Financial Focus – September 4th, 2024

Check out this week’s episode of Financial Focus, where David Nelson discusses the importance of the U.S. market on global economies and financial markets. He also emphasizes the need to stay savvy with market cycles and warns against letting political preferences skew investment decisions.

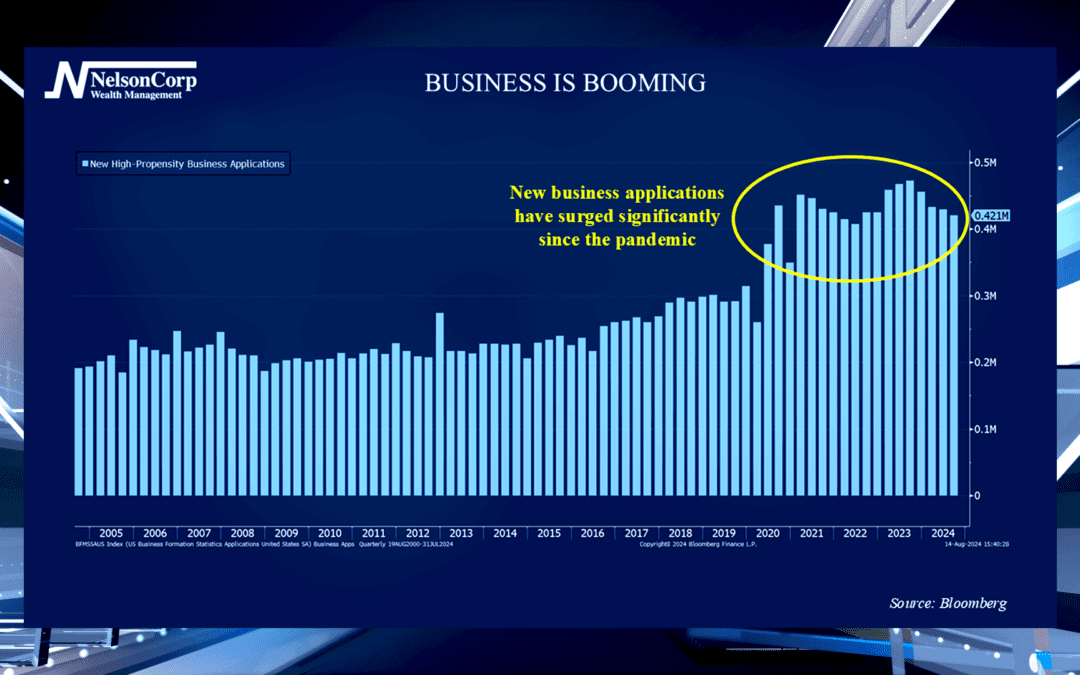

Breaking Ground

It seems like the economy has been quite resilient recently. Nate Kreinbrink joins us to share what is driving these positive results and if he believes the trend will continue.

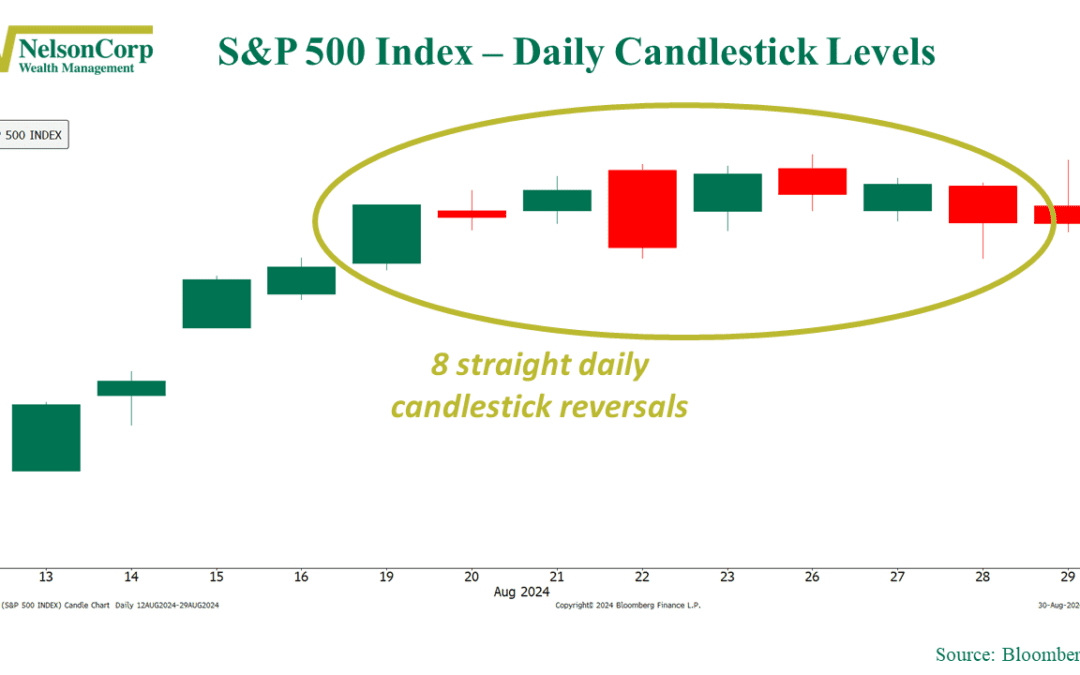

Red Zone

After a strong run, the S&P 500 is starting to look like a football team repeatedly getting stuffed at the goal line. Is this a temporary stall or a sign of trouble ahead? Dive into our latest analysis to see if the market can overcome resistance or if lofty valuations might spell trouble ahead.

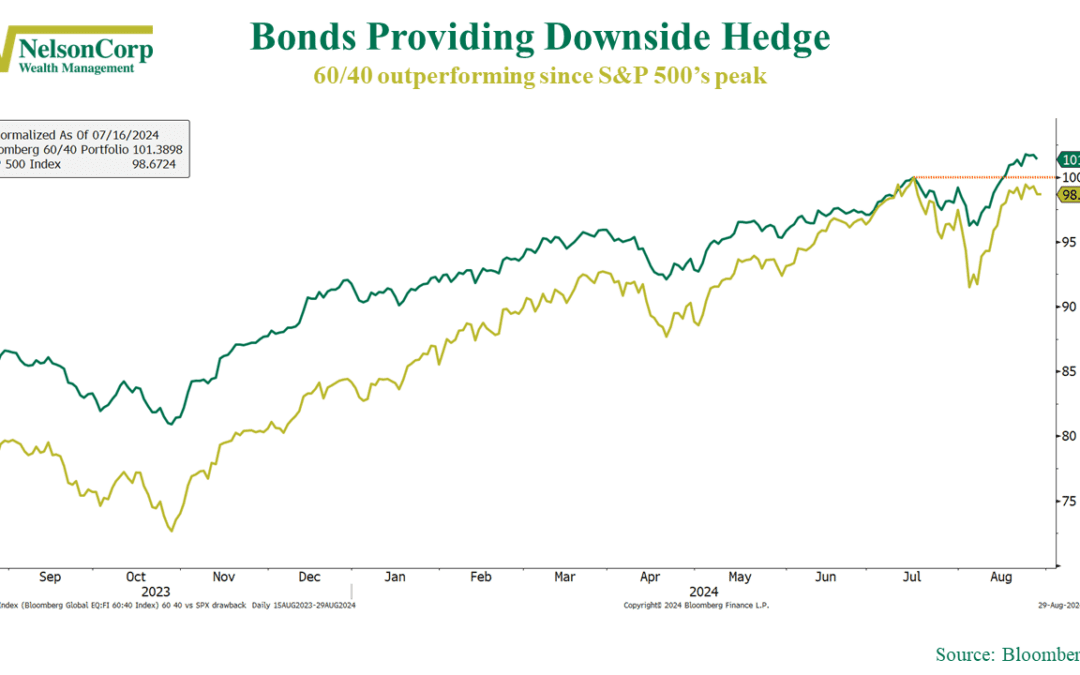

The Tortoise Beats the Hare

We all know the story—slow and steady wins the race. The tortoise beats the hare. Well, lately, it turns out bonds have been channeling their inner tortoise. How so? Imagine this: the S&P 500 Index (the stock market) is like the hare—fast, flashy, always in...

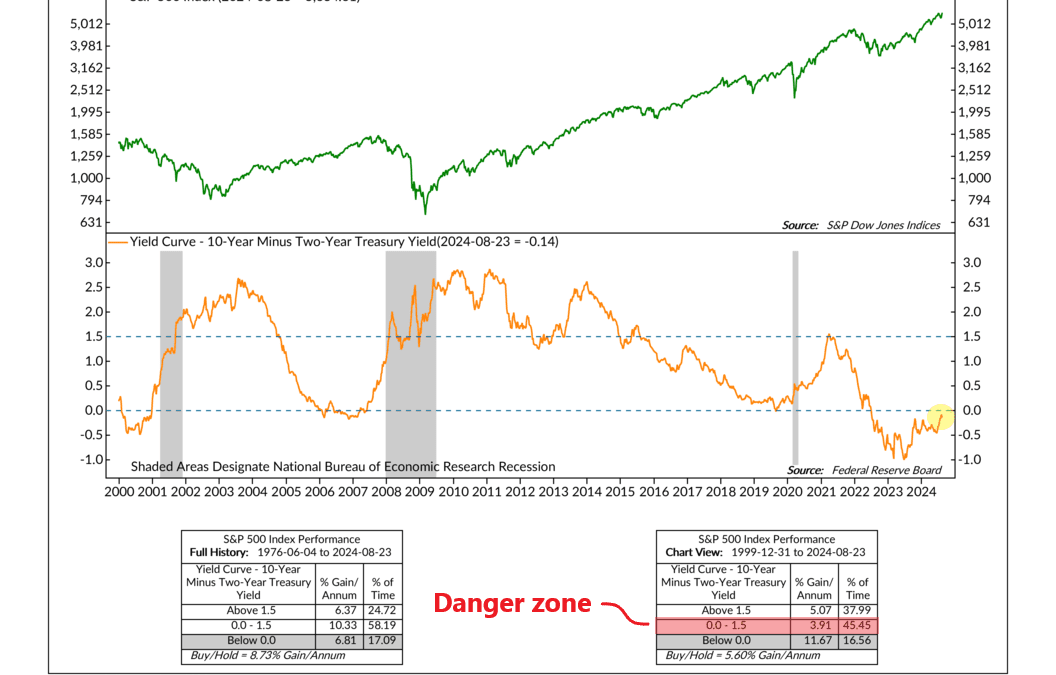

Un-Inversion

If you’ve kept your eye on financial markets the past few years, you’ve likely heard some buzz about the yield curve. It went negative over two years ago, meaning short-term rates (2-year Treasury rates) rose above long-term rates (10-year Treasury rates)....

Financial Focus – August 28th, 2024

In this episode of Financial Focus, Nate Kreinbrink and Mike VanZuiden discuss the upcoming Medicare annual enrollment period, emphasizing the importance of reviewing and possibly changing Medicare plans to ensure they meet individual needs. They also encourage listeners to seek personalized advice to navigate the complexities of Medicare options.

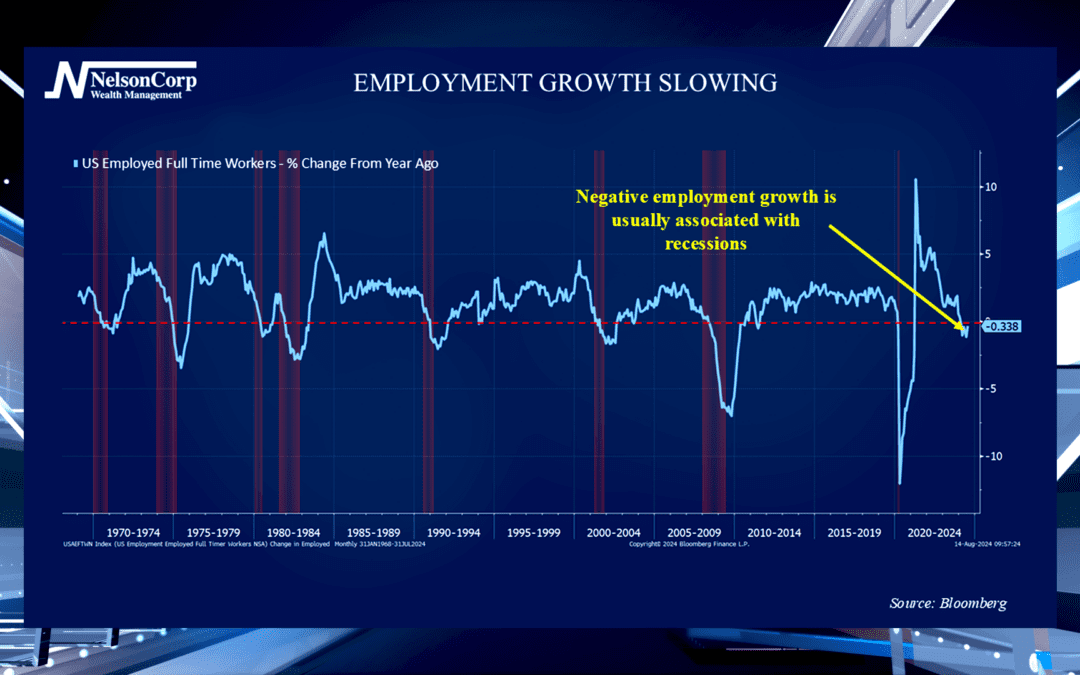

Hiring Halt

Recently, we’ve seen some concerning trends in employment numbers. David Nelson explains how this market indicator has historical ties to recession and an economic downturn may be on the horizon.

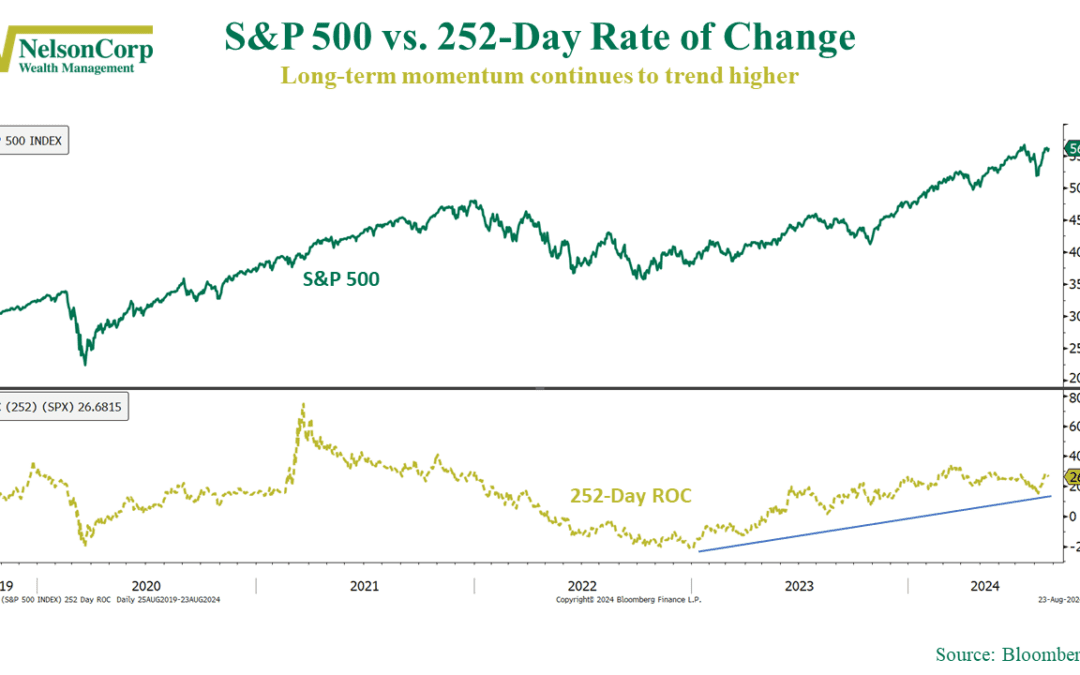

Strength in Numbers

The stock market had a good week, with more stocks joining the rally and long-term trends looking strong. Dig into this week’s commentary, where we explain why new highs and falling bond yields are good news for the ongoing bull market.

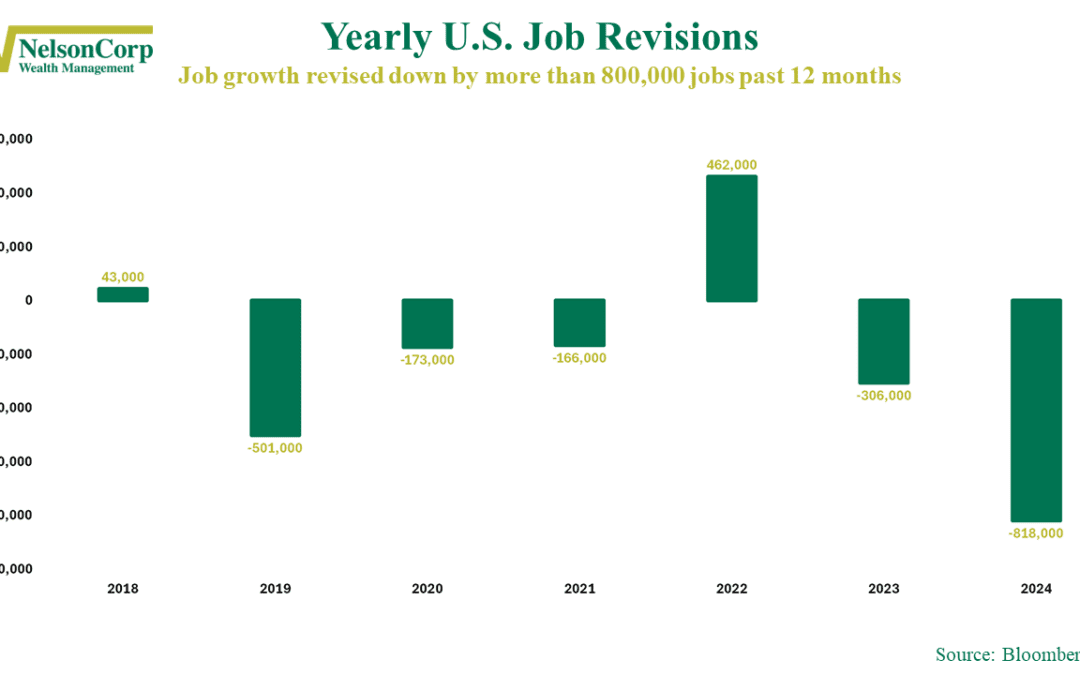

Revisions

There’s a famous scene in the classic western Once Upon a Time in the West (1968) where the character Harmonica steps off a train and is confronted by three gunmen. When Harmonica asks if they brought a horse for him, one of the gunmen smirks and says, “Looks...

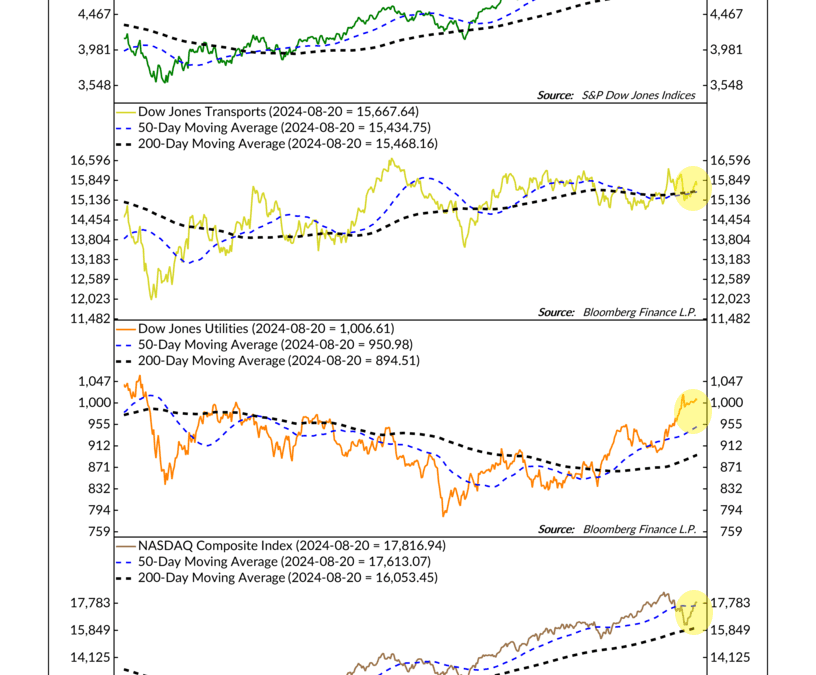

Sweet Spot

Let’s dive into this week’s indicator: moving averages in technical analysis. What’s a moving average, you ask? It’s simply a way to smooth out the ups and downs in stock prices, giving you a clearer view of the trend. Here’s how it works: imagine you’re...

880 13th Avenue North

Clinton, Iowa 52732

563-242-9042

5465 Utica Ridge Road

Davenport, Iowa 52807

563-823-0532

9079 East Tamarack Drive

Dubuque, Iowa 52003

800-248-9042

info@nelsoncorp.com

Fax: 563-242-9062

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and NelsonCorp Wealth Management are not affiliated. This communication is strictly intended for individuals residing in the states of AZ, AR, CA, CO, CT, FL, GA, IA, IL, IN, MA, ME, MI, MN, MO, NC, NE, NJ, NM, NV, NY, OH, OR, SD, TN, TX, UT, VA, WI, and WY. No offers may be made or accepted from any resident outside the specific states referenced. Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Clients and prospective clients should be prepared to bear investment loss including loss of original principal.

Cambridge’s Form CRS (Customer Relationship Summary)

The information being provided is strictly as a courtesy. When you link to any of these websites provided herein, NelsonCorp Wealth Management makes no representation as to the completeness or accuracy of information provided at these sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, sites, information, and programs made available through this site.