Correction in Context

The market slipped into correction territory last week. Was this a stumble or the start of a slide? Check out this week’s commentary to see why stocks and credit markets and seeing things differently—and what it all means for investors.

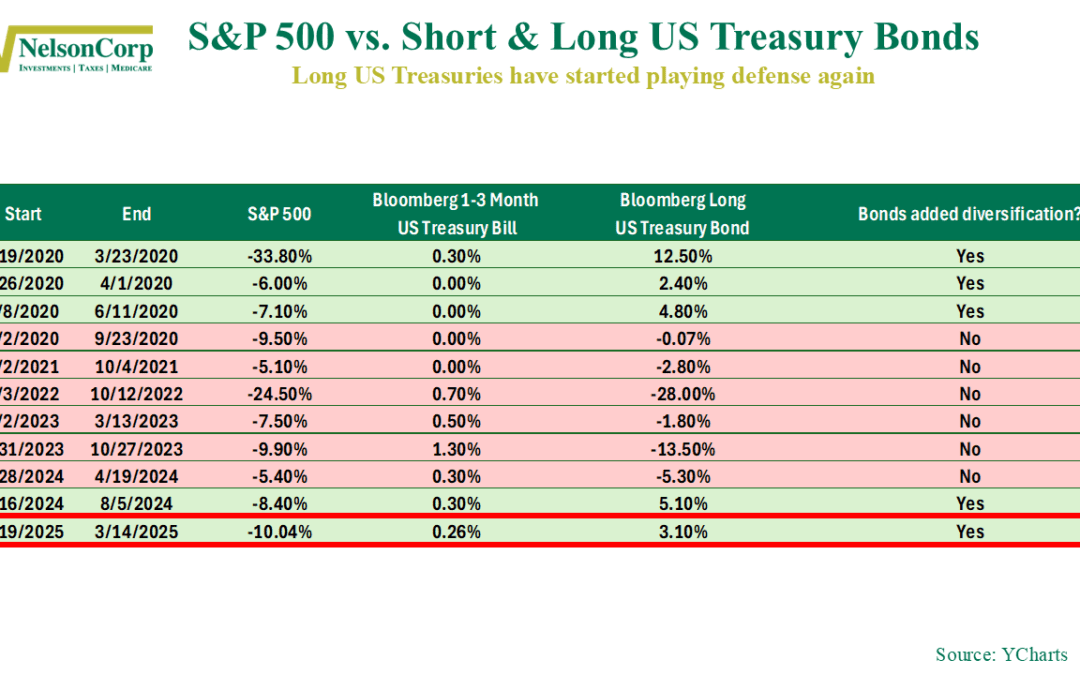

Bonds Playing Defense Again

This week’s featured chart is, well... it's a table. It tracks how short- and long-duration bonds have performed whenever the S&P 500 stock index has dropped by 5% or more over the past five years. The table highlights whether long-term bonds (Bloomberg...

Stochastic Slump

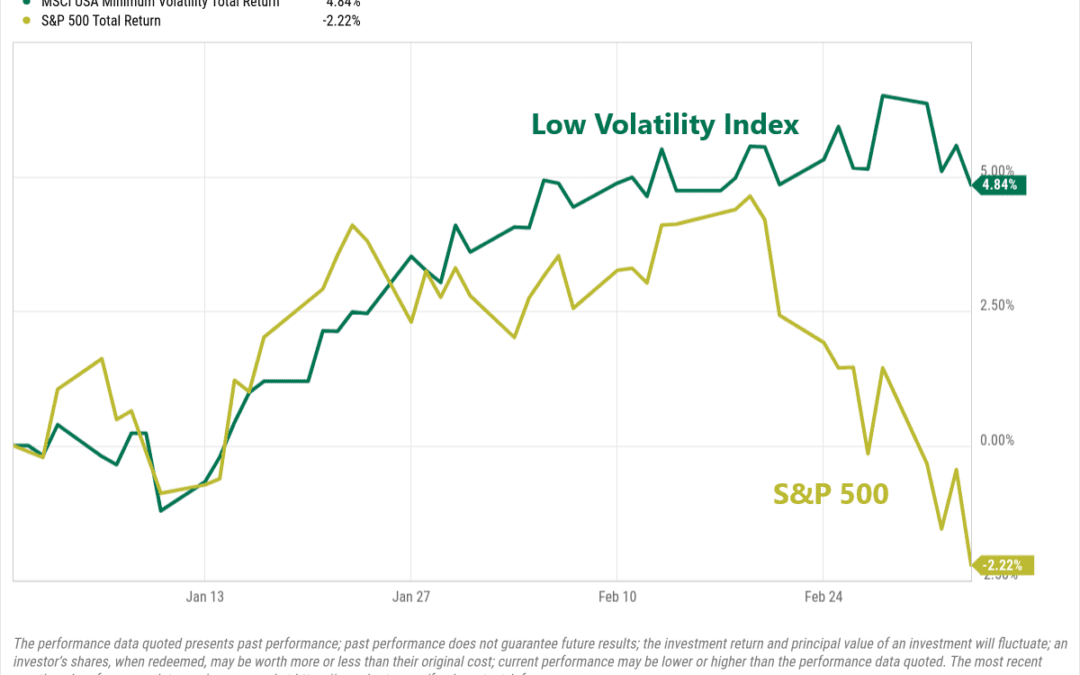

Markets don’t go up forever. Occasionally, they hit a wall. Recently, the U.S. stock market has done just that, leaving many investors wondering: is momentum slowing down? Just how overbought was the market? Is a larger downturn coming? This week’s featured...

Financial Focus – March 12th, 2025

In this week’s episode of Financial Focus, Nate Kreinbrink discusses market updates and the complexities of retirement planning, emphasizing the importance of having a solid financial strategy. He highlights key retirement considerations, such as pension options, healthcare coverage, and investment allocations, while encouraging listeners to seek guidance to navigate the process smoothly.

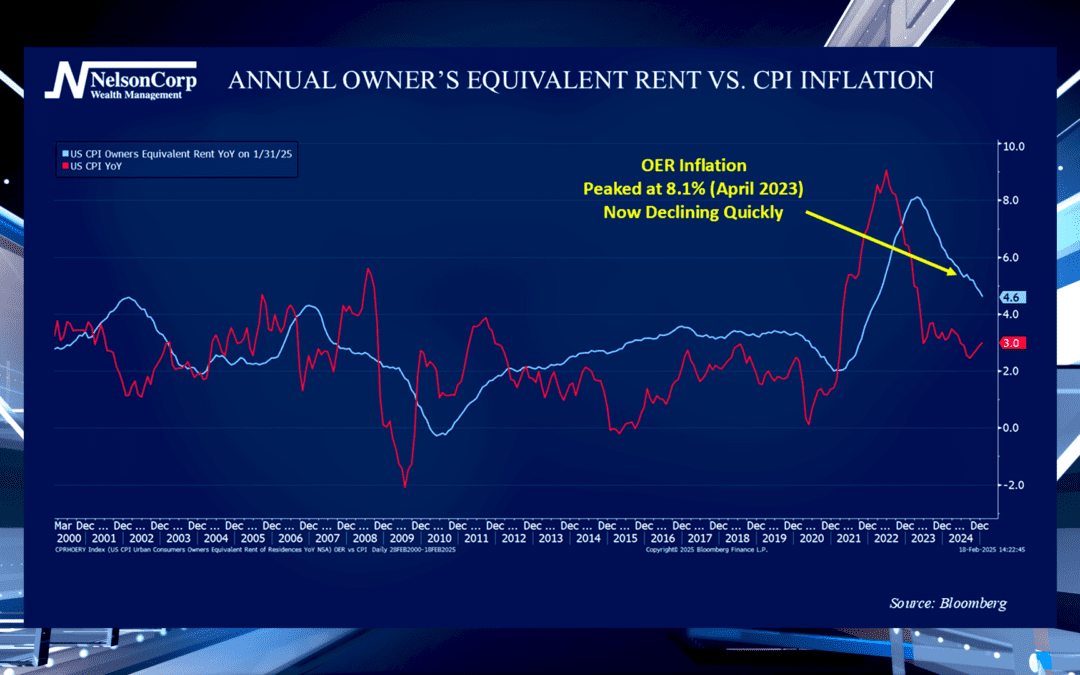

Housing Inflation

James Nelson talks with us about housing inflation and the owner’s equivalent annual rent. Learn more about what this means for inflation and the housing market moving forwards.

Tension at the Trendline

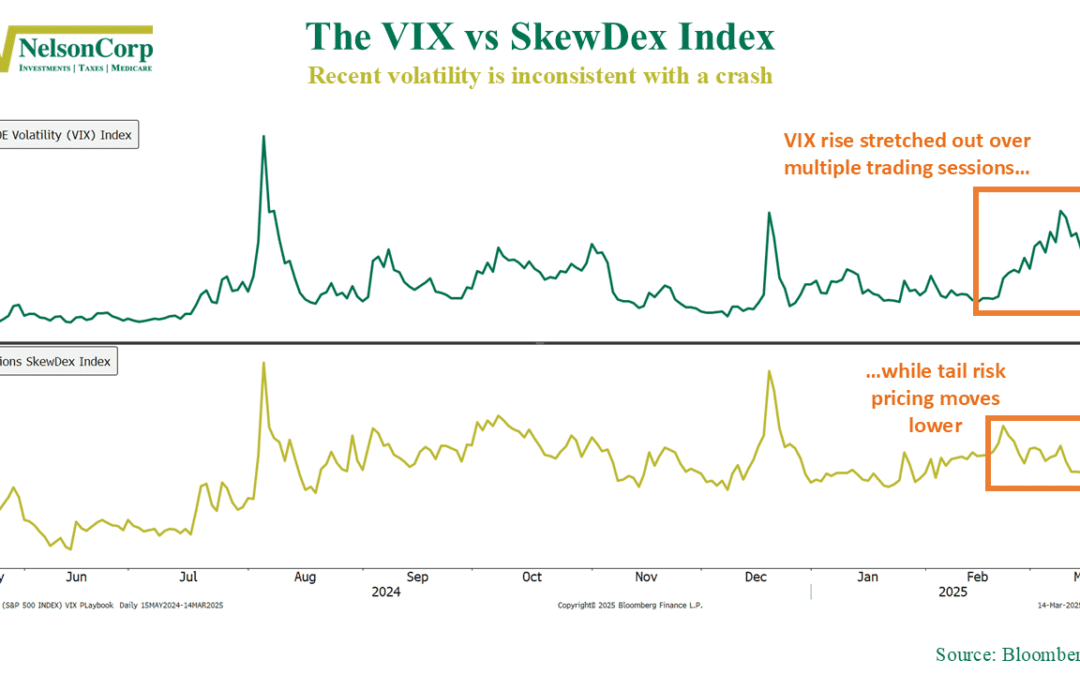

The stock market hit another rough patch last week, and all eyes are on a key level that could make or break the next move. But, with volatility rising, our process helps cut through the noise—here’s what we’re watching now.

Trend Trouble

It was a wild week for financial markets, with tariff announcements and major policy shifts in Europe keeping investors on edge. These developments fueled significant volatility in stocks. The S&P 500—Wall Street’s go-to benchmark—swung more than 1% in...

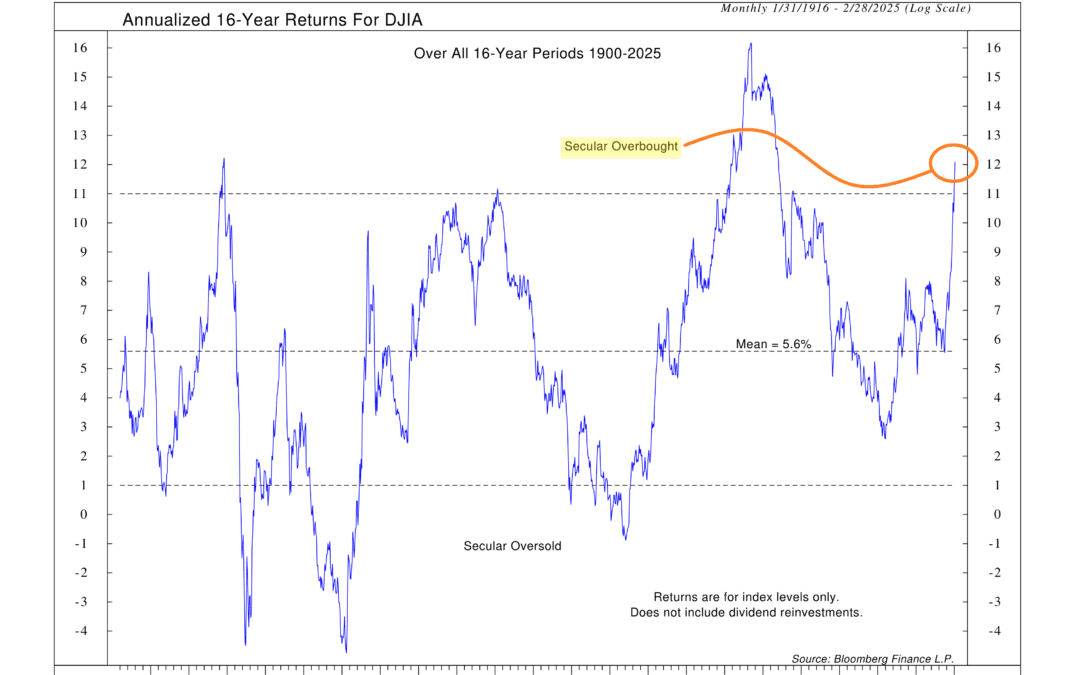

What Goes Up Must Come Down

Markets have a way of pulling investors in at the worst times and scaring them away when the best opportunities appear. When things look good, people expect them to stay that way. When things look bad, they assume they’ll never improve. But history tells a...

Financial Focus – March 5th, 2025

In this week’s episode of Financial Focus, David Nelson joins Gary Determan to discuss market swings, the impact of tariffs on farmers, and the broader economic outlook. He talks about the shift to a more defensive investment approach and shares insights on how global trade changes are affecting businesses and consumers.

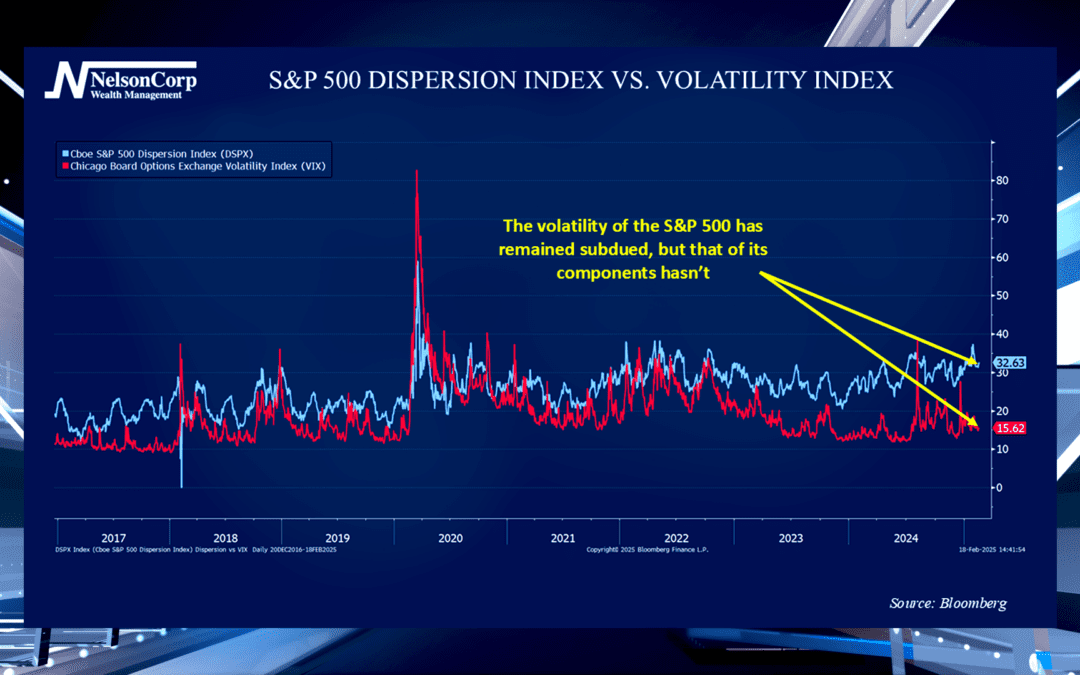

Go Your Own Way

Lately, the stock market seems stable, but some investors are noticing more turbulence under the surface. David Nelson is here to share what has historically occurred when the indexes appear calm while individual stocks are volatile and advises viewers to proceed with caution.

880 13th Avenue North

Clinton, Iowa 52732

563-242-9042

5465 Utica Ridge Road

Davenport, Iowa 52807

563-823-0532

9079 East Tamarack Drive

Dubuque, Iowa 52003

800-248-9042

info@nelsoncorp.com

Fax: 563-242-9062

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and NelsonCorp Wealth Management are not affiliated. This communication is strictly intended for individuals residing in the states of AZ, AR, CA, CO, CT, FL, GA, IA, IL, IN, MA, ME, MI, MN, MO, NC, NE, NJ, NM, NV, NY, OH, OR, SD, TN, TX, UT, VA, WI, and WY. No offers may be made or accepted from any resident outside the specific states referenced. Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Clients and prospective clients should be prepared to bear investment loss including loss of original principal.

Cambridge’s Form CRS (Customer Relationship Summary)

The information being provided is strictly as a courtesy. When you link to any of these websites provided herein, NelsonCorp Wealth Management makes no representation as to the completeness or accuracy of information provided at these sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, sites, information, and programs made available through this site.