Financial Focus – August 21st, 2024

This week on Financial Focus, Nate Kreinbrink and Andy Fergurson explain some tax-saving strategies, like first putting money into a traditional IRA or 401(k) and then converting it to a Roth account, especially if you live in states with tax breaks for retirement income.

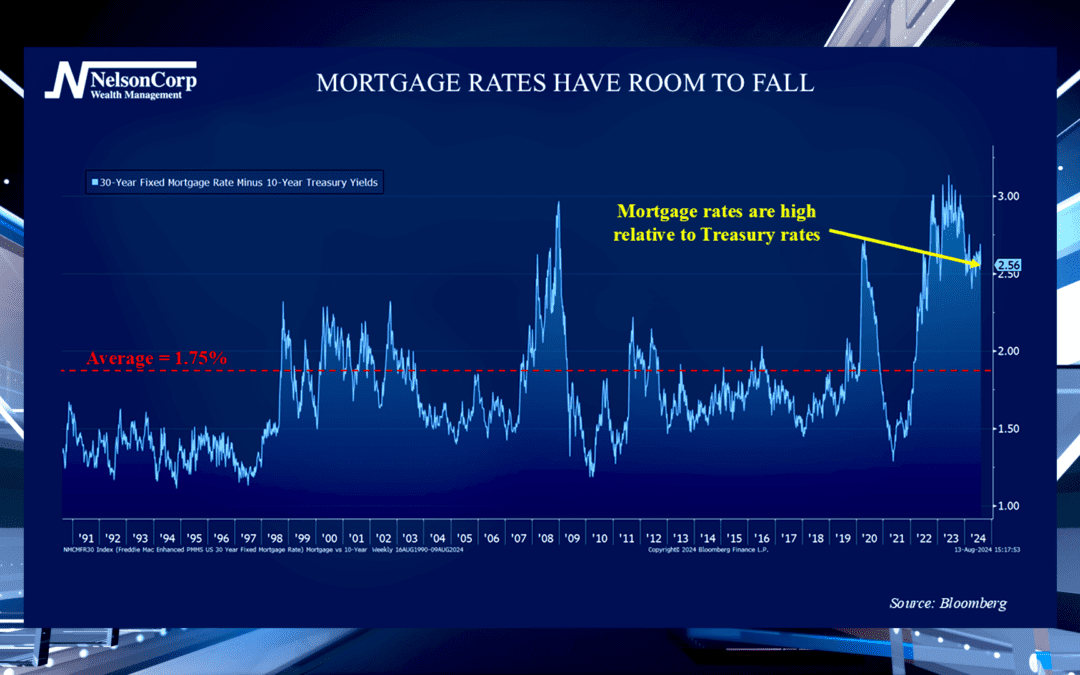

Room To Fall

Mortgage rates have been trending downward recently. David Nelson shares more good news on that front especially for viewers in the market for a new home.

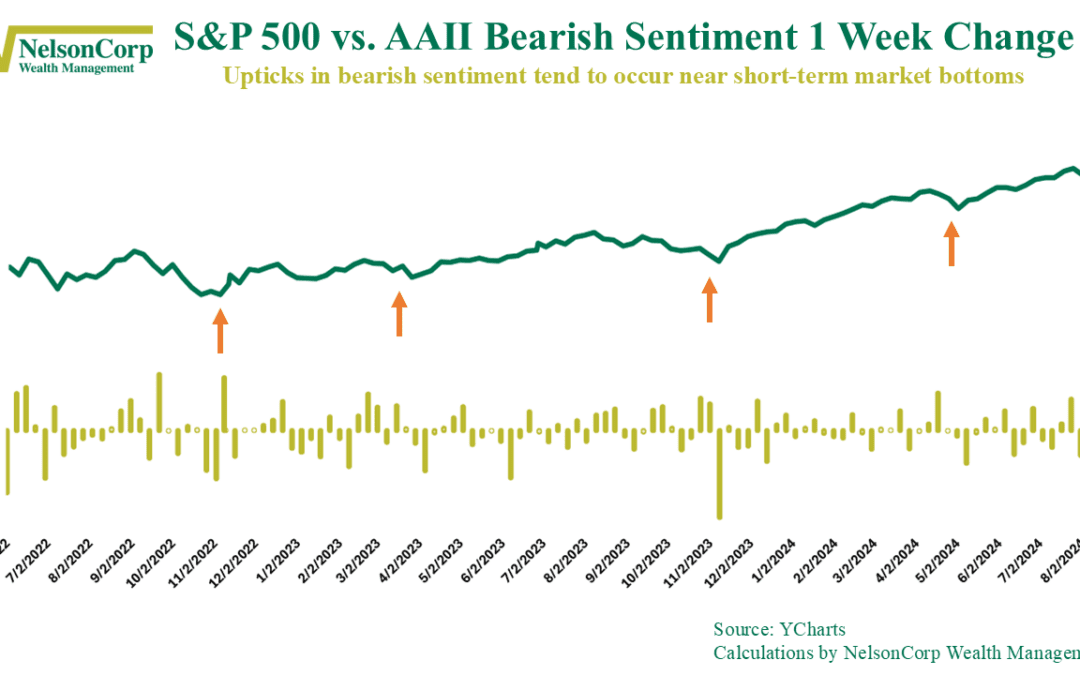

Not Derailed

A string of better-than-expected economic data has left the stock market in a chipper mood recently. Check out this week’s commentary, where we explore what this means for the current investing landscape.

Butterfly Effect

In chaos theory, there’s this concept known as the butterfly effect. You might have heard of it or seen the 2004 movie by the same name. The idea is that tiny actions can lead to unpredictable changes over time. The famous example is a butterfly flaps its wings...

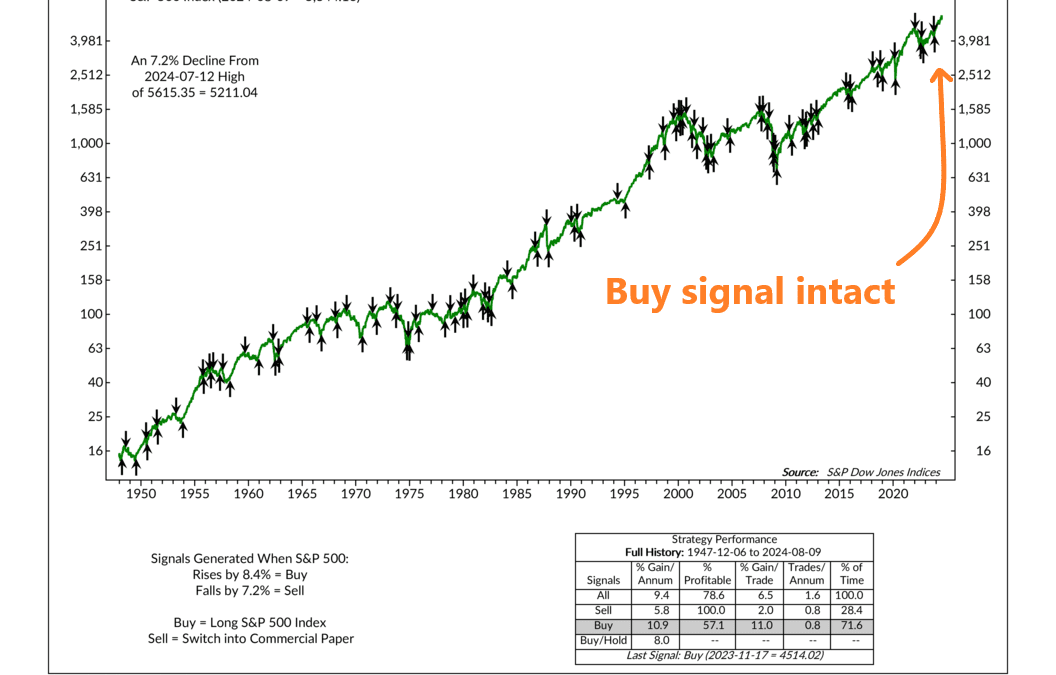

Keep It Simple

Imagine a simple stock market indicator. It looks at the market each week and determines if it’s going up or down. No bells. No Whistles. Just you and the price action. Pretty easy, right? Well, as a matter of fact, it is. Our featured indicator, shown above,...

Financial Focus – August 14th, 2024

In this week’s Financial Focus, Nate Kreinbrink emphasizes the importance of saving regularly for retirement, starting with employer plans to maximize matching contributions. He outlines various saving options and recommends consulting a professional to tailor strategies to individual needs.

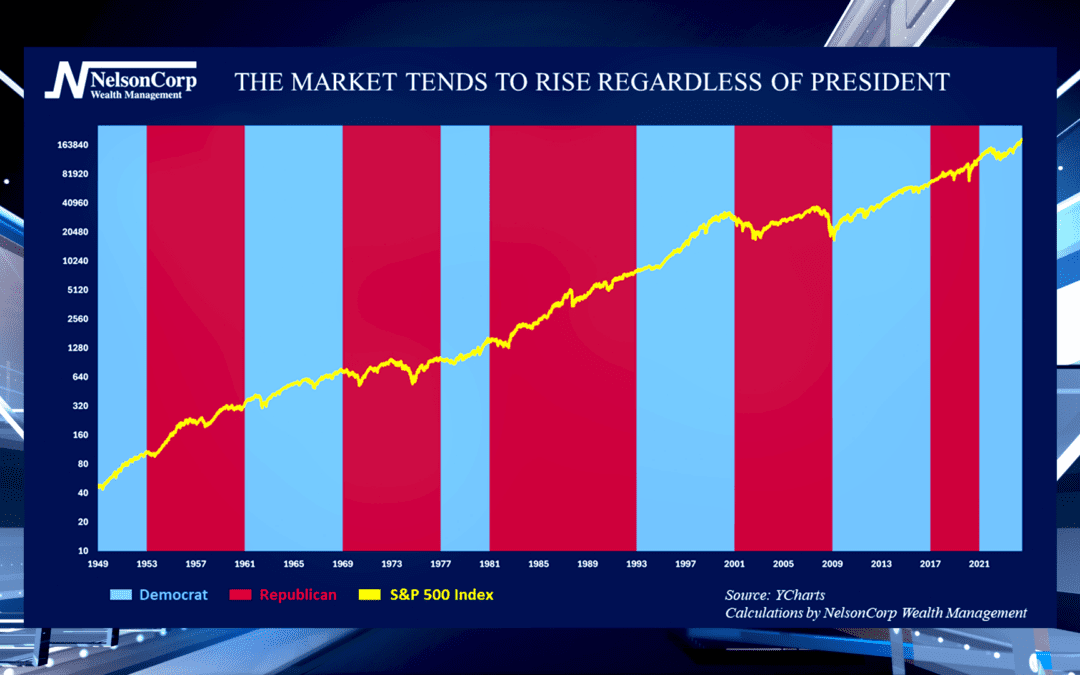

Politically Independent

There have been quite a few changes in the presidential race lately. John Nelson offers his insights into how the upcoming election might affect financial markets and surprises us too.

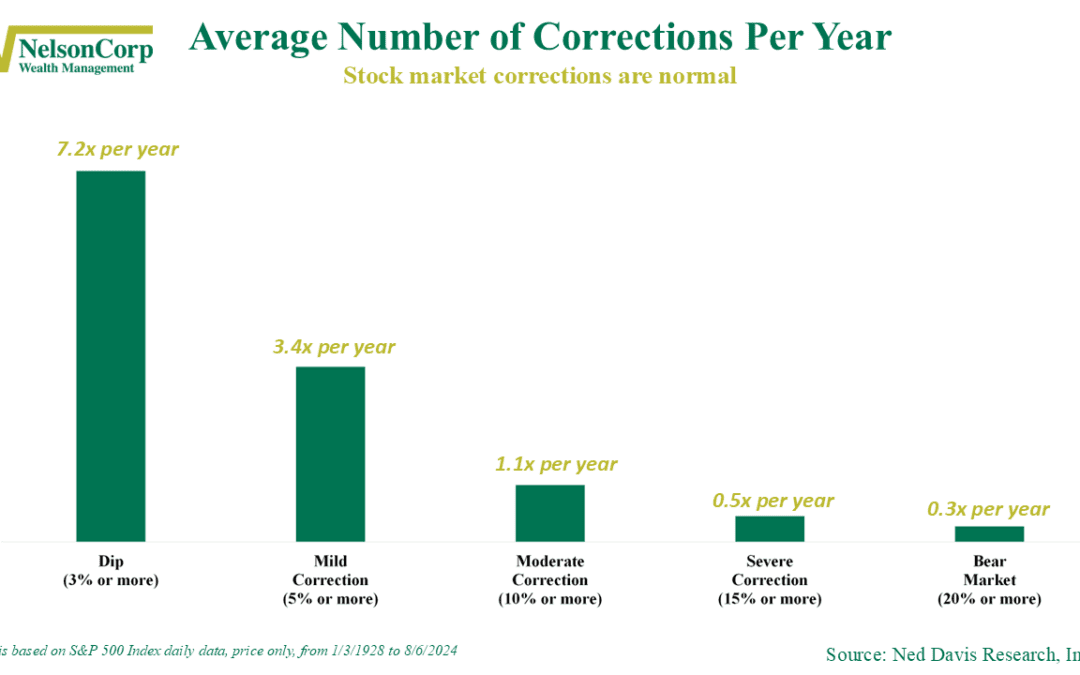

Drawdowns Are Normal

After a chaotic start to the week, the market staged a remarkable comeback and cut its losses significantly. But are we out of the woods yet? In this week’s commentary, we explore the recent market turbulence, the history of corrections, and what our risk models are telling us about the road ahead.

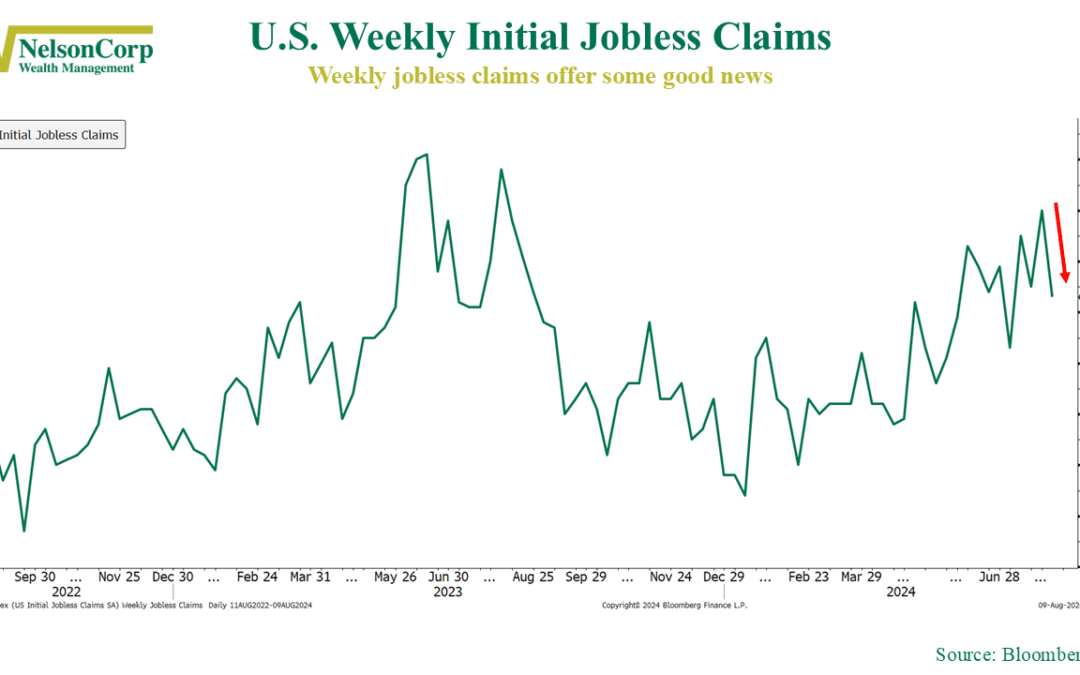

A Sigh of Relief

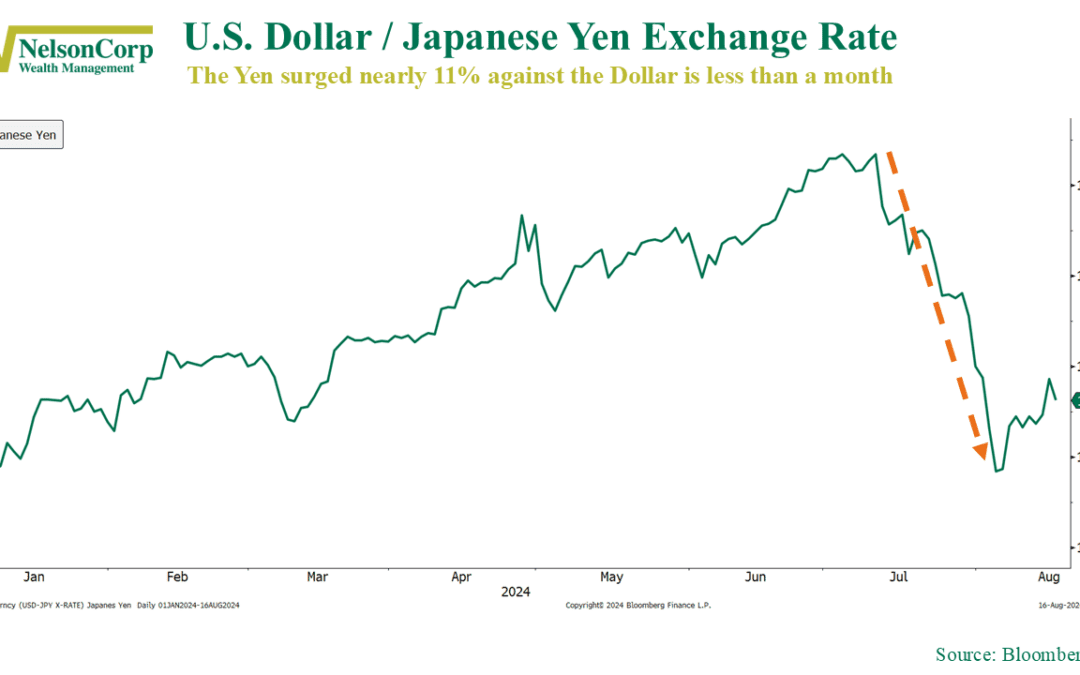

It was a wild week in financial markets. A lot of crazy stuff happened. While I could point to several noteworthy charts—like the sharp decline in Japanese stocks or the fleeting reversal of the inverted yield curve—one chart stood out above the rest: weekly...

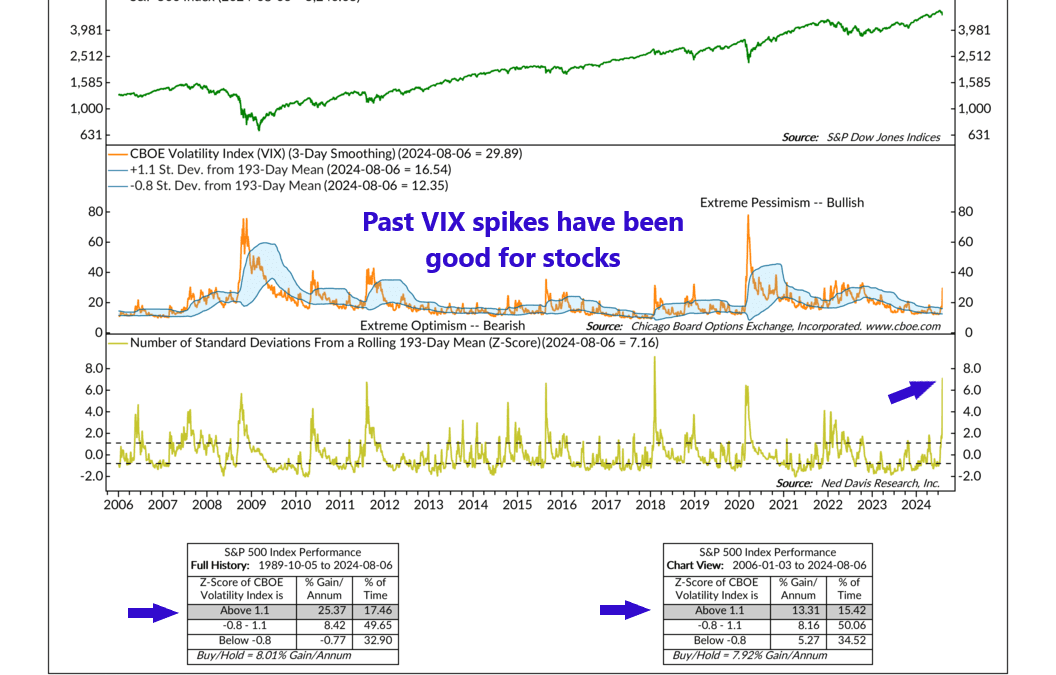

Spike!

If you’re like me, you've probably been catching some Olympic events on TV lately. Volleyball is one of my favorites. There’s something really exciting about watching players leap into the air and powerfully spike the ball over the net. This week, a different...

880 13th Avenue North

Clinton, Iowa 52732

563-242-9042

5465 Utica Ridge Road

Davenport, Iowa 52807

563-823-0532

9079 East Tamarack Drive

Dubuque, Iowa 52003

800-248-9042

info@nelsoncorp.com

Fax: 563-242-9062

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and NelsonCorp Wealth Management are not affiliated. This communication is strictly intended for individuals residing in the states of AZ, AR, CA, CO, CT, FL, GA, IA, IL, IN, MA, ME, MI, MN, MO, NC, NE, NJ, NM, NV, NY, OH, OR, SD, TN, TX, UT, VA, WI, and WY. No offers may be made or accepted from any resident outside the specific states referenced. Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Clients and prospective clients should be prepared to bear investment loss including loss of original principal.

Cambridge’s Form CRS (Customer Relationship Summary)

The information being provided is strictly as a courtesy. When you link to any of these websites provided herein, NelsonCorp Wealth Management makes no representation as to the completeness or accuracy of information provided at these sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, sites, information, and programs made available through this site.