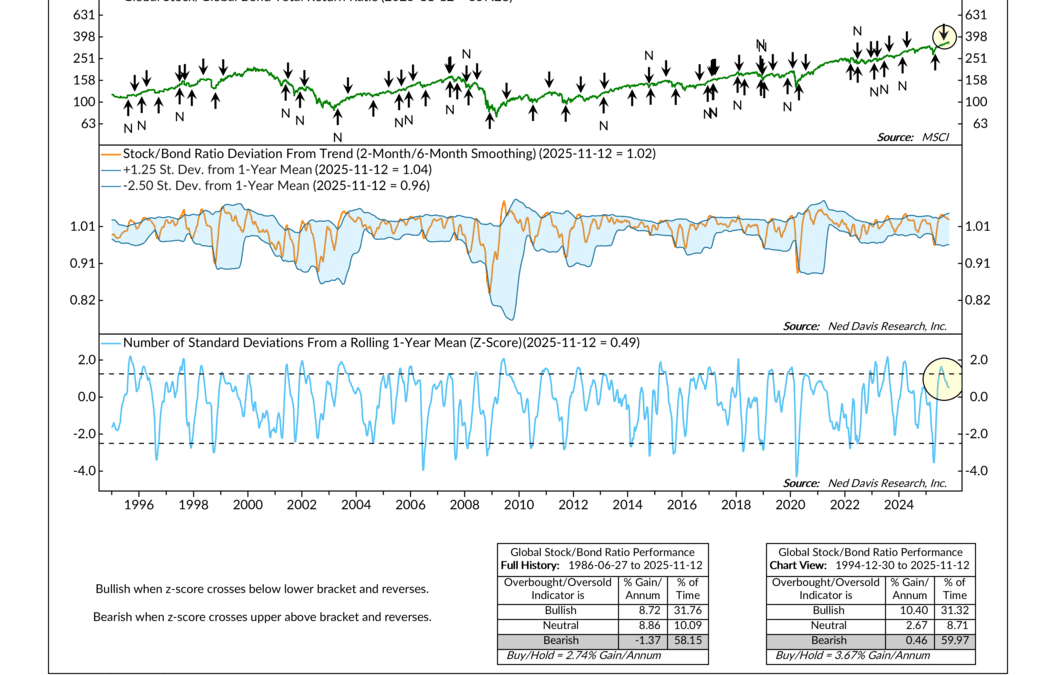

The Rubberband Man

This week’s indicator is what we call an overbought and oversold indicator. The simplest way to think of it is like a rubber band. Pull it gently and nothing happens. Stretch it far enough and you start to feel the tension build. Keep pulling, and eventually...

Financial Focus – November 12th, 2025

This week on Financial Focus, we dig into the new tax rules and why so many of the headlines around them deserve a closer look. If you’re sorting through what’s true, what’s “kind of” true, and what actually applies to you, this episode is worth checking out.

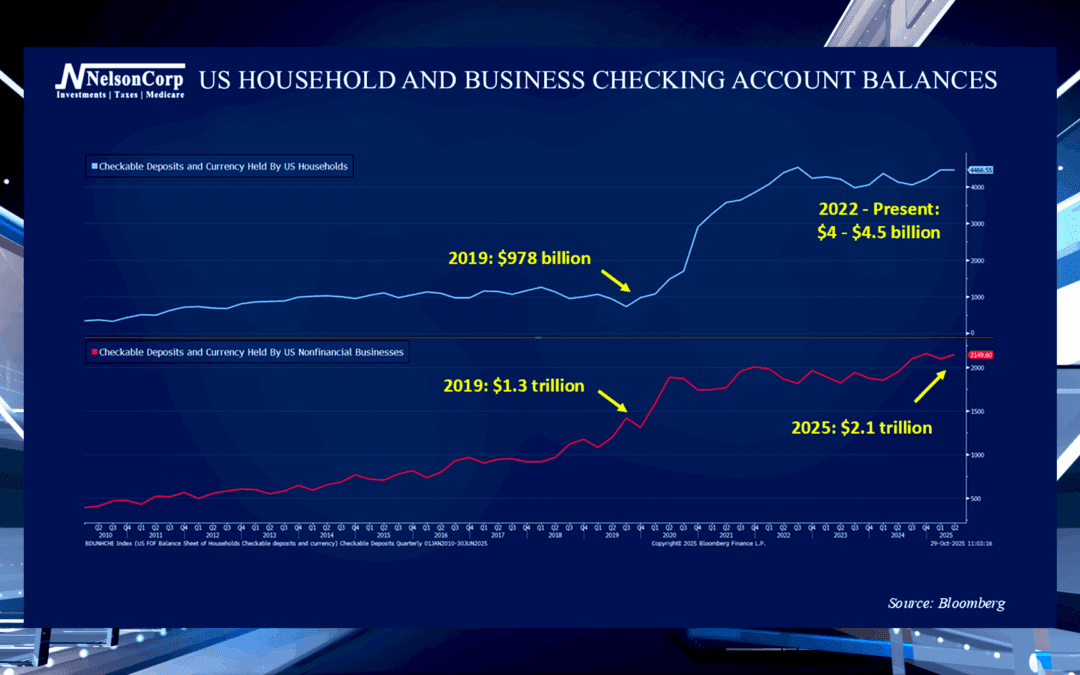

Money In The Bank

The amount of money in the economy today is considerably more than there was years ago. John Nelson joins us to share the significant growth in US household and business checking account balances plus how this extra cash may impact the market.

Wobbly Wall Street

OVERVIEW Markets pulled back last week as technology stocks led declines and volatility spiked. The S&P 500 fell 1.63%, the Dow Jones Industrial Average dropped 1.21%, and the NASDAQ sank 3.04%, giving back a portion of recent gains. Broadly, the Russell...

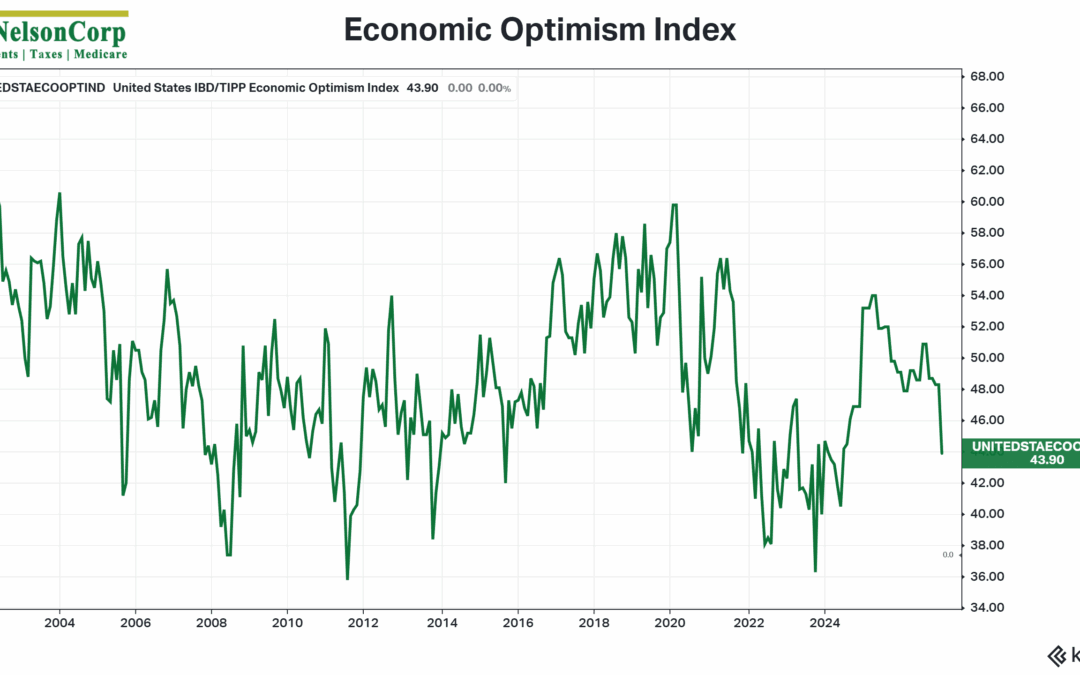

Confidence Cracks

Well, we got some data last week that Americans are starting to feel less great about the status of the U.S. economy. It came in the form of the IBD/TIPP Economic Optimism Index, shown above. As you can see, it fell sharply in November, its biggest monthly drop...

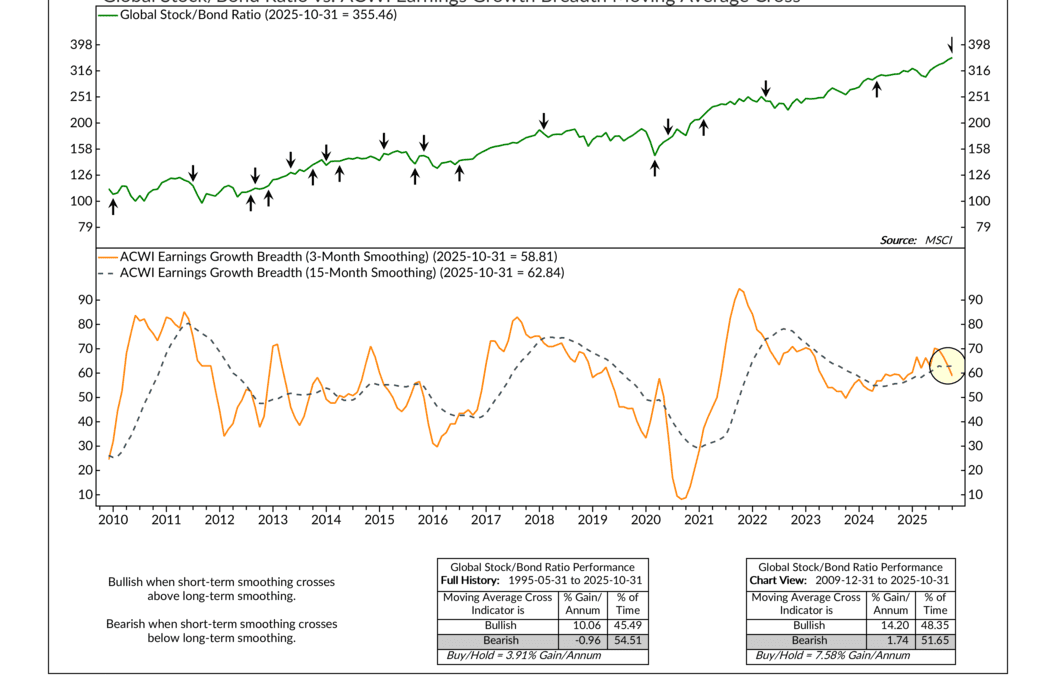

Going Global

For this week’s indicator, we’re going global. U.S. stocks have been strong this year, but what about the rest of the world? What does the data say about the broader global market? To answer that, we can turn to a measure called Earnings Growth Breadth. This...

Financial Focus – November 5th, 2025

As we move into November, Nate Kreinbrink highlights key year-end planning opportunities, from reviewing Medicare coverage during open enrollment to making smart tax decisions before December 31. Tune in as he explains how a little proactive planning now can make a big difference come tax time.

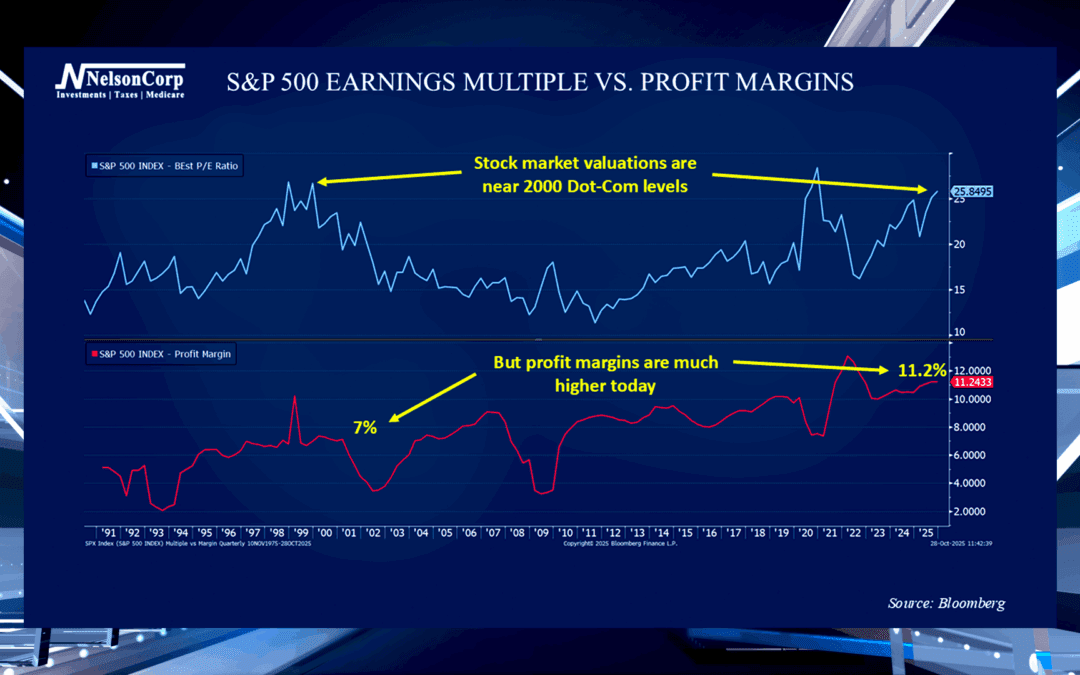

On The Margin

We have heard recent concerns that the stock market may be in a bubble. John Nelson is here to explain the similarities and differences between today’s market and past bubble market conditions.

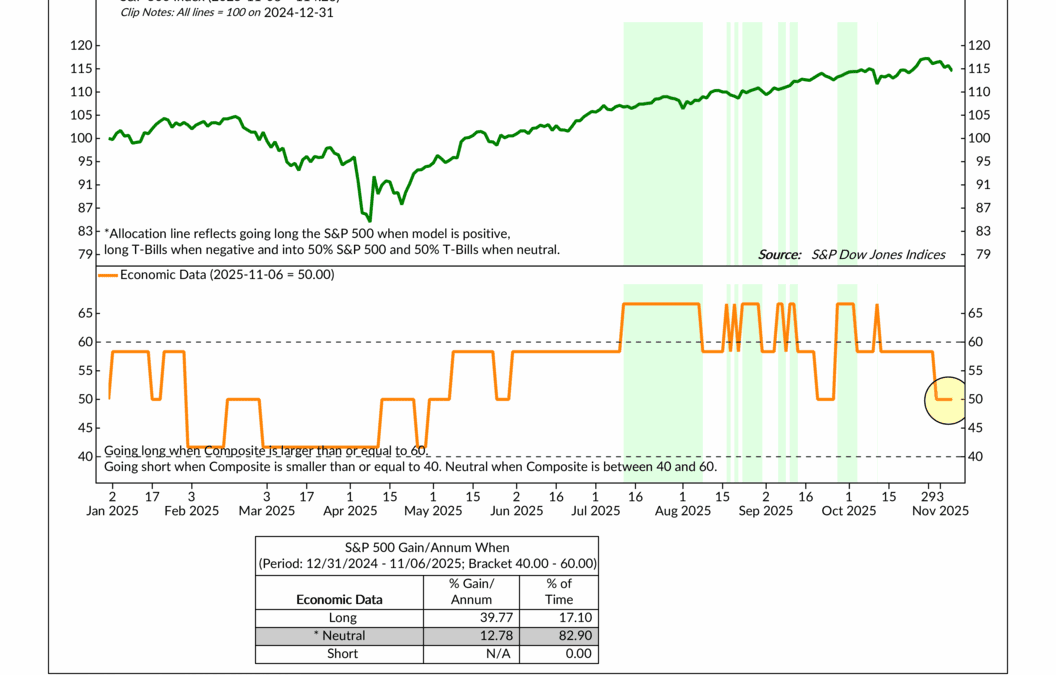

No Data No Problem

OVERVIEW Markets were mixed last week, with technology and large-cap stocks leading gains while smaller companies and bonds struggled. The S&P 500 rose 0.71%, the Dow Jones Industrial Average gained 0.75%, and the NASDAQ jumped 2.24%. Broadly, the Russell...

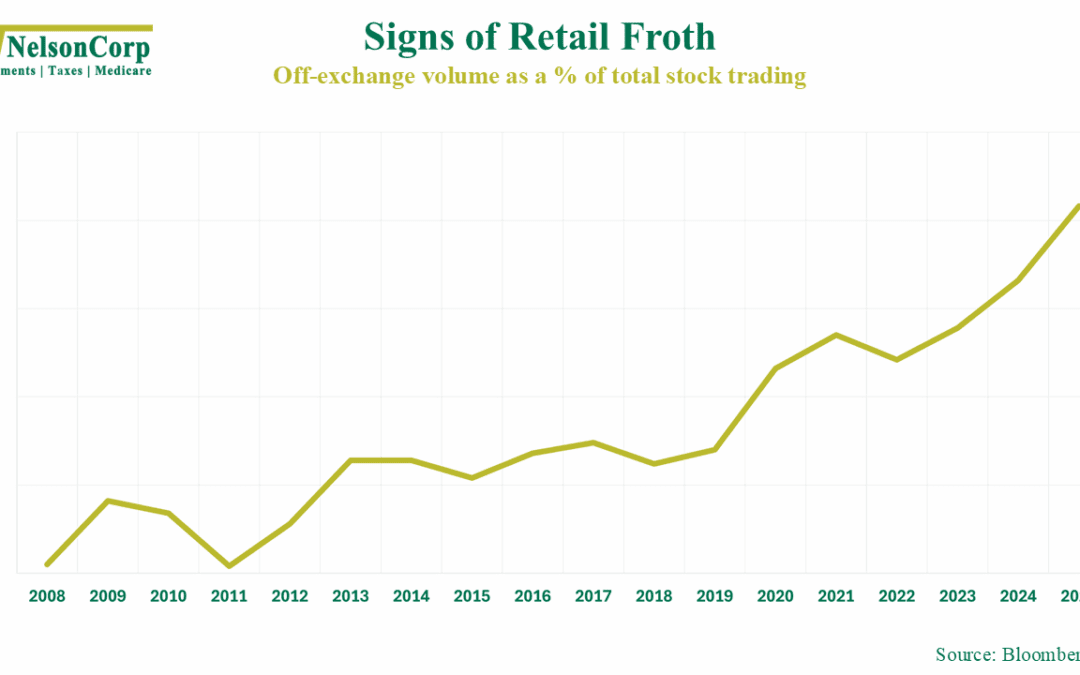

Signs of Froth

The stock market is starting to look a lot like the top of my wife’s double-shot espresso latte: frothy. Frothy, in the context of the stock market, means prices are being driven more and more by excitement and speculation than by fundamentals. For example,...

880 13th Avenue North

Clinton, Iowa 52732

563-242-9042

5465 Utica Ridge Road

Davenport, Iowa 52807

563-823-0532

9079 East Tamarack Drive

Dubuque, Iowa 52003

800-248-9042

info@nelsoncorp.com

Fax: 563-242-9062

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and NelsonCorp Wealth Management are not affiliated. This communication is strictly intended for individuals residing in the states of AZ, AR, CA, CO, CT, FL, GA, IA, IL, IN, ME, MI, MN, MO, NC, NJ, NY, SD, TN, TX, UT, WI, and WY. No offers may be made or accepted from any resident outside the specific states referenced. Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Clients and prospective clients should be prepared to bear investment loss including loss of original principal.

Cambridge’s Form CRS (Customer Relationship Summary)

The information being provided is strictly as a courtesy. When you link to any of these websites provided herein, NelsonCorp Wealth Management makes no representation as to the completeness or accuracy of information provided at these sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, sites, information, and programs made available through this site.