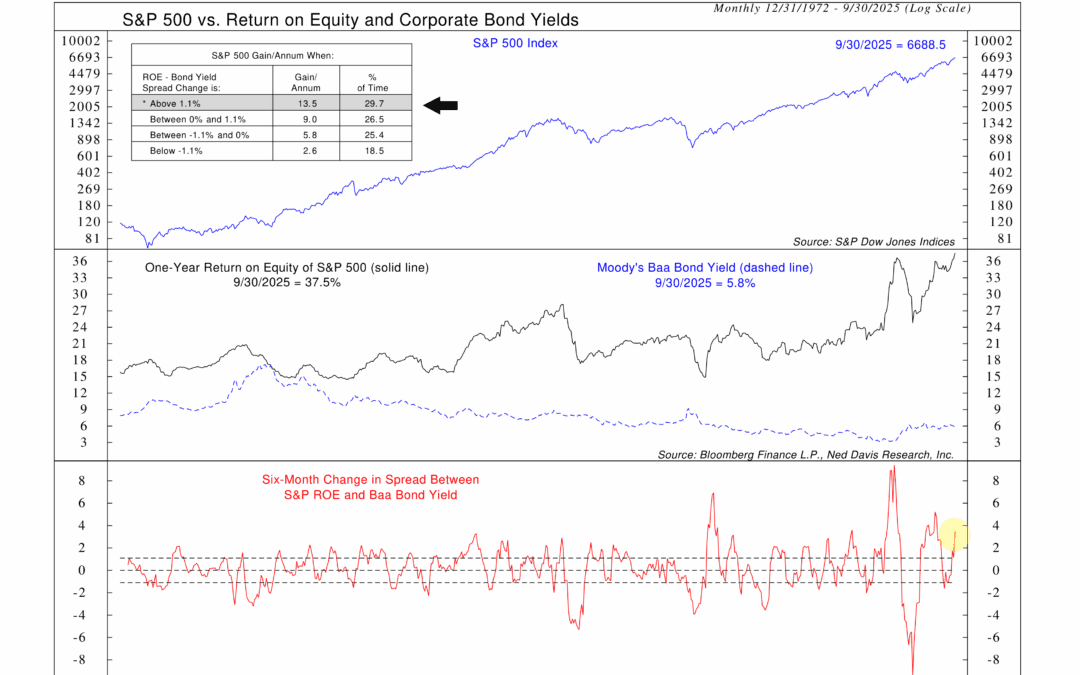

R-O-E and the Borrowing Fee

There are a lot of different variables out there that affect the stock market—more than you’d probably like to think about. But there are a handful that really drive stock performance, the ones investors make sure to pay close attention to. Corporate...

Financial Focus – October 29th, 2025

This week on Financial Focus, Nate Kreinbrink and Mike VanZuiden discuss why open enrollment season is such an important time for those on Medicare. From changing Advantage plans to new prescription coverage rules, they explain what to watch for to avoid costly surprises in 2026.

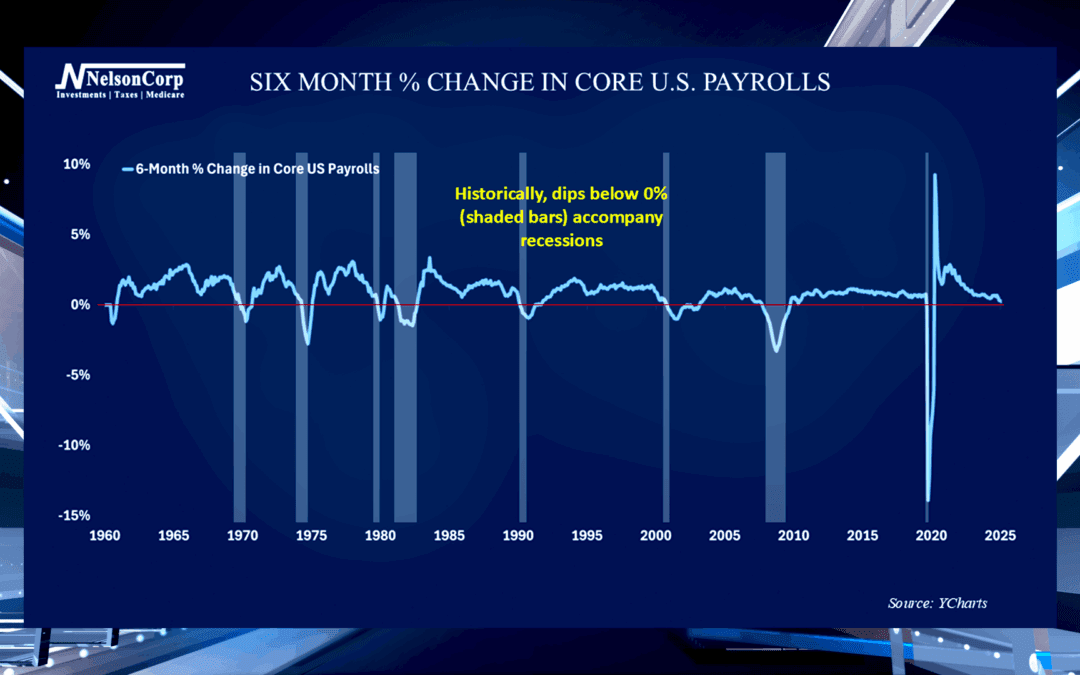

Flatlining

The job market has been incredibly strong for a while now. John Nelson joins us to share private sector payroll data to show how this market is now softening

Why So Serious?

OVERVIEW Markets surged last week, marking one of the strongest weekly performances in recent months as gains spread broadly across equities and commodities. The S&P 500 rose 1.92%, while the Dow Jones Industrial Average gained 2.20%. The NASDAQ led large...

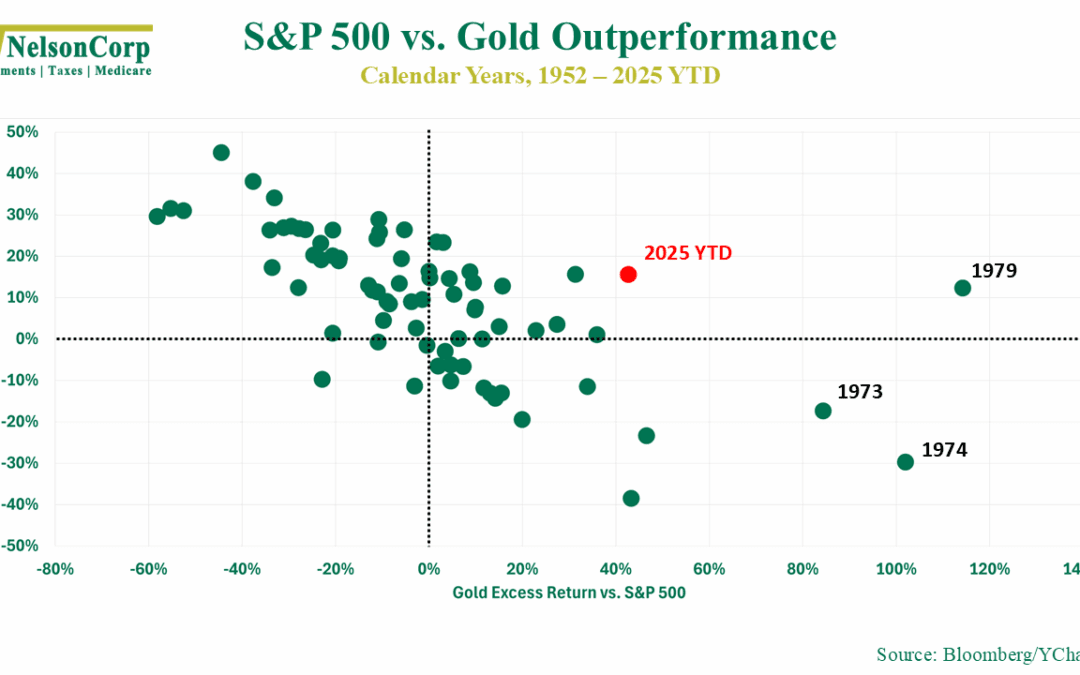

The Golden Rule

This week’s chart takes a look at the relationship between stocks and gold, a classic rivalry between growth and safety. Each dot on the chart represents a calendar year from 1952 through 2025, plotting the S&P 500’s annual price return (vertical axis)...

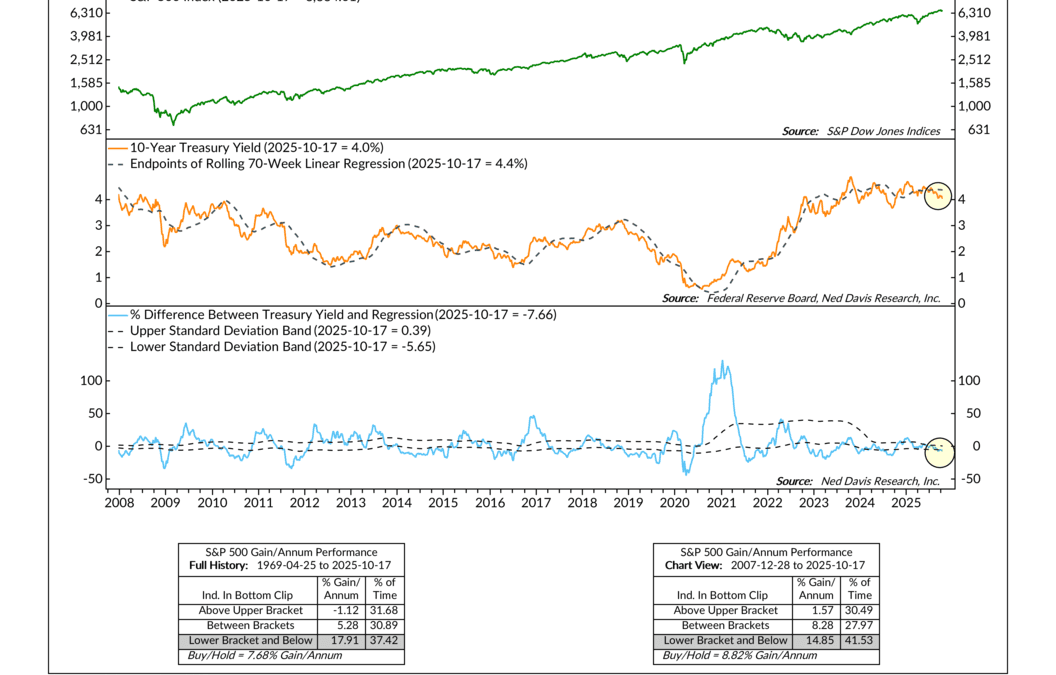

Yielding Strength

Few relationships have been as important to financial markets as the one between stock prices and interest rates. This week, our featured indicator tracks that relationship by comparing the S&P 500 Index (top panel) to the 10-year Treasury yield and how far...

Financial Focus – October 22nd, 2025

David Nelson joins Gary Determan on this week’s Financial Focus to discuss everything from estate planning for high-net-worth clients to the firm’s latest newsletter, community giving, and market outlook. Tune in as David shares insights on why staying disciplined matters, even when markets look strong.

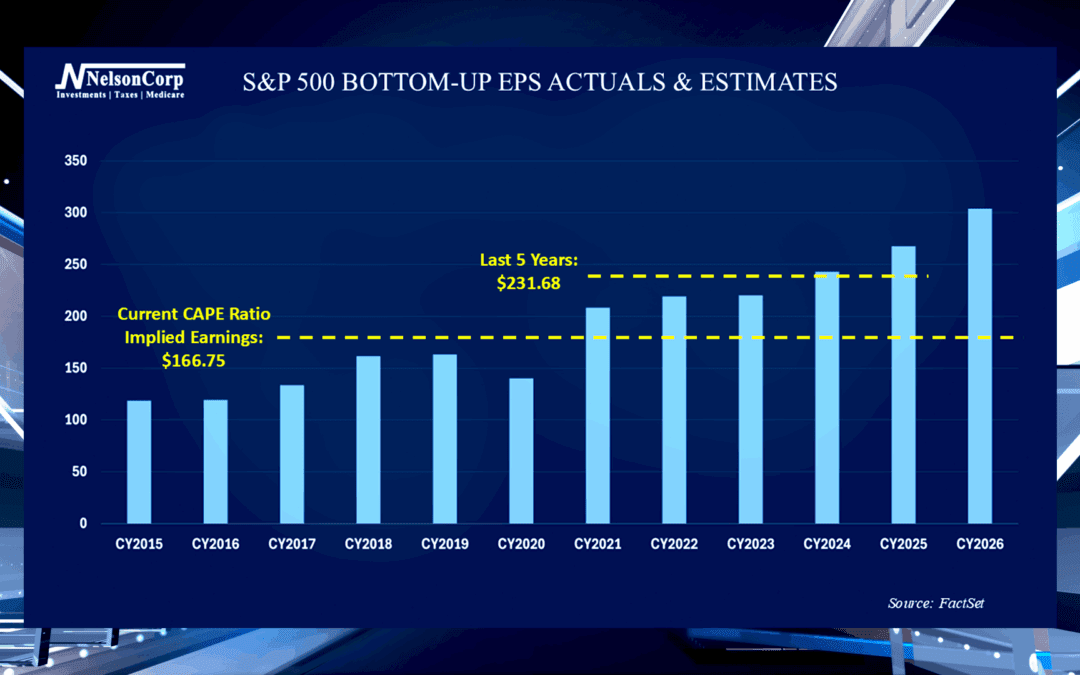

The CAPE in Context

The stock market has been described as expensive lately. David Nelson is here to share CAPE Shiller data and illustrate why it is important for the valuation picture.

Opposites Attract

OVERVIEW Markets rebounded sharply last week, breaking a recent losing streak as gains spread across nearly every major index. The S&P 500 climbed 1.70%, while the Dow Jones Industrial Average rose 1.56%. The NASDAQ led large caps higher with a 2.14%...

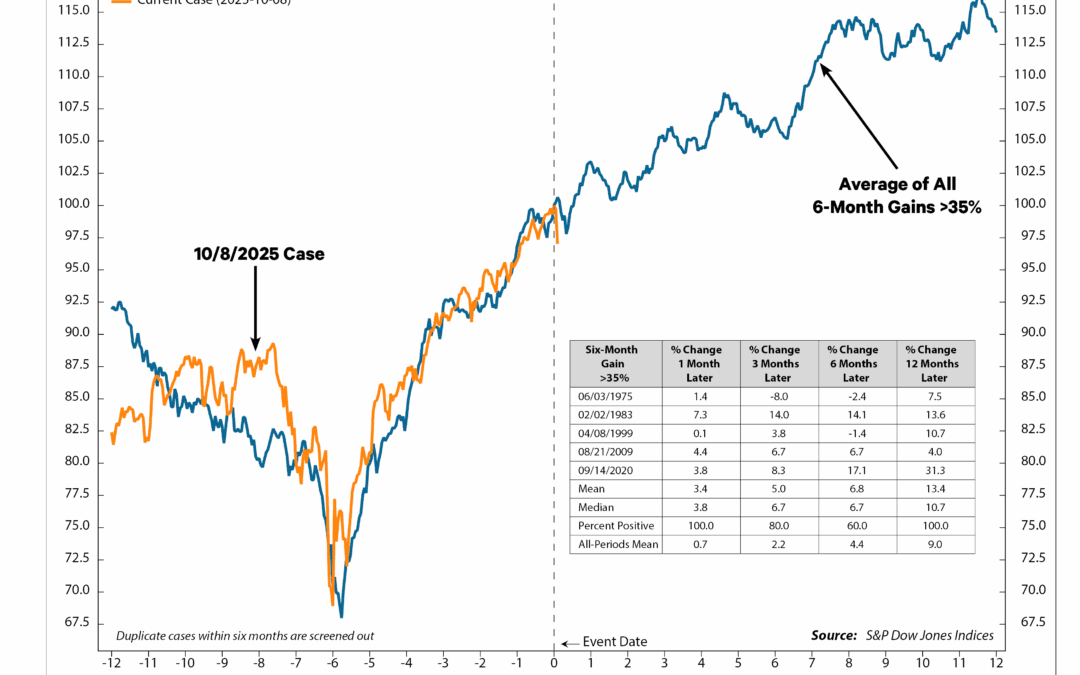

Sprint, Then Jog

I’ve got an interesting chart for folks this week. It shows how the stock market (S&P 500 Index) has historically performed, on average, after a 6-month rally of at least 35%. That’s the blue line—the average. Why is that interesting? Because the orange...

880 13th Avenue North

Clinton, Iowa 52732

563-242-9042

5465 Utica Ridge Road

Davenport, Iowa 52807

563-823-0532

9079 East Tamarack Drive

Dubuque, Iowa 52003

800-248-9042

info@nelsoncorp.com

Fax: 563-242-9062

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and NelsonCorp Wealth Management are not affiliated. This communication is strictly intended for individuals residing in the states of AZ, AR, CA, CO, CT, FL, GA, IA, IL, IN, MA, ME, MI, MN, MO, NC, NJ, NY, SD, TN, TX, UT, WI, and WY. No offers may be made or accepted from any resident outside the specific states referenced. Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Clients and prospective clients should be prepared to bear investment loss including loss of original principal.

Cambridge’s Form CRS (Customer Relationship Summary)

The information being provided is strictly as a courtesy. When you link to any of these websites provided herein, NelsonCorp Wealth Management makes no representation as to the completeness or accuracy of information provided at these sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, sites, information, and programs made available through this site.