Financial Focus – April 3rd, 2024

In this week’s episode of Financial Focus, David Nelson discusses the current state of the market, emphasizes the importance of protecting and growing clients’ money, and highlights the unique advantage of NelsonCorp’s integrated approach to financial planning.

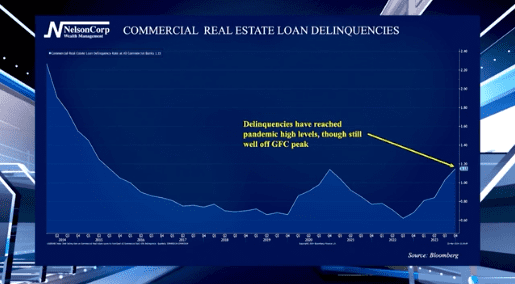

Delinquency

While the residential real estate category is improving, concern remains for commercial real estate and office space in particular. David Nelson explains if this is a market factor viewers should be paying attention to and what it reveals about the economy & markets.

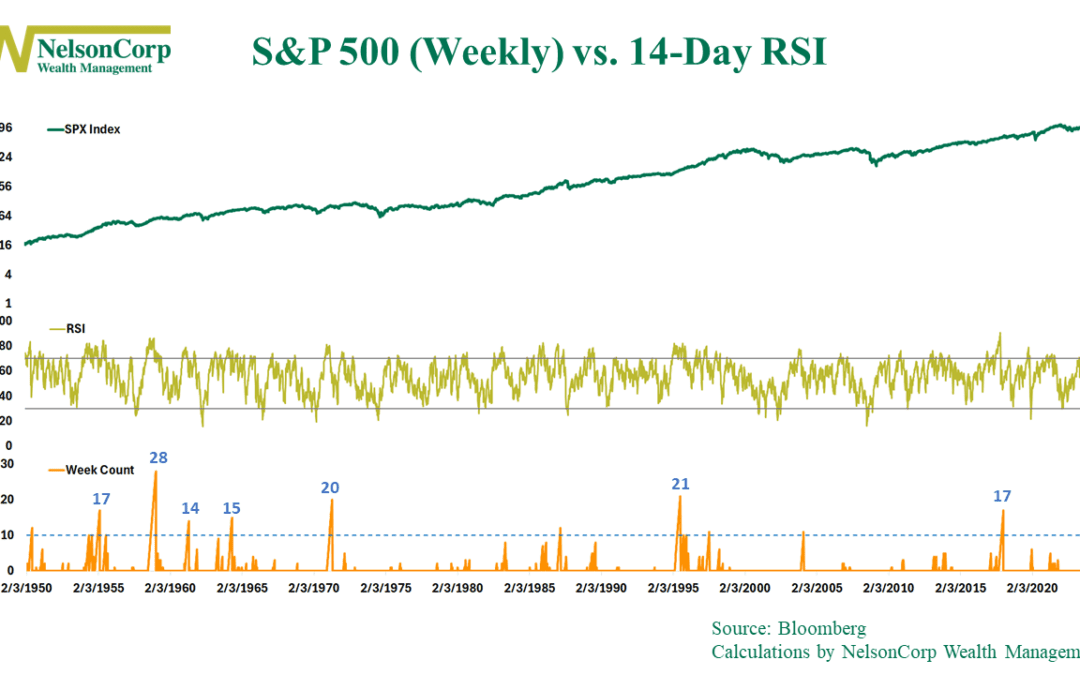

Going Yard

An important technical indicator is warning that stocks are in danger of being overbought. In this week’s commentary, we discuss the implications of the market’s recent strong momentum and highlight what a low equity risk premium means for stocks and bonds going forward.

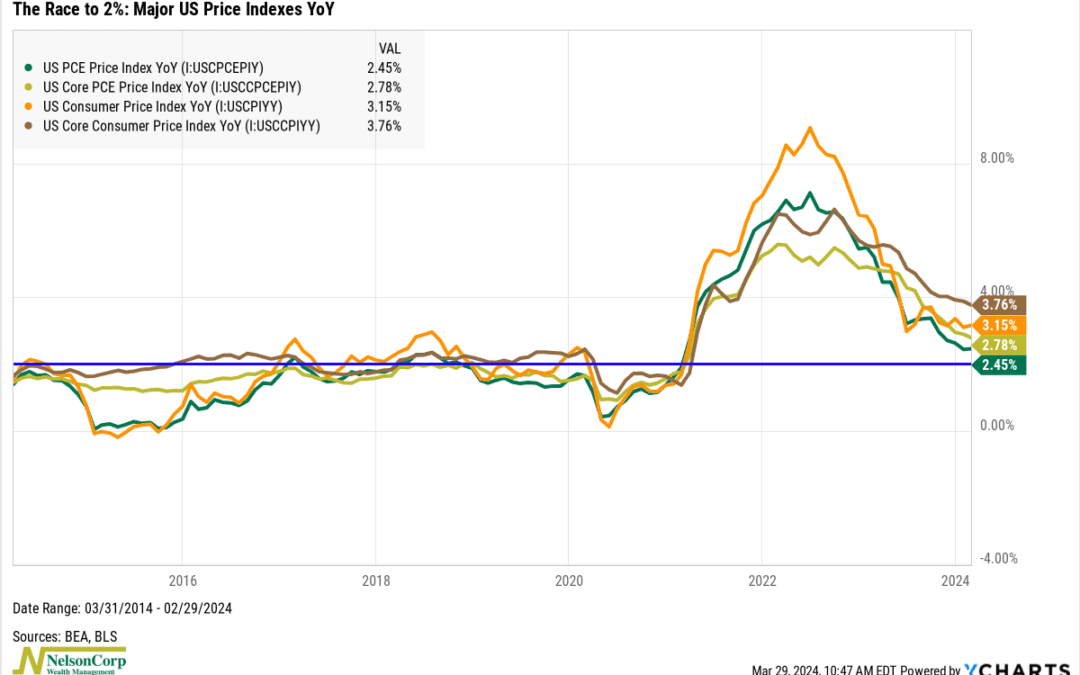

The Race to 2%

At the latest Federal Reserve meeting, chairman Jerome Powell mentioned that inflation continues to “move down gradually on a sometimes bumpy road to 2%.” Why is 2% such a big deal? Well, hitting that target gives the Fed the green light to consider cutting...

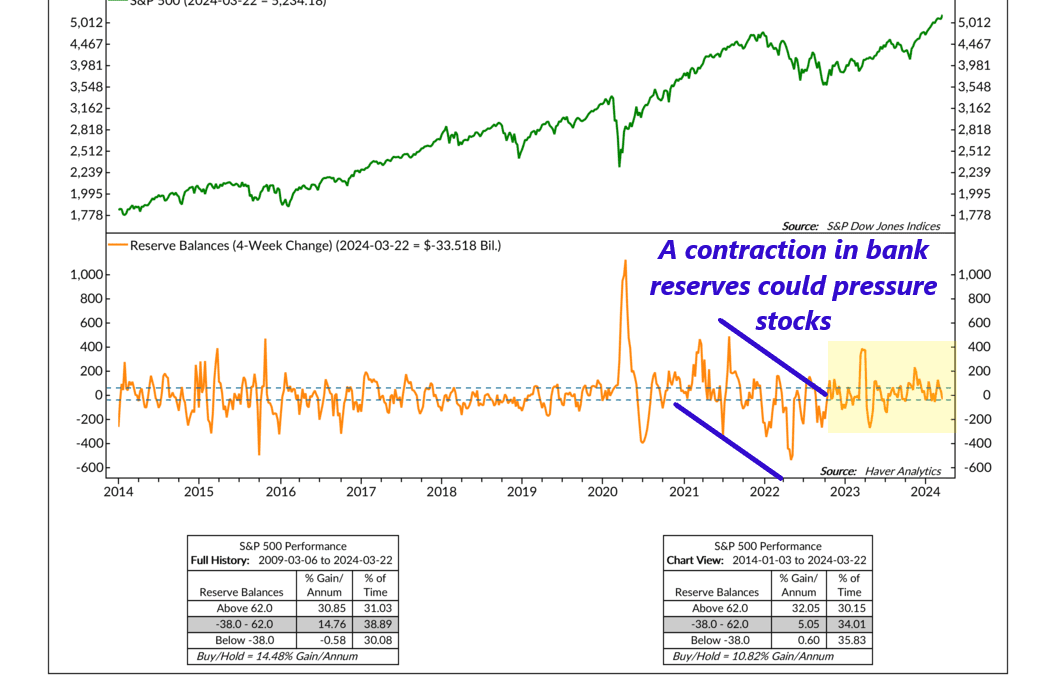

On Reserve

The stock market loves liquidity. By liquidity, we’re referring to the amount of easily accessible cash sloshing around the financial system. In our modern world of banking, one of the best ways to measure liquidity is by looking at the amount of bank reserves...

Financial Focus – March 27th, 2024

Check out this week’s episode of Financial Focus with Nate Kreinbrink as he discusses the basics of social security benefits and when to claim them.

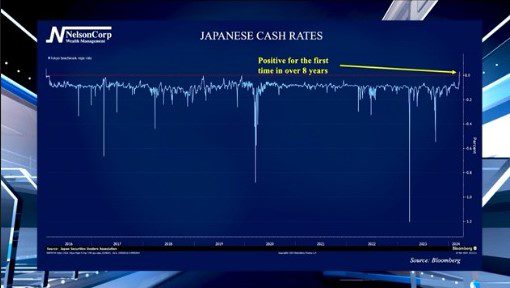

0%

Here in the United States, it seems the market is very focused on rate cuts. David Nelson joins us to share if other countries are cutting rates and how this dynamic affects us here at home.

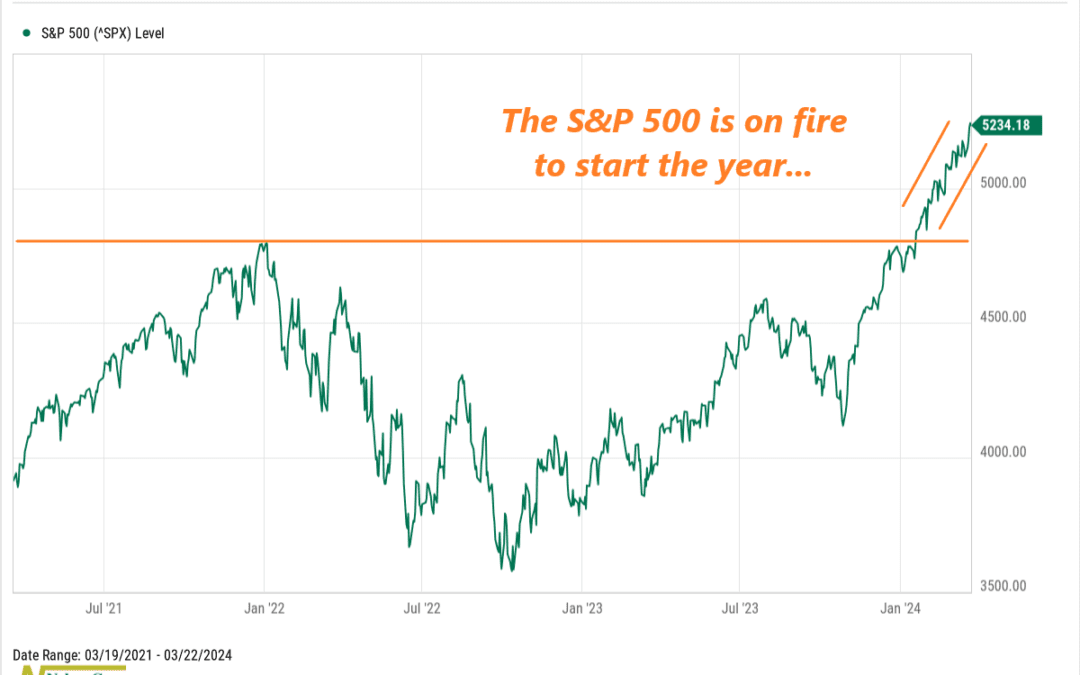

Hot Start

The S&P 500 stock index has been on fire to start the year, reaching 20 record highs already. In this week’s commentary, we look at the historical record to answer the question: have stocks gone up too fast?

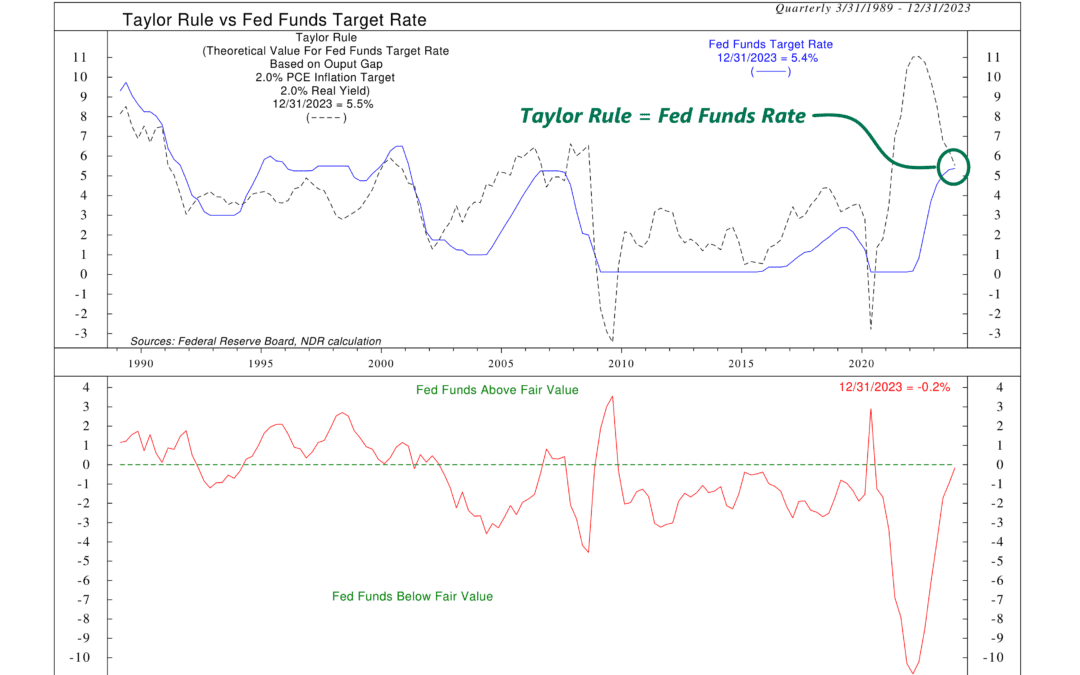

Taylor Rule

The big financial news this week was all about the Federal Reserve's meeting on Wednesday. Pretty much everything happened as expected. The Fed decided to keep its policy rate steady at 5.5% for now, but they're still thinking about cutting rates up to three...

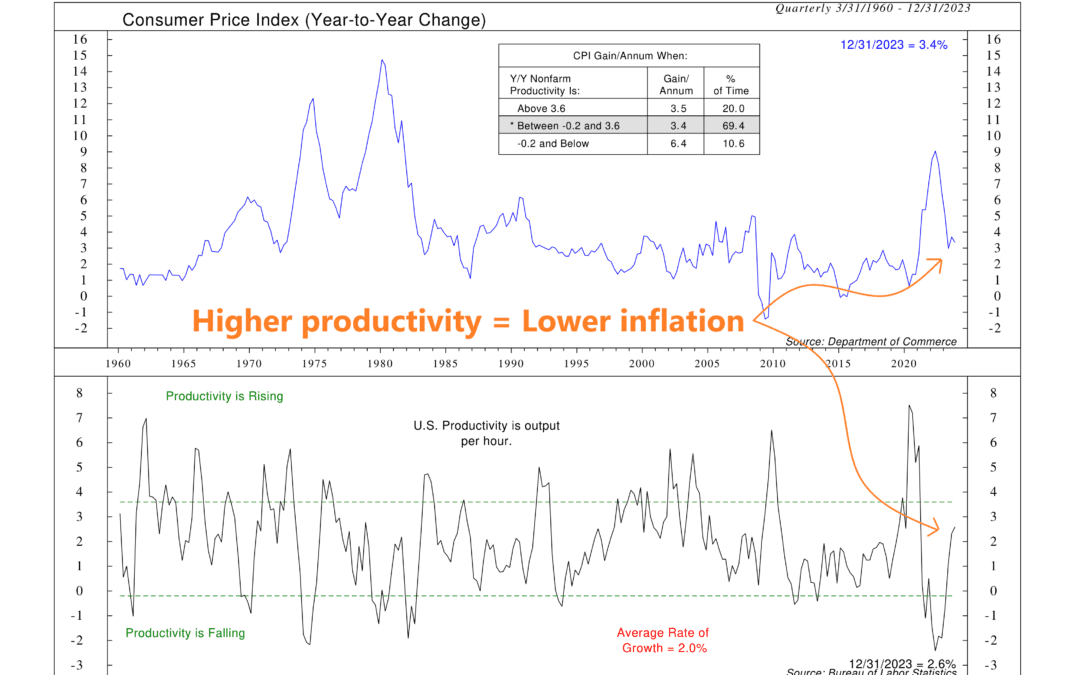

Getting Productive

Productivity makes everything better. That’s because, in simplest terms, it means getting more bang for your buck—doing more, with less, if you will. Regarding the economy, I like to think of productivity as a chef sharpening a knife. Just as a sharp knife...

880 13th Avenue North

Clinton, Iowa 52732

563-242-9042

5465 Utica Ridge Road

Davenport, Iowa 52807

563-823-0532

9079 East Tamarack Drive

Dubuque, Iowa 52003

800-248-9042

info@nelsoncorp.com

Fax: 563-242-9062

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and NelsonCorp Wealth Management are not affiliated. This communication is strictly intended for individuals residing in the states of AZ, AR, CA, CO, CT, FL, GA, IA, IL, IN, MA, ME, MI, MN, MO, NC, NE, NJ, NM, NV, NY, OH, OR, SD, TN, TX, UT, VA, and WI. No offers may be made or accepted from any resident outside the specific states referenced. Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Clients and prospective clients should be prepared to bear investment loss including loss of original principal.

Cambridge’s Form CRS (Customer Relationship Summary)

The information being provided is strictly as a courtesy. When you link to any of these websites provided herein, NelsonCorp Wealth Management makes no representation as to the completeness or accuracy of information provided at these sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, sites, information, and programs made available through this site.