Say Something Nice

The market’s been rough lately, no doubt about it. But in this week’s commentary, we highlight three encouraging signs that suggest better days may be ahead.

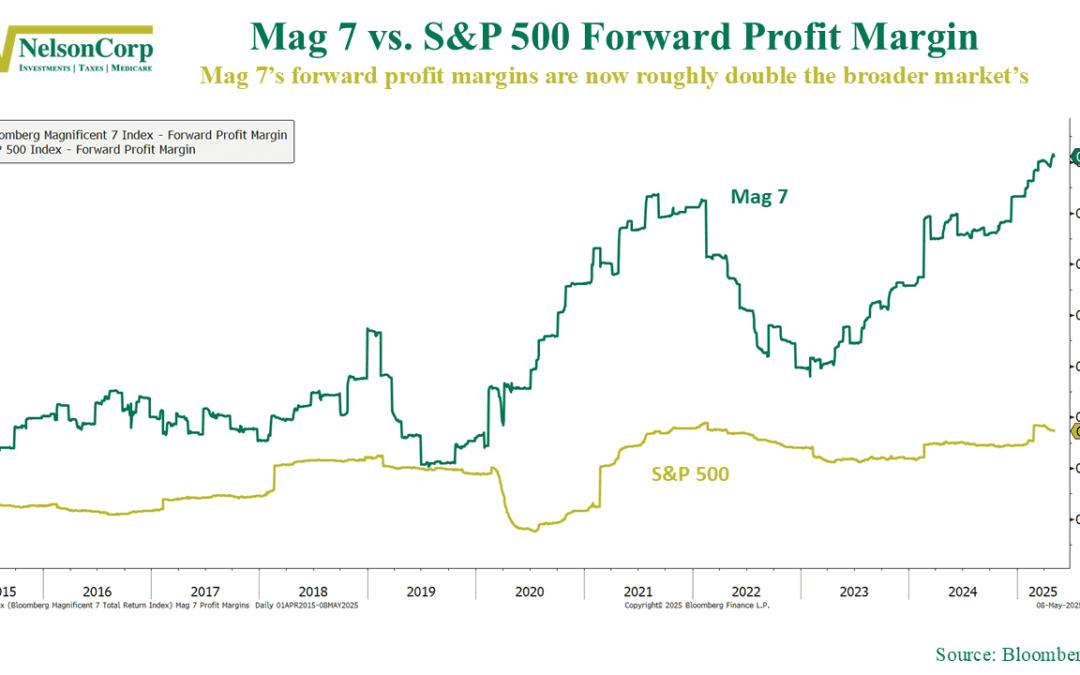

The Big Get Bigger

This week’s chart shows that when it comes to profitability in the stock market, the big just keep on getting better. What do I mean? Well, this week’s chart shows the forward (expected) profit margins of the seven largest tech companies in the S&P 500...

The Terrible Twos

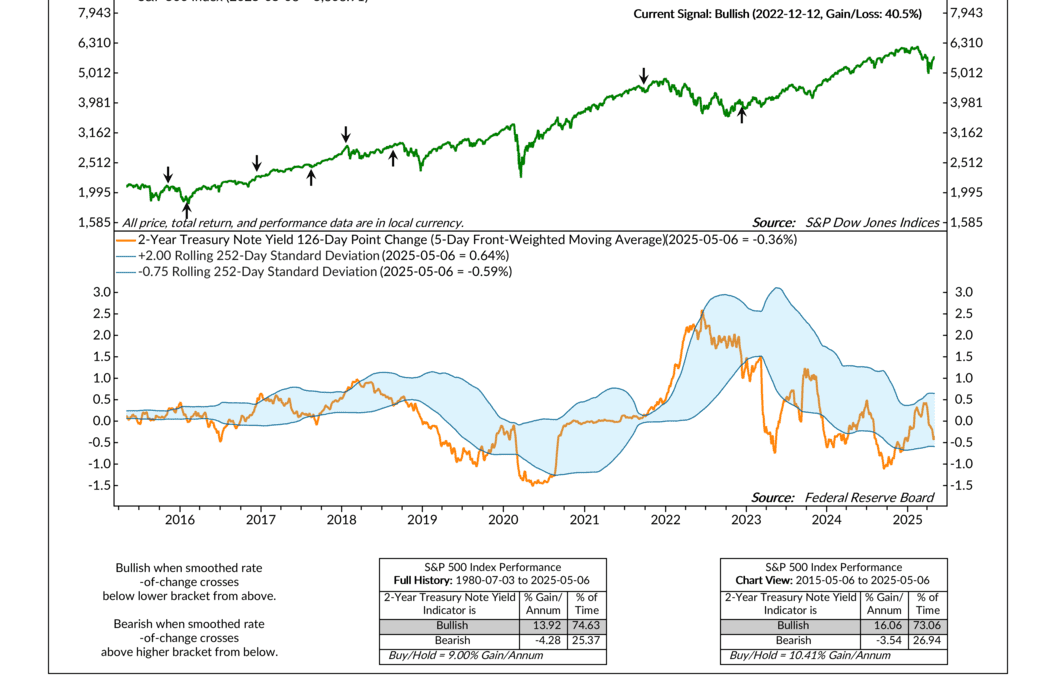

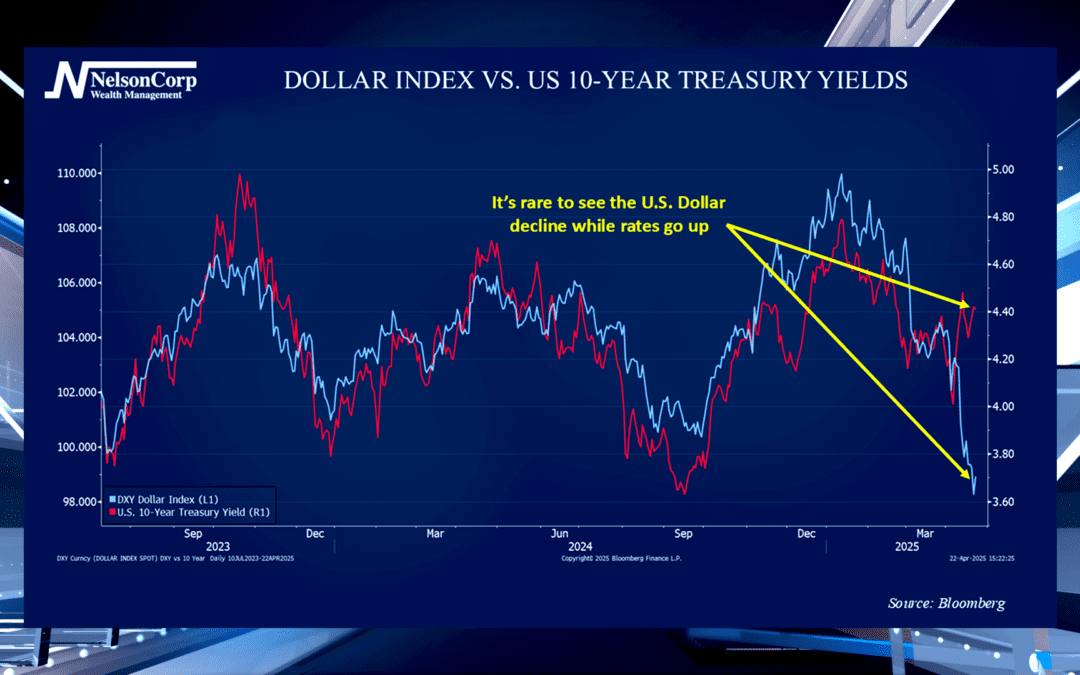

So, the Fed came out this week and reiterated that they’re keeping rates where they are for now. You know, watching the data, that kind of thing. But if you look at what the bond market’s doing, it’s saying something different—and that’s the topic of this...

Financial Focus – May 7th, 2025

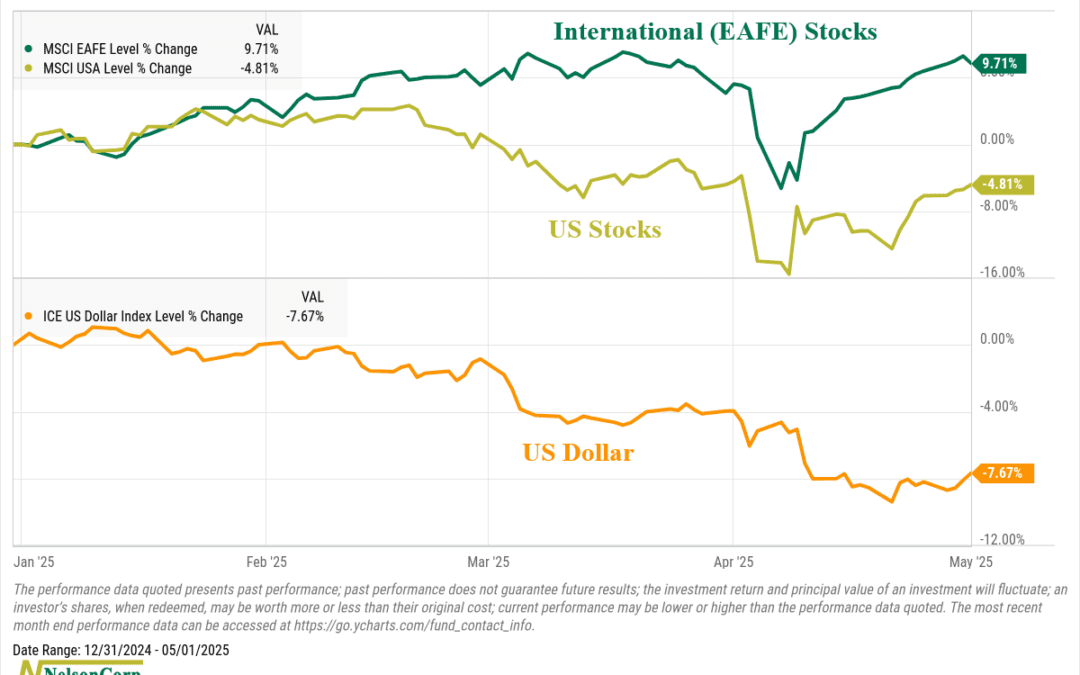

In this episode of Financial Focus, David Nelson discusses Warren Buffett’s legacy, the impact of computerized trading on recent market swings, and how tax strategies can help investors reduce liabilities by shifting income from ordinary to capital gains. He also highlights growing investment opportunities abroad as the U.S. dollar weakens and international markets outperform domestic ones.

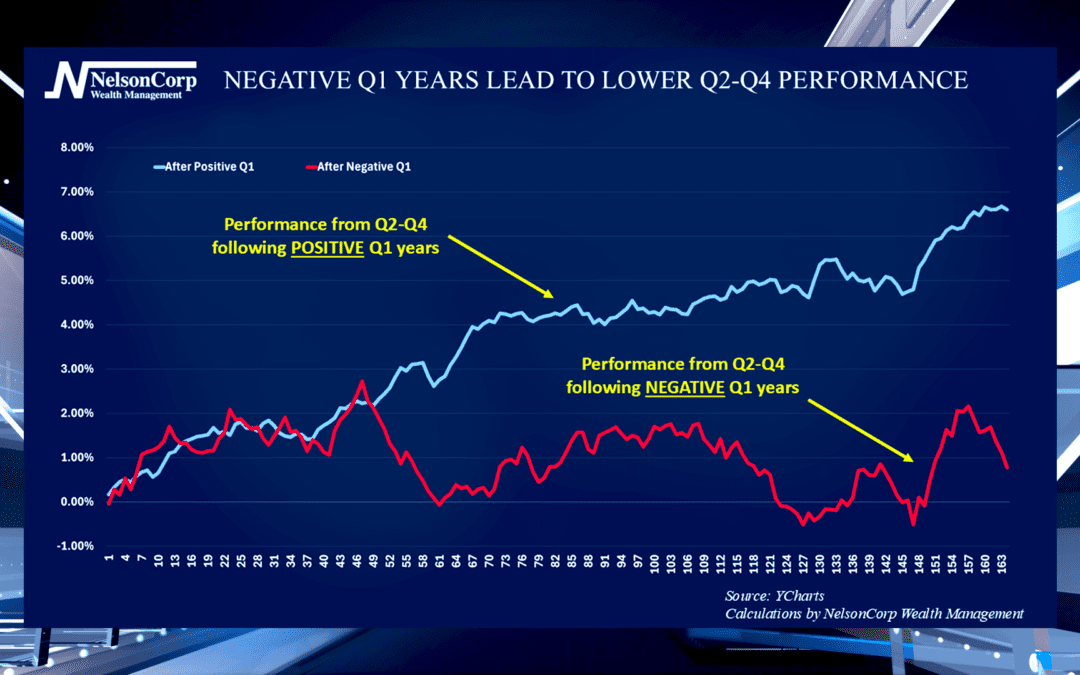

The Q1 Effect

First quarter did not start 2025 off on solid footing. David Nelson is here to share historical data on how years have traditionally finished after bumpy beginnings.

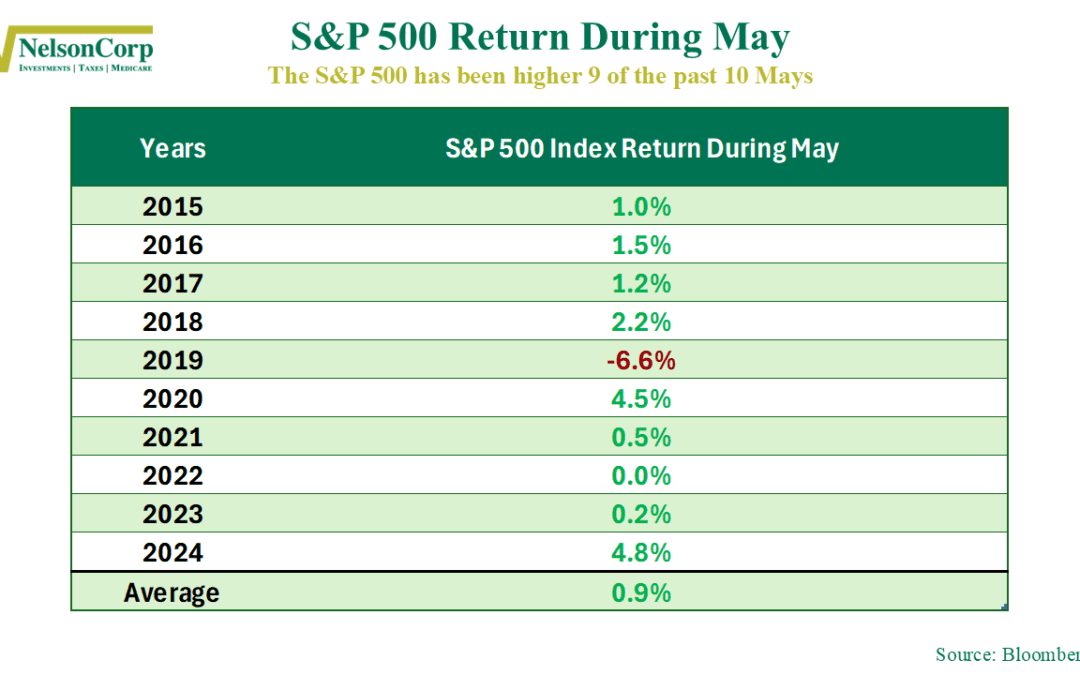

Sell in May?

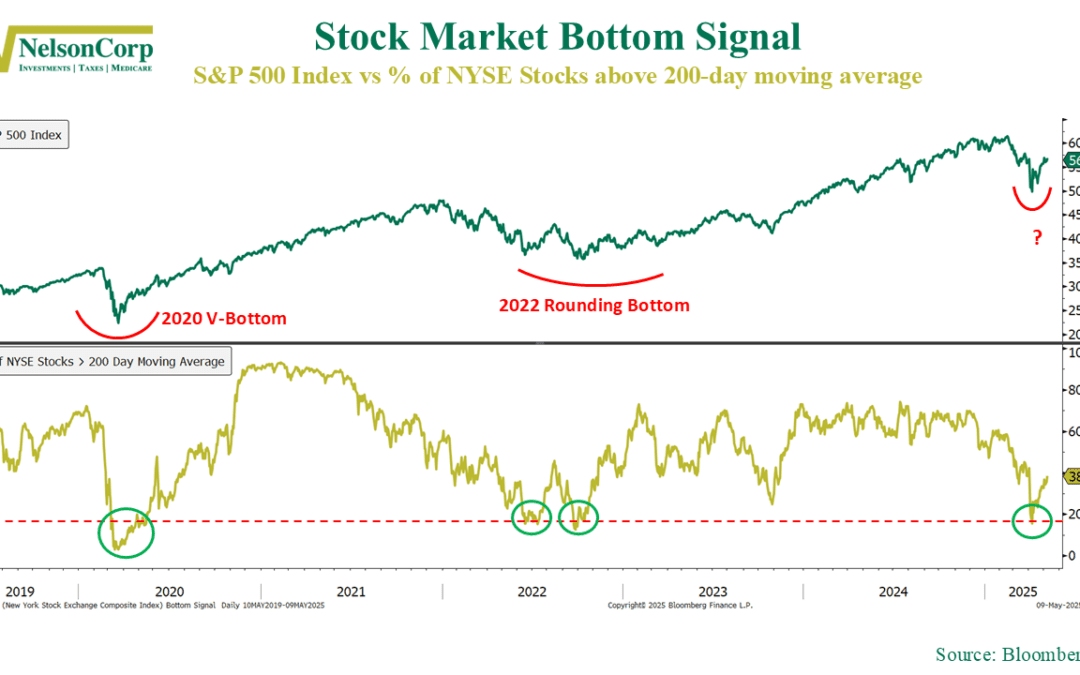

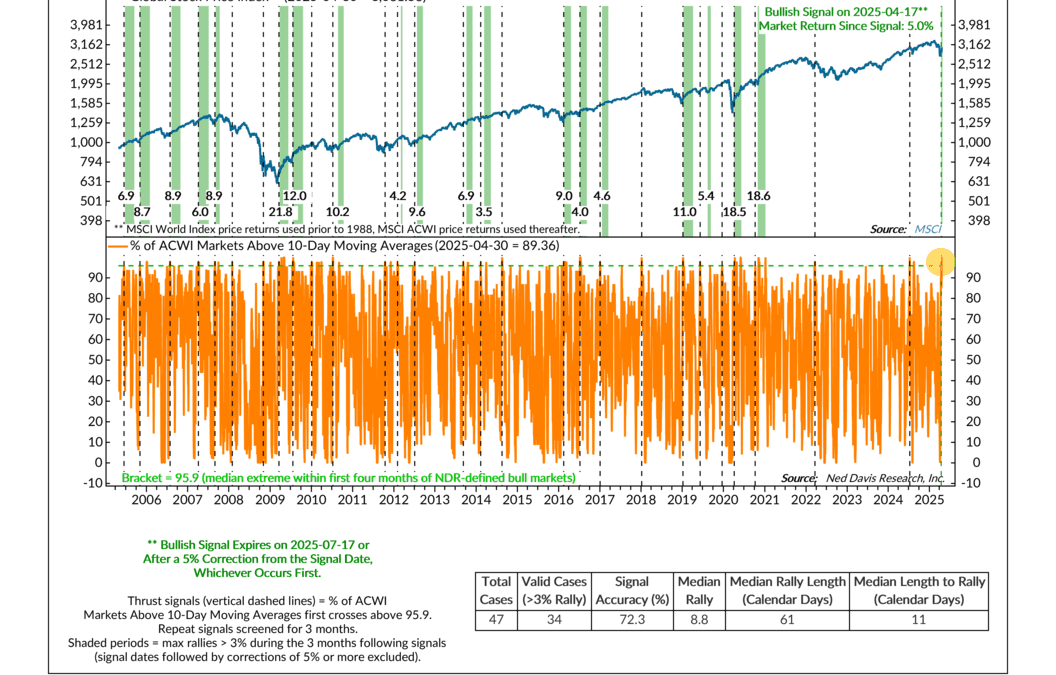

Should you sell in May and go away? Recent history suggests—probably not. Check out this week’s commentary to see why the trend, breadth, volume, and sentiment all suggest the bulls are gaining ground.

The World Turns

One of the more interesting developments this year is the strength in international stocks. For a long time, they’ve trailed the U.S., often by a wide margin. When it came to international diversification, many investors asked themselves: why bother? But...

A Shot of Strength

After a rocky few months to start the year, we finally got some good news a few weeks ago: a global breadth thrust. What’s that? Simply put, it’s when a big chunk of global stocks all start moving higher at the same time—and in a relatively short period. In the...

Financial Focus – April 30th, 2025

This week on Financial Focus, Nate and Mike explain how retirees can make the most of charitable giving through smart tax strategies—like donating directly from IRAs after age 70½ or using donor-advised funds before then. If you’re already giving, these tactics can help you give more without paying more.

The “Sell America Trade”

We have seen considerable movement in the markets lately—especially in currencies and interest rates. David Nelson joins us to discuss data showing a rare event… the U.S. dollar appearing to lose appeal with global investors.

880 13th Avenue North

Clinton, Iowa 52732

563-242-9042

5465 Utica Ridge Road

Davenport, Iowa 52807

563-823-0532

9079 East Tamarack Drive

Dubuque, Iowa 52003

800-248-9042

info@nelsoncorp.com

Fax: 563-242-9062

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and NelsonCorp Wealth Management are not affiliated. This communication is strictly intended for individuals residing in the states of AZ, AR, CA, CO, CT, FL, GA, IA, IL, IN, MA, ME, MI, MN, MO, NC, NE, NJ, NM, NV, NY, OH, OR, SD, TN, TX, UT, VA, WI, and WY. No offers may be made or accepted from any resident outside the specific states referenced. Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Clients and prospective clients should be prepared to bear investment loss including loss of original principal.

Cambridge’s Form CRS (Customer Relationship Summary)

The information being provided is strictly as a courtesy. When you link to any of these websites provided herein, NelsonCorp Wealth Management makes no representation as to the completeness or accuracy of information provided at these sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, sites, information, and programs made available through this site.