Financial Focus – September 18th, 2024

In this episode of Financial Focus, Nate Kreinbrink and Andy Fergurson discuss tax planning strategies, highlighting the benefits of long-term capital gains over ordinary income. They also explain the difference between employer 401(k) matching and maximum contributions, offering advice on traditional vs. Roth 401(k) options.

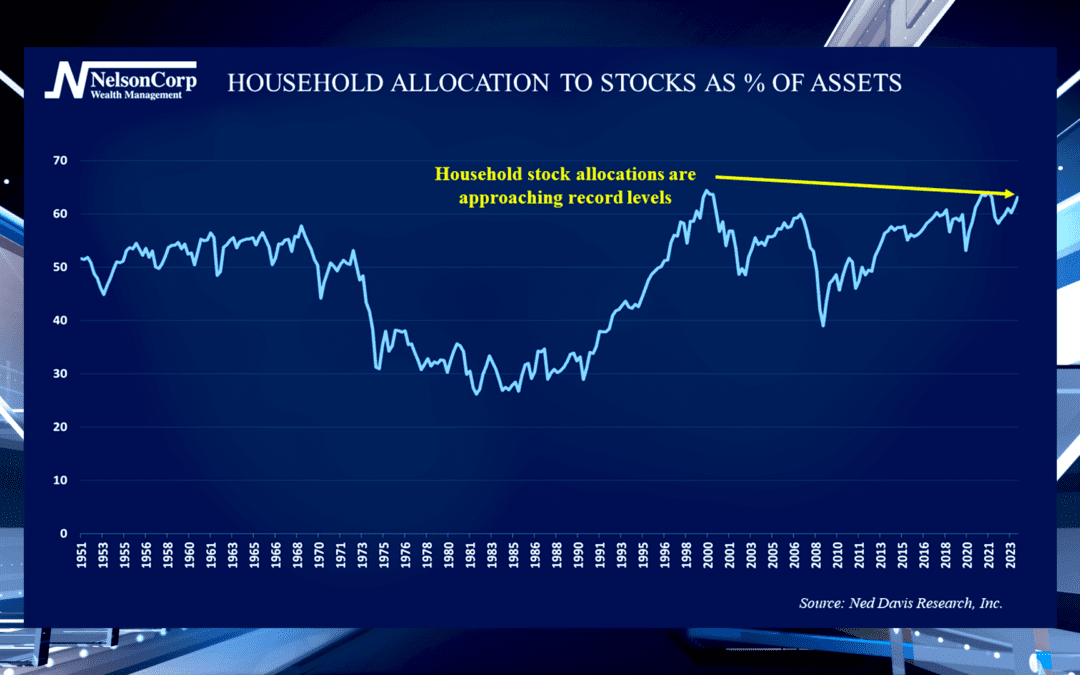

Really Bullish

More households have been making moves in the stock market recently. David Nelson joins us to highlight this investor behavior and advises us to avoid overallocation and extremes.

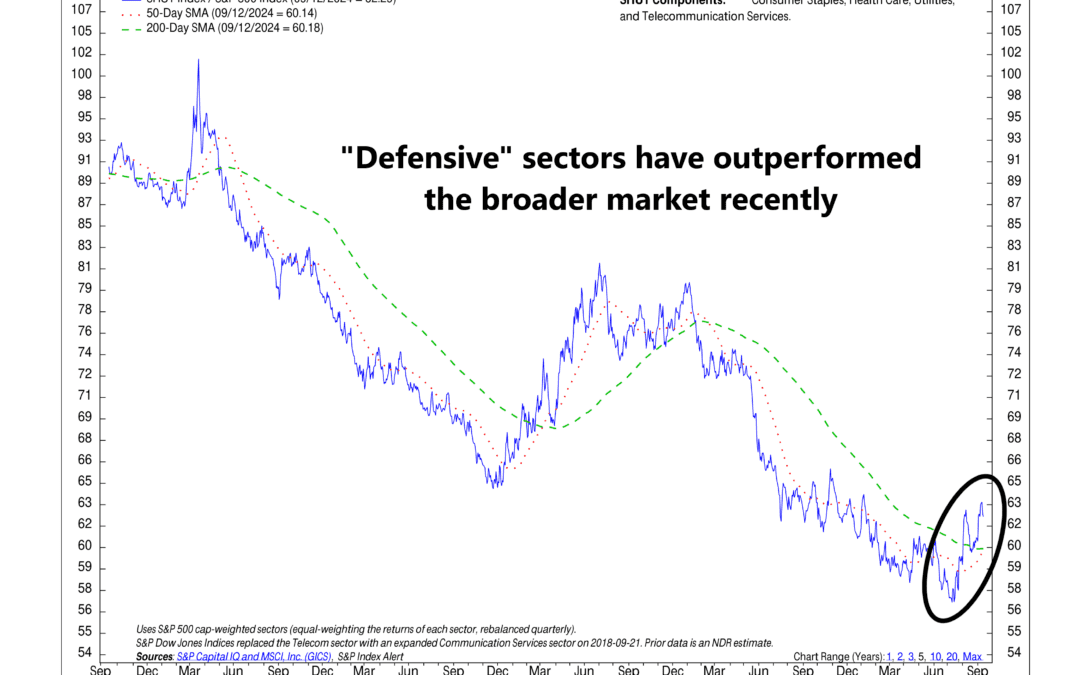

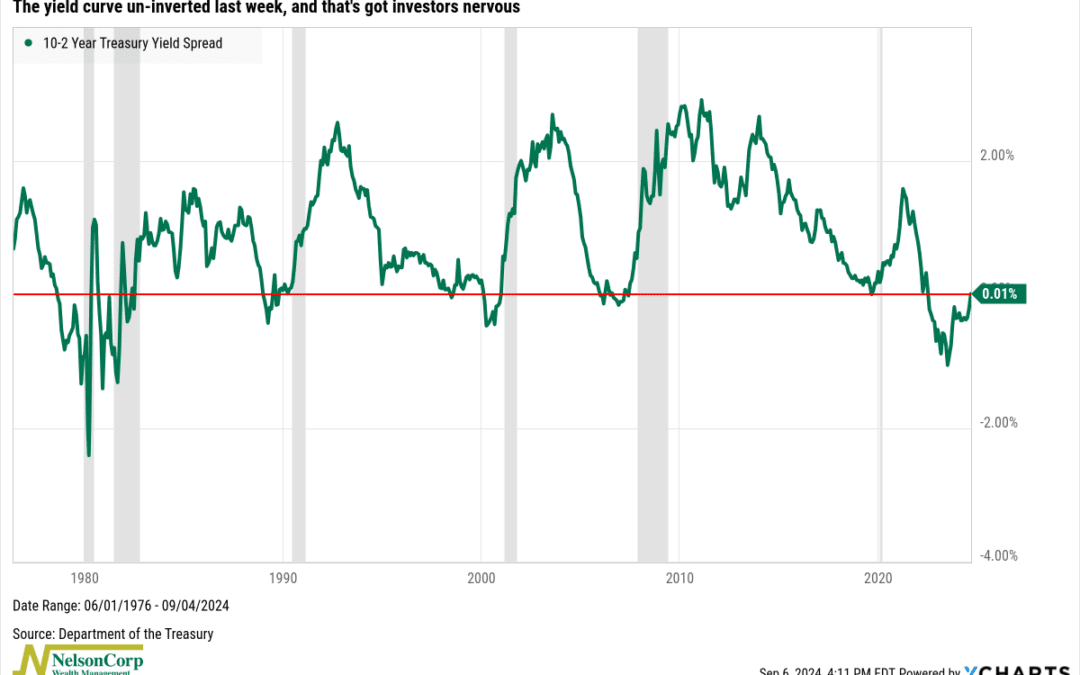

Out of Alignment

Curious about which sectors are steering the market lately? In this week’s commentary, we break down the surprising leaders and why the market still feels like it’s stuck in neutral.

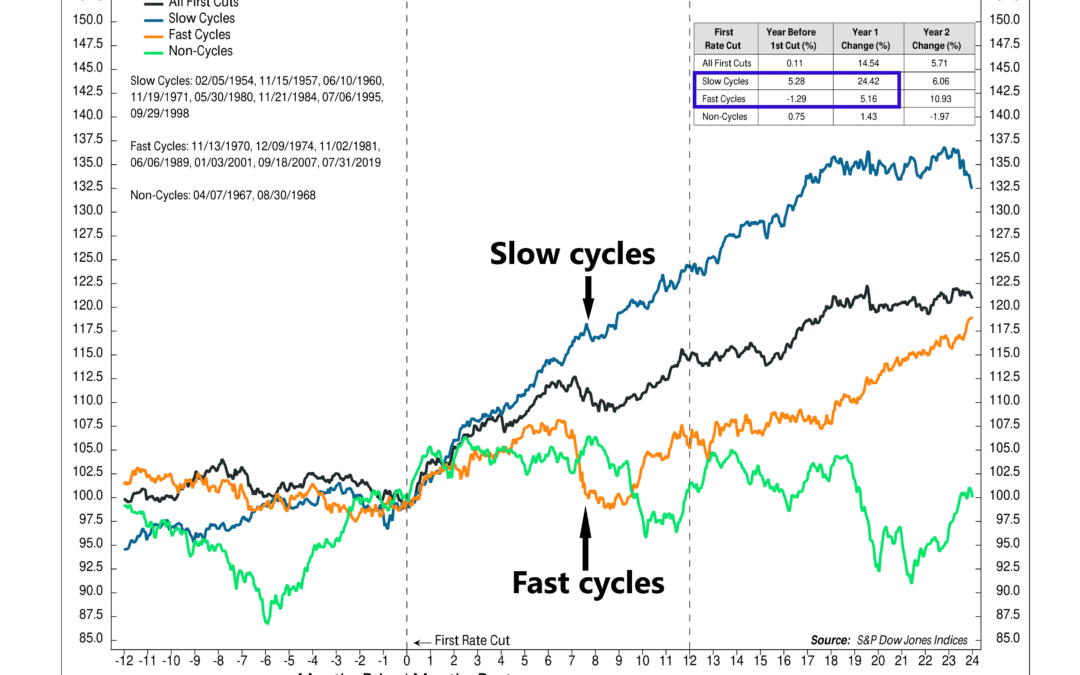

Take it Easy

Fast or slow? When it comes to rate cuts, this week’s featured chart suggests that slower is better. The chart shows how the S&P 500 has historically responded to different rate-cut speeds. There have been eight "slow cycles" where the Fed reduced rates...

Corporate Cuts

This week’s indicator is all about that nasty word nobody likes: layoffs. Why layoffs? Because when they start to rise, it can signal that the job market is cooling off—often before we see it in other stats like initial jobless claims. This makes it a useful...

Financial Focus – September 11th, 2024

In this week’s episode of Financial Focus, Nate Kreinbrink discusses pensions and explains the various payout options available to retirees, including single life annuities, beneficiary options, and lump-sum payouts. He also emphasizes the importance of making pension decisions based on individual needs and long-term planning.

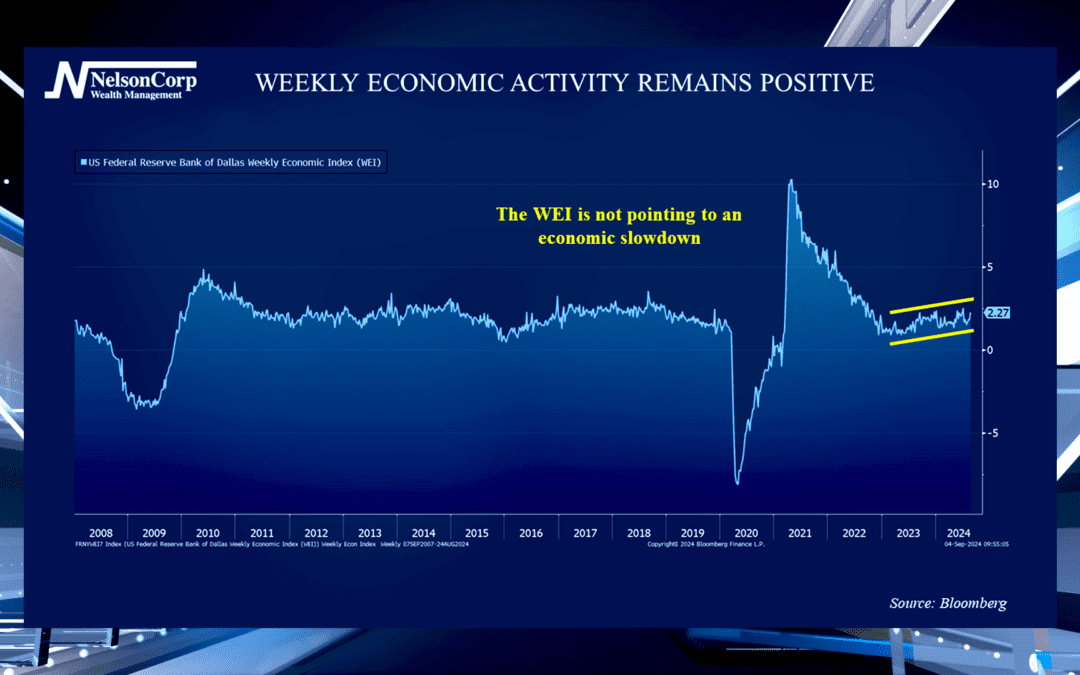

Real-Time Tracking

We’ve seen some positive changes to economic growth figures recently. David Nelson offers his insights from the latest data and explains why he still advises investors to proceed with caution.

Bad News is Bad News

Bad news is bad news again. In this week’s commentary, we explore how weak economic data is unsettling investors and what to expect in this shifting market environment.

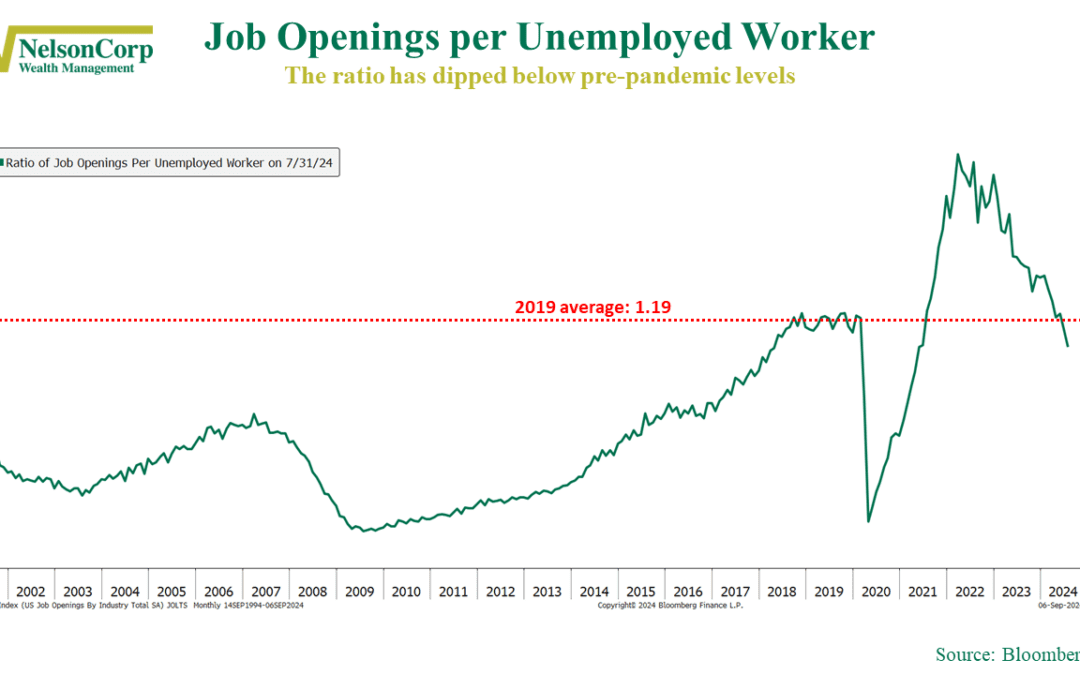

The Job Seeker’s Ratio

The market got a jolt from the latest JOLTS (Job Openings and Labor Turnover Survey) report this week. According to the latest data from the Bureau of Labor Statistics, the number of job openings in the U.S. dropped to 7.67 million in July. That’s the lowest...

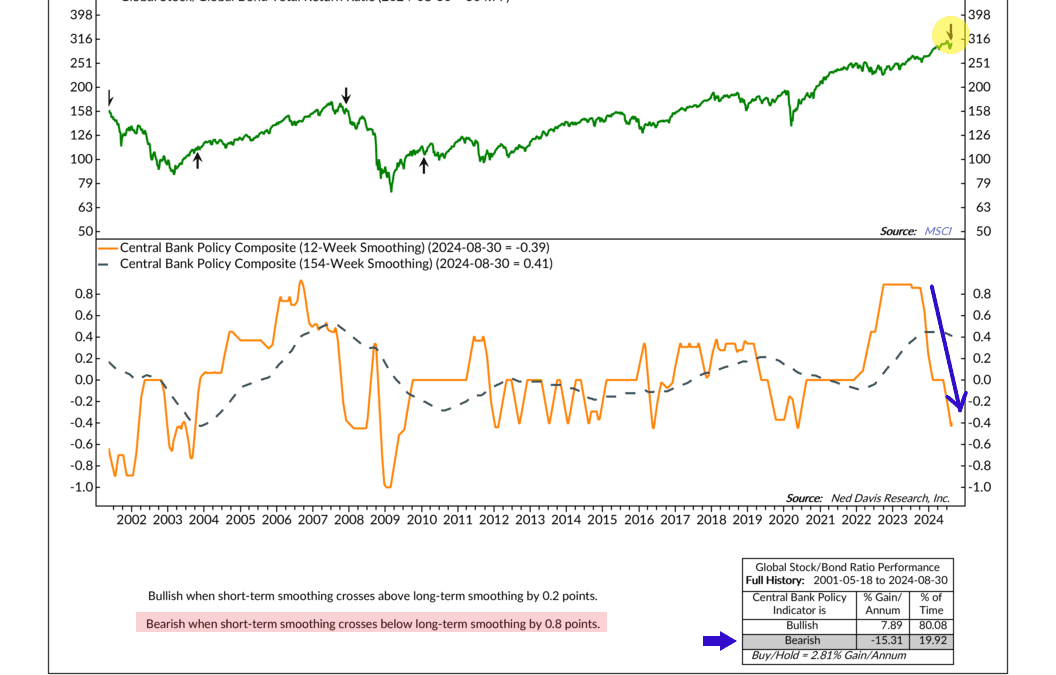

Central Banks on the Move

When it comes to financial markets, central banks matter. They’re a big player. What they do affects almost everything in the economy, so it's important to keep an eye on their moves and know their policies. That’s where this week’s indicator comes into play....

880 13th Avenue North

Clinton, Iowa 52732

563-242-9042

5465 Utica Ridge Road

Davenport, Iowa 52807

563-823-0532

9079 East Tamarack Drive

Dubuque, Iowa 52003

800-248-9042

info@nelsoncorp.com

Fax: 563-242-9062

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and NelsonCorp Wealth Management are not affiliated. This communication is strictly intended for individuals residing in the states of AZ, AR, CA, CO, CT, FL, GA, IA, IL, IN, MA, ME, MI, MN, MO, NC, NE, NJ, NM, NV, NY, OH, OR, SD, TN, TX, UT, VA, WI, and WY. No offers may be made or accepted from any resident outside the specific states referenced. Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Clients and prospective clients should be prepared to bear investment loss including loss of original principal.

Cambridge’s Form CRS (Customer Relationship Summary)

The information being provided is strictly as a courtesy. When you link to any of these websites provided herein, NelsonCorp Wealth Management makes no representation as to the completeness or accuracy of information provided at these sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, sites, information, and programs made available through this site.