So You’re Saying There’s a Chance?

OVERVIEW Markets were mixed over the week, with modest gains in some large-cap areas and more pressure beneath the surface. The S&P 500 edged higher by 0.34%, while the Dow Jones Industrial Average slipped 0.42%. The NASDAQ finished slightly lower, down...

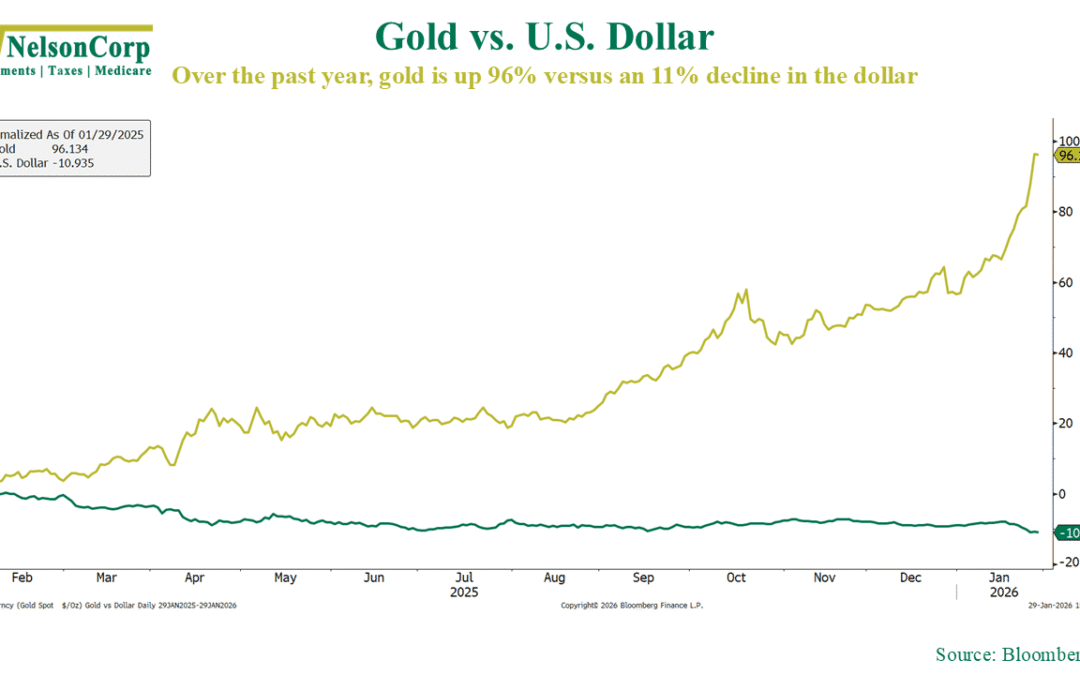

Good for Gold

Gold has been on an absolute heater lately. The dollar? Not so much. That’s the message from this week’s chart, shown above, which compares the cumulative return of gold to the U.S. dollar over the past year. As you can see, gold is up more than 90% over the...

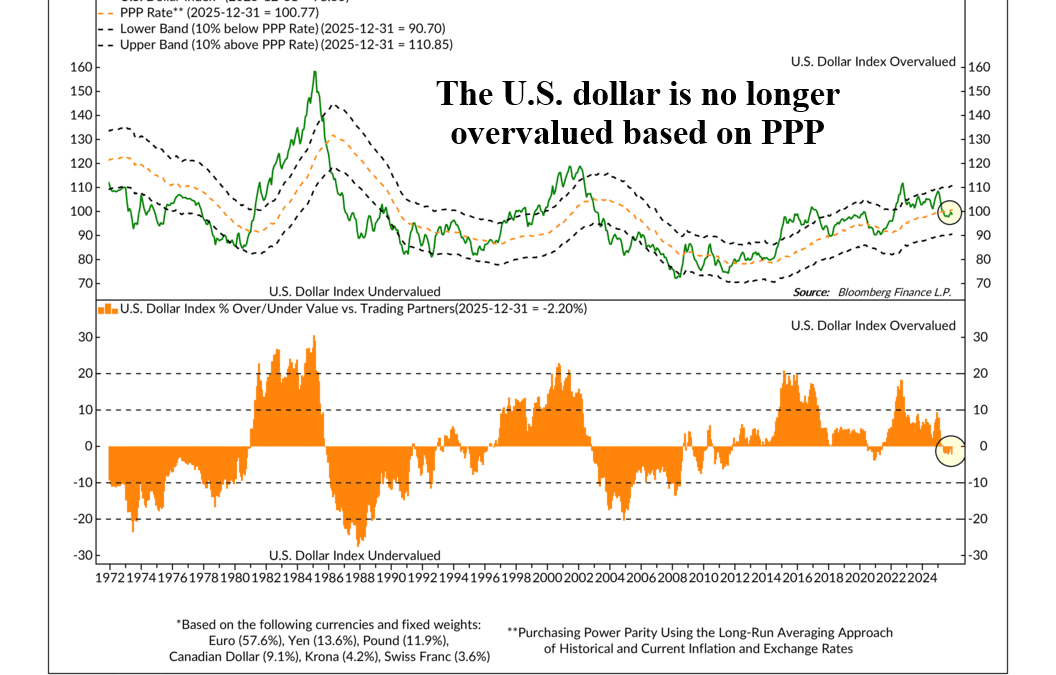

What’s Up With the Dollar?

The U.S. dollar has been in the news a lot lately. Mainly because it’s been falling—a lot. Last year, the ICE U.S. Dollar Index, the benchmark index for the U.S. dollar, fell roughly 10%. This year, it’s already down another 2%. But should we really be...

Financial Focus – January 28th, 2026

This week on Financial Focus, Nate Kreinbrink and Mike Steigerwald discuss how Medicare plans are evolving and why today’s coverage may not look the same a few years from now. They share why taking a long-term view of healthcare decisions can help avoid costly surprises later.

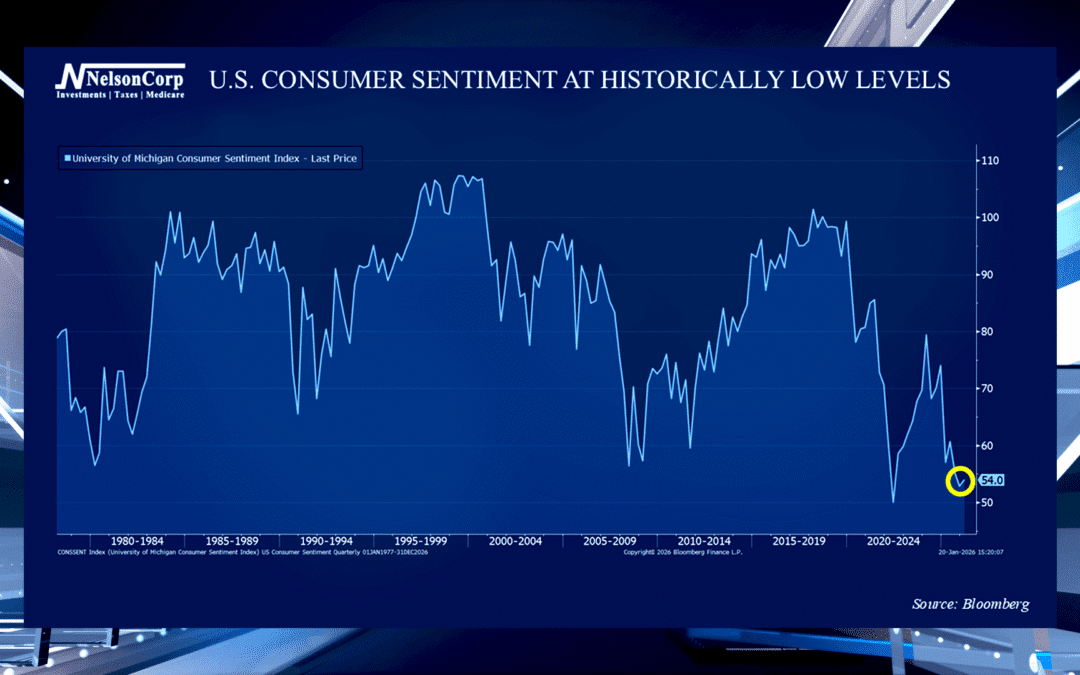

Bad Sentiment, No Problem

The U.S. Consumer Sentiment Index tracks consumers’ confidence in the economy, reflecting their financial outlook and spending intentions. David Nelson explains how the current data shows consumer confidence at historic lows but reminds us that the markets are focused on the future, not today.

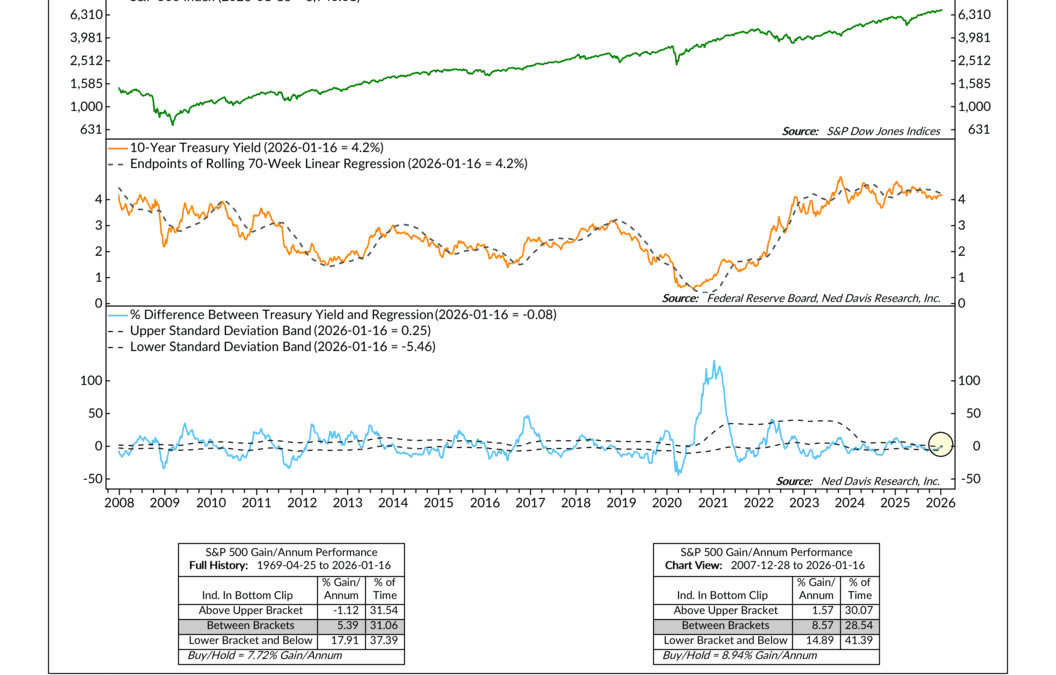

The Balance of Risk

OVERVIEW Markets pulled back modestly over the week, with most U.S. equity indexes finishing slightly lower. Large-cap stocks were under mild pressure, as the S&P 500 fell 0.35% and the Dow Jones Industrial Average declined 0.53%. The NASDAQ was essentially...

Financial Focus – January 21st, 2026

Tax season is right around the corner, and there are several changes this year that could catch people off guard. We talk through what’s new, what to watch for, and a few simple steps that could save you time, stress, and money.

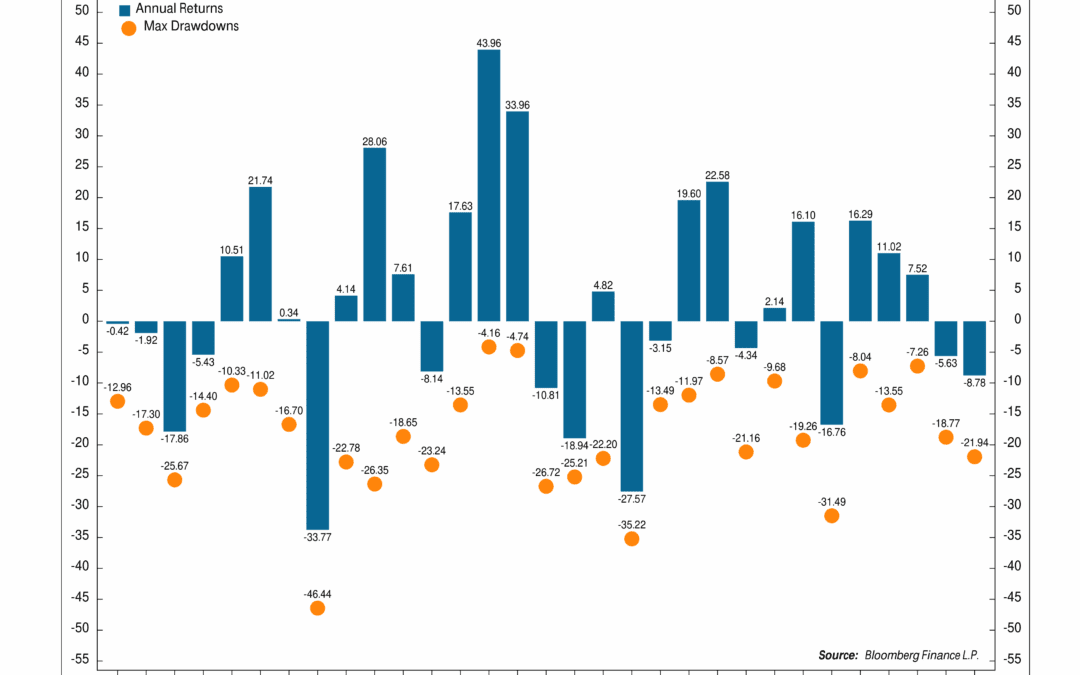

Midterm Mania

This week’s chart looks at how the Dow Jones Industrial Average has typically behaved during midterm election years. There have been 31 midterm elections since 1902. Each blue bar on the chart represents the annual return for that midterm year, while the orange...

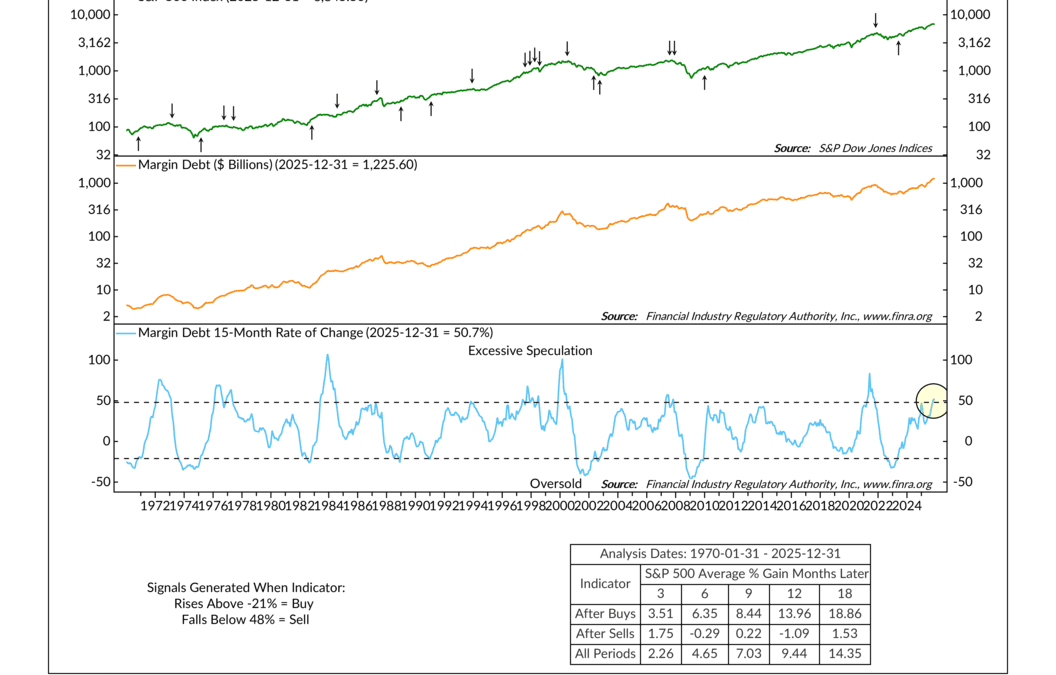

The Discount Rate

Interest rates are important for the stock market. In a technical sense, they’re what we call the “discount rate.” This is the rate at which the future cash flows generated by the companies in the stock market get discounted back to the present. Because of how...

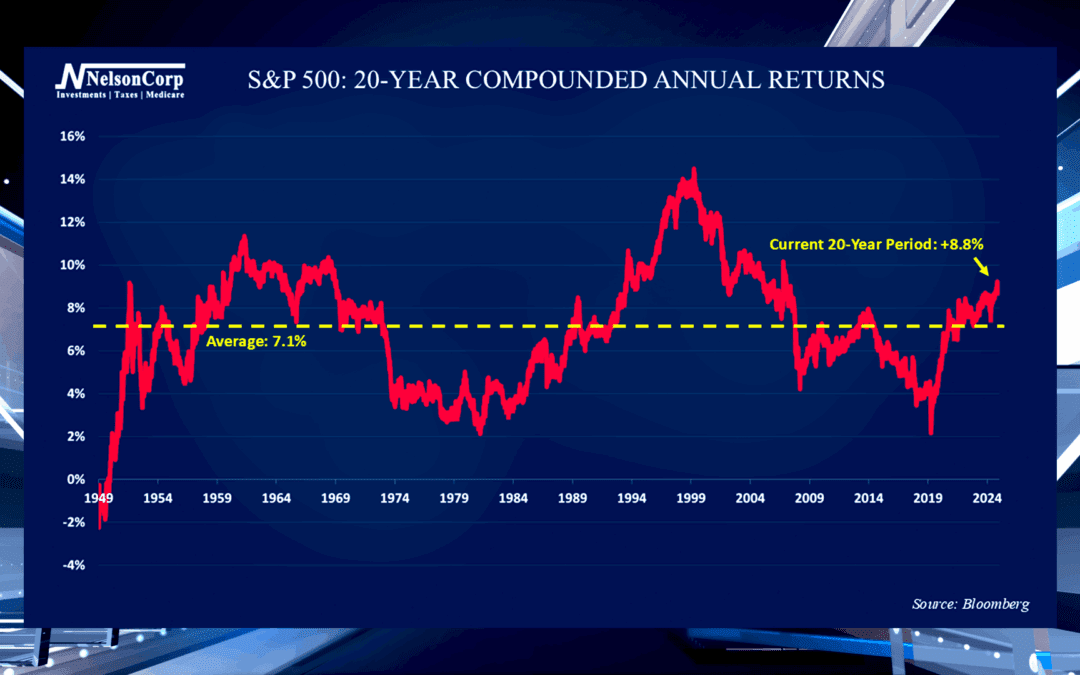

Long-Term Cycles

When investors evaluate long-term stock market returns, it is helpful to look through the lens of rolling 20-year periods. Nate Kreinbrink shares the history of S&P 500’s returns and where the index stands now.

880 13th Avenue North

Clinton, Iowa 52732

563-242-9042

5465 Utica Ridge Road

Davenport, Iowa 52807

563-823-0532

9079 East Tamarack Drive

Dubuque, Iowa 52003

800-248-9042

info@nelsoncorp.com

Fax: 563-242-9062

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and NelsonCorp Wealth Management are not affiliated. This communication is strictly intended for individuals residing in the states of AZ, AR, CA, CO, CT, FL, GA, IA, IL, IN, ME, MI, MN, MO, NC, NJ, NY, SD, TN, TX, UT, WI, and WY. No offers may be made or accepted from any resident outside the specific states referenced. Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Clients and prospective clients should be prepared to bear investment loss including loss of original principal.

Cambridge’s Form CRS (Customer Relationship Summary)

The information being provided is strictly as a courtesy. When you link to any of these websites provided herein, NelsonCorp Wealth Management makes no representation as to the completeness or accuracy of information provided at these sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, sites, information, and programs made available through this site.