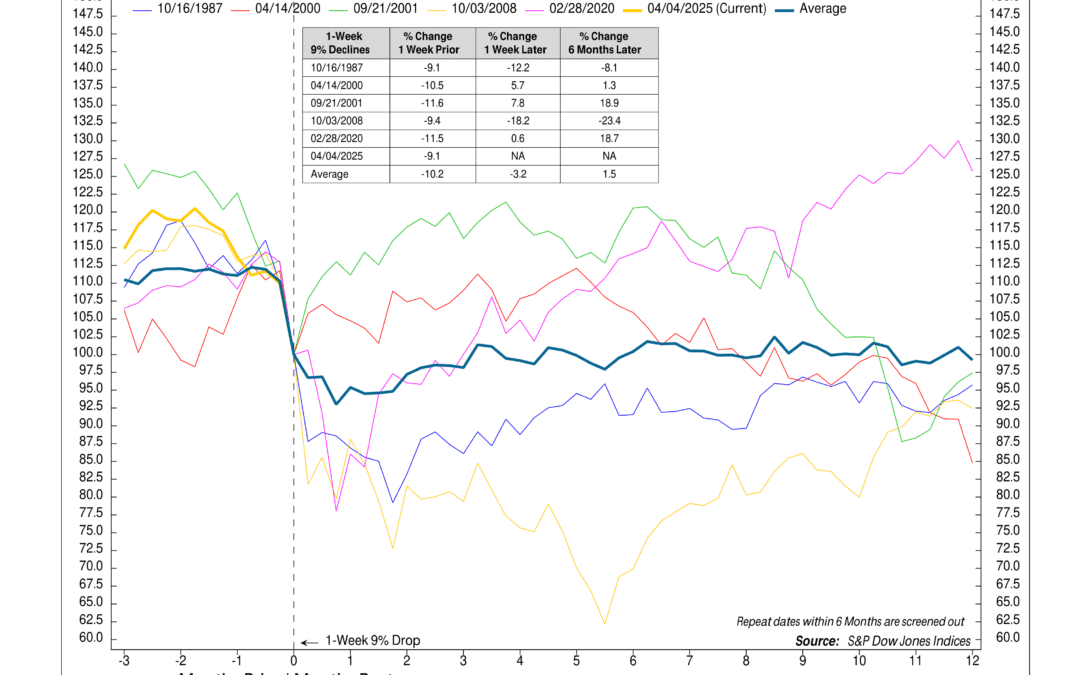

Margin Debt Warning

Margin debt is the amount of money investors borrow to buy stocks. David Nelson explains the historical trend of margin debt and why investors should continue to be cautious.

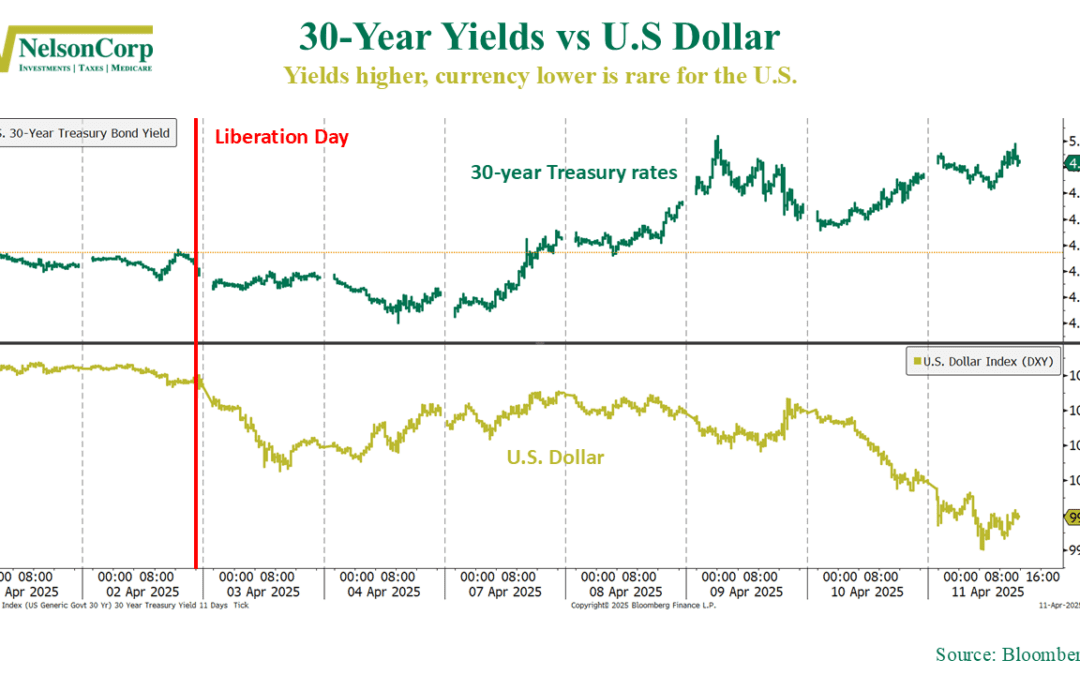

Risk Off

The S&P 500 got slammed to close the week, dropping over 4% on Thursday and then following that up with another bruising decline on Friday. The two back-to-back haymakers left markets reeling and investors wondering: Is this the bottom—or just the beginning?