Don’t Call It a Comeback

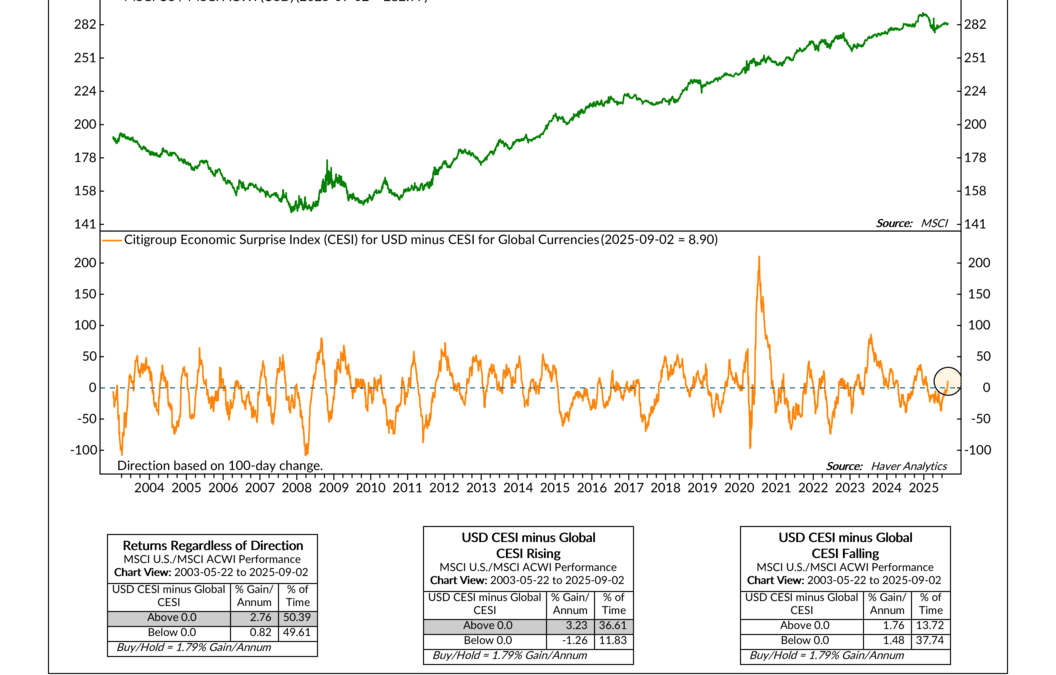

One of the big surprises in markets this year has been the strength of international stocks compared to the U.S. For years, American markets have been the clear leader. But then 2025 rolled around and things changed a bit. Tariffs were announced, the dollar...

Financial Focus – September 3rd, 2025

Successful investing isn’t about chasing the next big thing, it’s about building a balanced plan that works over time. On this week’s Financial Focus, David Nelson explains why diversification and discipline remain the keys to lasting financial security.

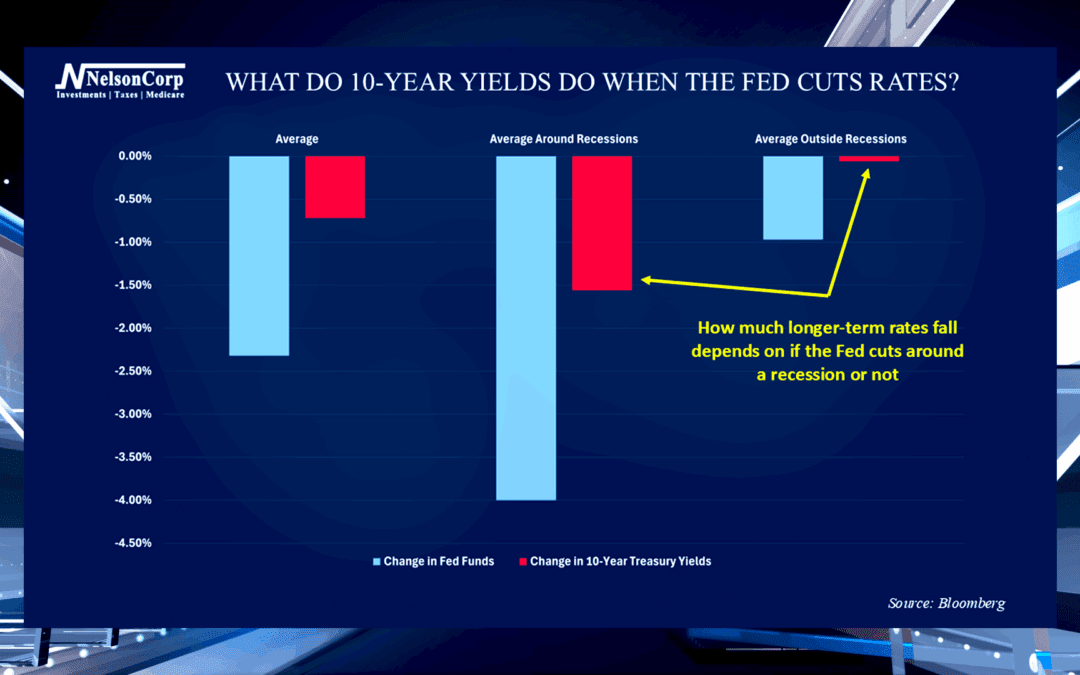

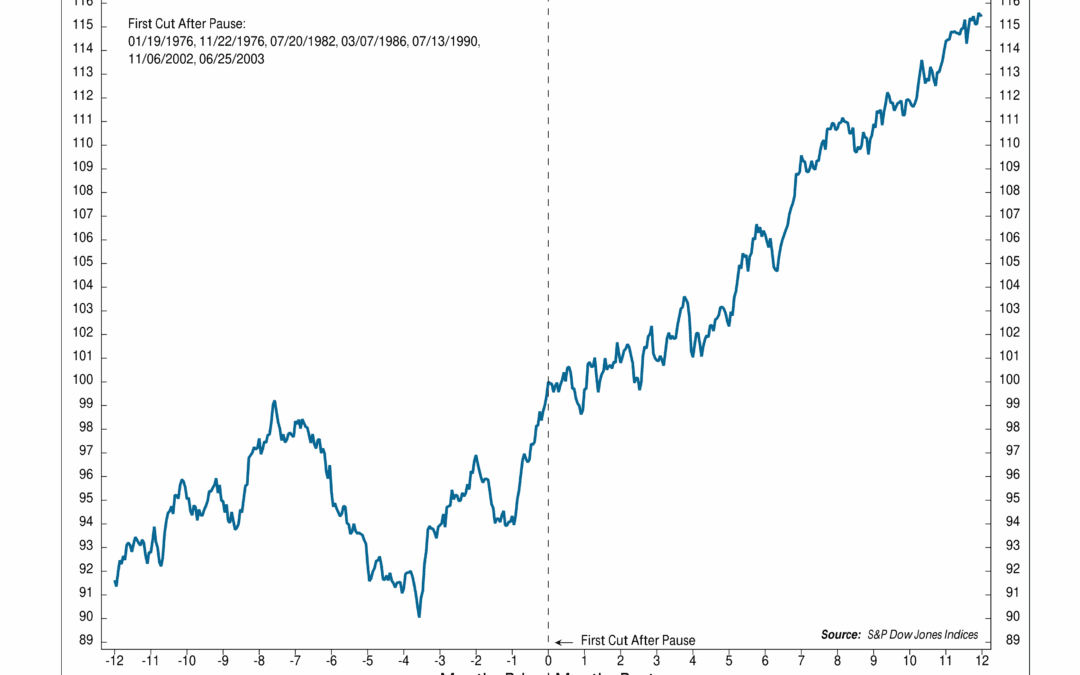

It Depends

Many investors believe when the Fed cuts rates that equates to a positive impact on the markets. David Nelson uses 10-Year Treasury Yield data to explain why this isn’t always the case.

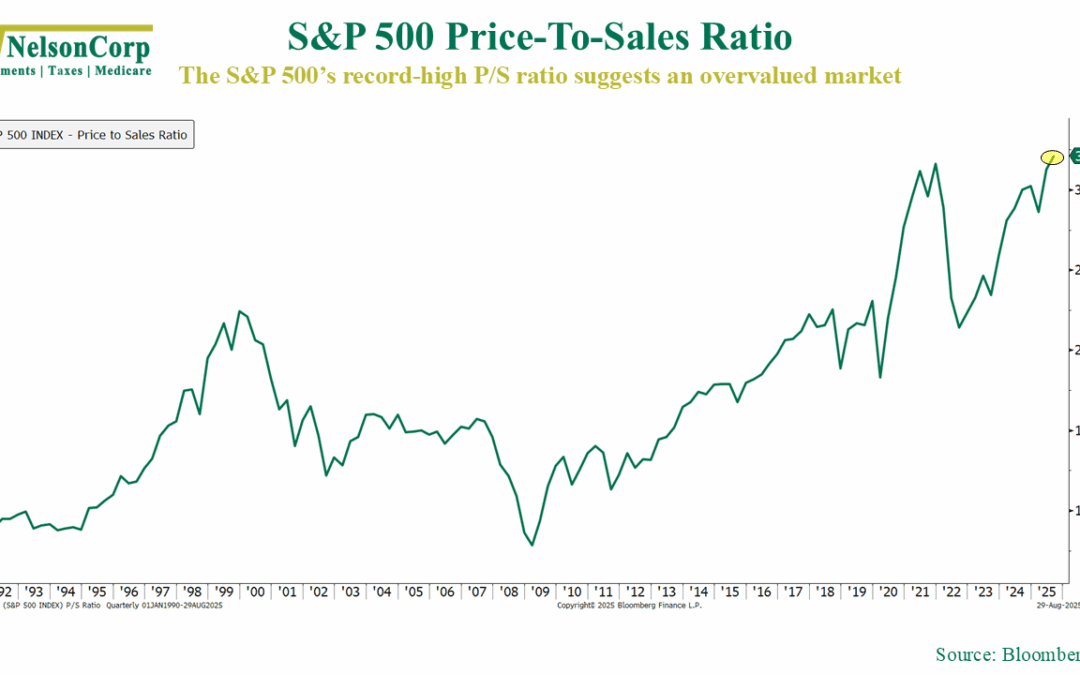

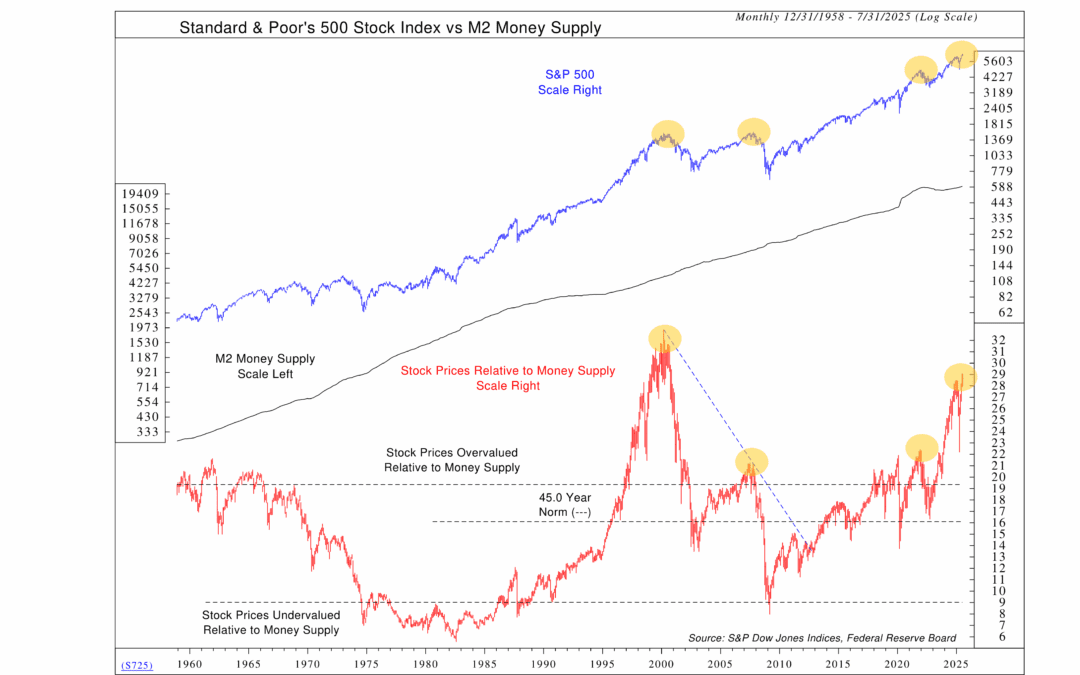

Is the Market Overvalued?

OVERVIEW Markets took a step back last week, with weakness spread across major U.S. equity benchmarks. The S&P 500 slipped 0.10%, while the Dow Jones Industrial Average and NASDAQ each lost 0.19%. Small- and mid-caps lagged further, with the S&P 600...

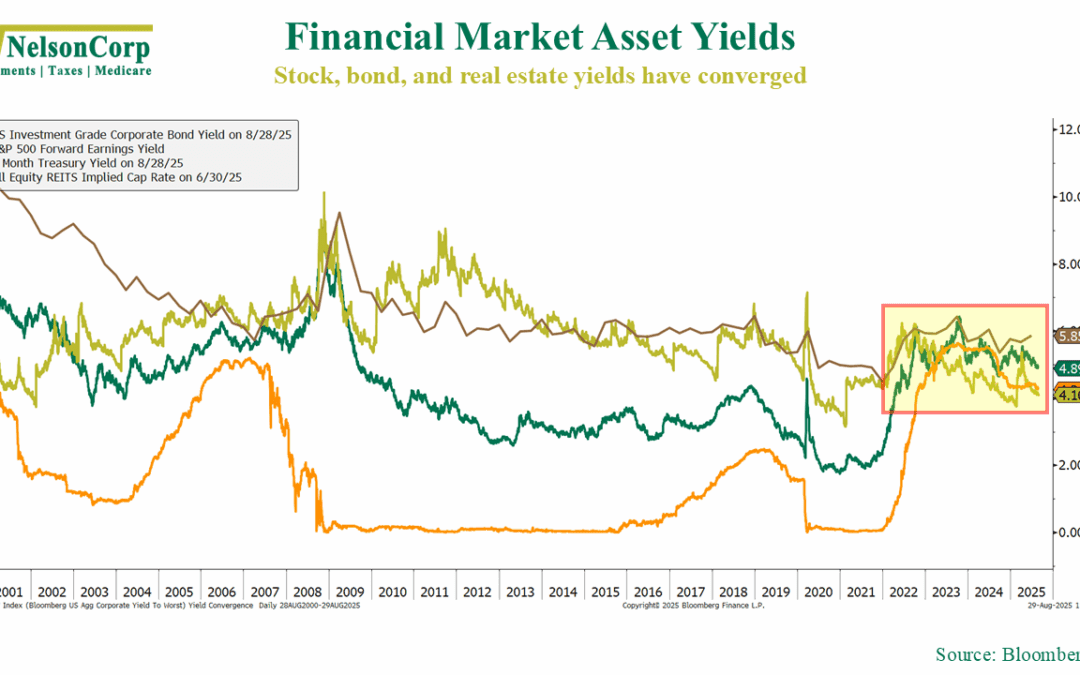

Come Together

Something a bit unusual is happening in financial markets right now. The income, or “yield,” you can earn from stocks, bonds, and even real estate (REITs) has all started to look the same. That doesn’t happen very often. This week’s chart shows what I mean....

Overextended

Have you ever noticed how a truck can only pull so much before the trailer starts to sway? Sure, you can push it a little, but eventually, the load and the power have to stay in balance. The stock market works in a similar way when you compare it to the amount...

Financial Focus – August 27th, 2025

Fall is in the air and football’s kicking off, but it’s also time to start thinking about Medicare open enrollment. Nate and Mike break down what you need to know and why a quick review of your coverage could put money back in your pocket.

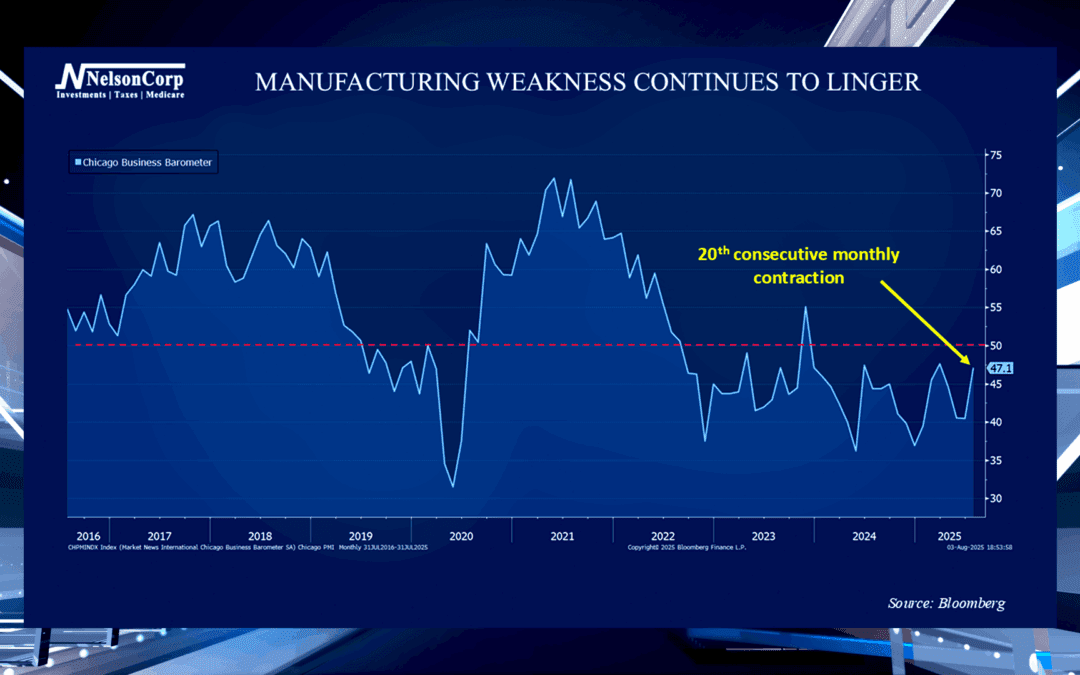

Manufacturing Malaise

When taking a bird’s-eye view, the GDP and consumer spending are currently showing positive signals for the economy. John Nelson drills down to show one pocket of weakness for investors to avoid right now.

Friendlier Fed

OVERVIEW Markets delivered a mixed but generally positive week, with leadership shifting toward smaller companies and value-oriented stocks. The S&P 500 rose 0.27%, while the Dow Jones Industrial Average outperformed with a 1.53% gain. The NASDAQ slipped...

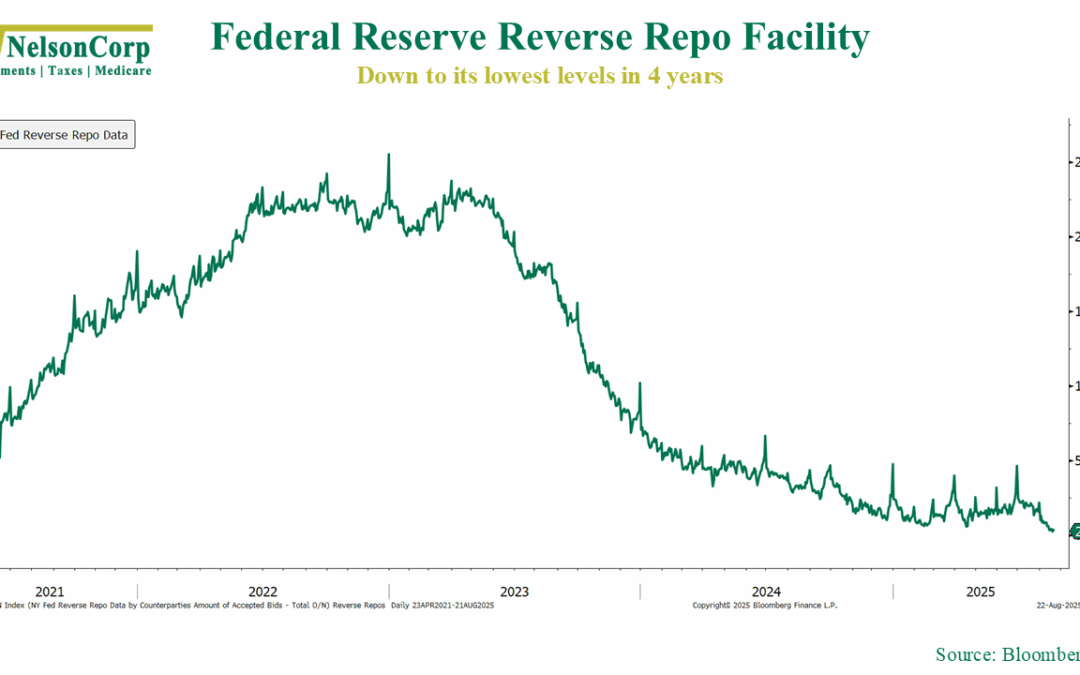

Coins in the Couch Cushion

There’s an interesting development happening in financial markets right now. Sure, it’s a little boring and technical, but it centers on something called the Reverse Repo Facility. I like to think of it as financial markets' version of coins in the couch...

880 13th Avenue North

Clinton, Iowa 52732

563-242-9042

5465 Utica Ridge Road

Davenport, Iowa 52807

563-823-0532

9079 East Tamarack Drive

Dubuque, Iowa 52003

800-248-9042

info@nelsoncorp.com

Fax: 563-242-9062

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and NelsonCorp Wealth Management are not affiliated. This communication is strictly intended for individuals residing in the states of AZ, AR, CA, CO, CT, FL, GA, IA, IL, IN, MA, ME, MI, MN, MO, NC, NJ, NY, SD, TN, TX, UT, WI, and WY. No offers may be made or accepted from any resident outside the specific states referenced. Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Clients and prospective clients should be prepared to bear investment loss including loss of original principal.

Cambridge’s Form CRS (Customer Relationship Summary)

The information being provided is strictly as a courtesy. When you link to any of these websites provided herein, NelsonCorp Wealth Management makes no representation as to the completeness or accuracy of information provided at these sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, sites, information, and programs made available through this site.